Imprisoned Sam Bankman-Fried’s “GM” Tweet Sends FTT Token Soaring

TLDR

- Sam Bankman-Fried’s X account posted “gm” (good morning) on Tuesday evening, sparking confusion since federal inmates can’t access social media directly

- A friend later clarified they posted on SBF’s behalf, not the imprisoned FTX founder himself

- The FTT token surged 32% following the tweet, with trading volume jumping from $10.4 million to $59 million

- FTX estate filed a $1.1 billion lawsuit against Genesis Digital Assets seeking to recover preferential payments

- The estate plans to distribute $1.6 billion to creditors by September 30 as part of ongoing bankruptcy proceedings

Sam Bankman-Fried’s verified X account posted a simple “gm” message on Tuesday evening. The two-letter greeting stands for “good morning” in crypto community language.

The post immediately raised questions about how an imprisoned person could access social media. Federal inmates in the United States do not have direct internet access or permission to use social platforms.

The tweet attracted over 4.5 million views within hours of posting. Trading activity around FTX-related tokens increased sharply following the message.

The account later clarified that SBF himself did not make the post. A friend posted the message on his behalf while he remains in federal prison.

SBF is currently serving a 25-year sentence at Federal Correctional Institution Terminal Island in Los Angeles. He was convicted on seven counts of fraud and conspiracy in November 2023.

The former FTX CEO was found guilty of stealing billions in customer funds. He also misled investors about the exchange’s financial condition before its November 2022 collapse.

Market Response to Social Media Activity

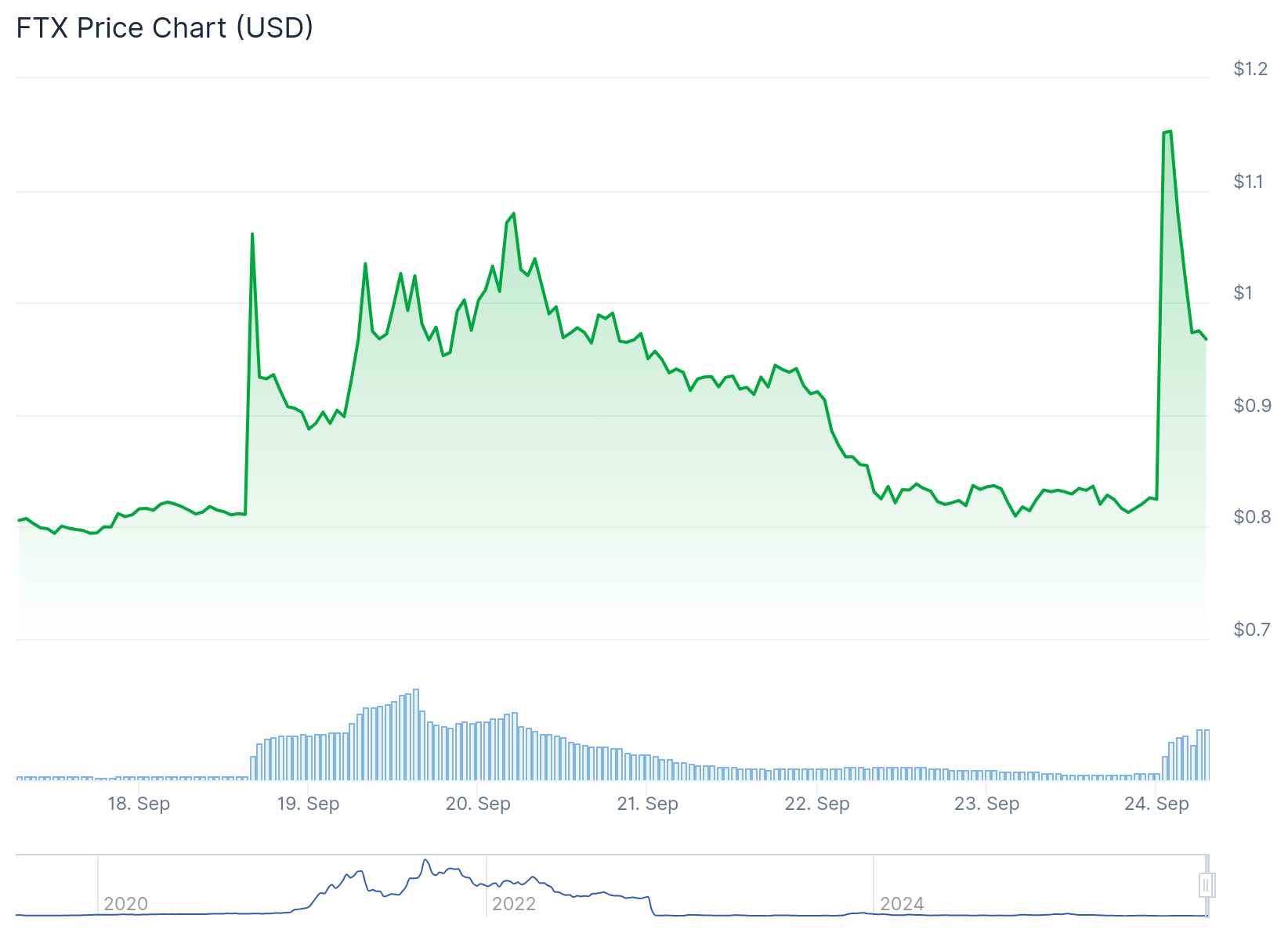

The FTT token price jumped to around $1.10 following the tweet. This represents a 32% increase over the previous 24-hour period.

FTX (FTT) Price

FTX (FTT) Price

Daily trading volume surged almost sixfold after the post appeared. Volume climbed from approximately $10.4 million to nearly $59 million according to CoinGecko data.

The FTT token once served as FTX’s native currency for fee discounts. It lost most of its utility when the exchange filed for bankruptcy in late 2022.

Speculative trading continues around the token during the ongoing estate liquidation process. The price movements show how social media activity can still impact crypto markets.

Legal Developments and Estate Actions

The FTX Recovery Trust filed a lawsuit on Tuesday against Genesis Digital Assets. The legal action seeks to recover $1.1 billion in alleged preferential payments.

The lawsuit claims Genesis Digital received favorable treatment in the months before FTX collapsed. These payments are part of broader efforts to recover funds for creditors.

The estate is preparing its third major creditor distribution scheduled for September 30. This payout will release approximately $1.6 billion to verified claimants.

Prison communication rules allow inmates to use TRULINCS, a monitored text messaging system. This system does not provide broader internet access or social media capabilities.

Possession of contraband cellphones in federal prison can result in disciplinary action. Violations may include solitary confinement or reduced good conduct time credits.

The post Imprisoned Sam Bankman-Fried’s “GM” Tweet Sends FTT Token Soaring appeared first on CoinCentral.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach