Tether's $500 billion valuation challenges OpenAI

The financing news of stablecoin giant Tether is enough to make the entire traditional financial circle hold its breath.

According to Bloomberg, the "central bank of the crypto world," which manages nearly $173 billion in USDT, is seeking a massive private equity round of $15-20 billion at a valuation of up to $500 billion.

What does this figure mean? It means Tether's size is on par with top global tech unicorns like OpenAI and SpaceX, and its $4.9 billion in quarterly net profit dwarfs many established financial institutions. This isn't just about raising capital; it's a "hidden whale" rising from the crypto world, officially declaring its value to the traditional financial system.

$500 billion valuation: a bold numbers game

Tether's bold valuation stems from its unshakable core advantages:

Absolute market dominance: Tether's USDT, with a market capitalization of approximately $172.8 billion, holds the top spot in the stablecoin market and is the de facto settlement currency in the crypto world. Its daily trading volume easily exceeds tens of billions of dollars, creating the deepest liquidity moat.

Astonishing Profitability: In the second quarter of 2025, Tether reported a net profit of $4.9 billion, with its reserve assets reaching $162.5 billion, exceeding its liabilities of $157.1 billion, demonstrating a strong financial position. This substantial profit was largely due to its holdings of high-yield U.S. Treasury bonds.

Behind the carnival: a zero-sum game

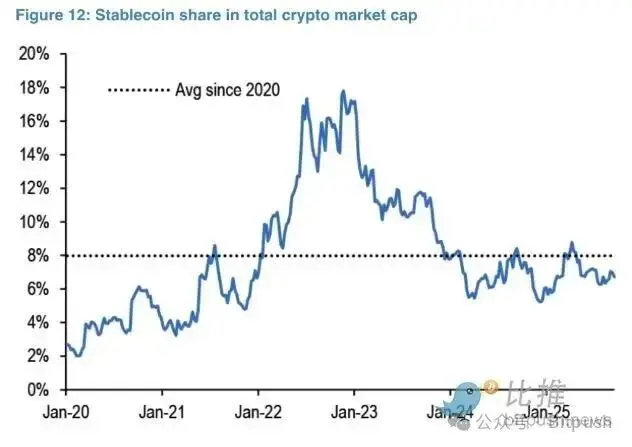

While Tether stands out due to its scale and profitability, competition in the stablecoin market is unprecedentedly fierce. A report by JPMorgan analysts noted that the convergence of the total market capitalization of stablecoins and the overall crypto market capitalization indicates that it is a "zero-sum game"—the primary focus for issuers is to compete for market share, not to expand the overall market.

This arms race is unfolding on multiple dimensions, with challengers trying to grab a piece of the pie from Tether and Circle’s dominance.

Tether's own strategic adjustment: USAT's compliance counterattack

In response to regulatory and challenger threats, Tether is undergoing a strategic shift. It plans to launch a new stablecoin called USAT, designed to fully comply with the recently passed US GENIUS Act. This differs from Tether's existing USDT, which has approximately 80% of its reserves in compliance with the act's requirements.

Anchored Compliance: USAT’s reserves will be held by institutions such as Anchorage Digital, which holds a banking license. This will help Tether build institutional trust, reduce its reliance on third-party banks, and avoid risks similar to what Circle experienced during the Silicon Valley Bank crisis in 2023.

Key personnel additions: Tether has appointed Bo Hines, executive director of Trump's Digital Asset Advisory Council, as CEO of its US operations. Hines was a key figure in the Trump administration's cryptocurrency policy, helping to push through the GENIUS Act, which provides a new regulatory framework for stablecoins and is directly related to Tether's plan to launch the compliant stablecoin USAT.

Close ties with Trump allies: Tether's primary reserve asset custodian is Cantor Fitzgerald, whose former CEO, Howard Lutnick, is currently the US Secretary of Commerce. This endorsement at the highest political level provides a significant trust advantage for Tether's expansion into the US market.

Profit maximization: By directly managing the USAT reserves, Tether aims to retain more of the interest income, thereby increasing profit margins and further strengthening its business model.

These moves indicate that Tether is shifting from a strategy of "avoiding regulation" to one of "actively embracing" and even "shaping" regulation. If Tether can successfully operate under US regulation, this will not only remove its biggest valuation barrier but also provide it with a significant credibility boost, thereby attracting a wider range of institutional funds.

Other competitors' actions

Faced with multiple challenges, Tether's main competitor, Circle, is not sitting still. It is building a dedicated stablecoin blockchain called Arc, aiming to firmly lock USDC at the center of the crypto ecosystem by optimizing speed, security, and interoperability. Payment giants like Visa have also partnered with Circle to explore using USDC for merchant payments on blockchains like Solana.

Fintech giants have also seen the huge potential of the stablecoin market and have jumped in. Companies like Robinhood and Revolut are reportedly developing their own stablecoins, attempting to leverage their large user bases and mature financial infrastructure to directly challenge existing stablecoin issuers.

The decentralized finance (DeFi) sector is also launching a challenge to the hegemony of stablecoins. Hyperliquid, one of the most popular DeFi protocols, is preparing to launch its native stablecoin, USDH, to break away from its reliance on Circle's USDC. JPMorgan analysts note that Hyperliquid's perpetual swap exchange currently accounts for 7.5% of total USDC usage. Once USDH successfully launches and establishes liquidity, this market share could shift directly from USDC, posing a significant threat to Circle.

Conclusion: A bold gamble or a new financial giant?

When Tether's valuation, at $500 billion, rivals that of AI giant OpenAI, we're witnessing not just the rise of a single company but a revolution in the financial paradigm. The intermediary model upon which traditional banks rely is being radically disrupted by the global, instant settlement capabilities of stablecoins.

This is no longer a simple competition; it's a dimensionality reduction attack. Tether's actual valuation is proclaiming to the world: the future of finance doesn't belong to concrete bank buildings, but to a global liquidity network built with code. Banking services no longer require branches, only a crypto wallet.

Just as the internet enabled the free flow of information, stablecoins like Tether are enabling the free flow of value. When financial infrastructure becomes as simple as sending an email, how much room will remain for traditional banks? The answer may lie in Tether's astonishing valuation.

This silent financial revolution has already arrived, not in the future tense, but is happening now.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach