Cardano Price Prediction Turns Bearish As Institutional Investors Accumulate Rollblock

In contrast, Rollblock has surged more than 500% in its presale, grabbing the attention of retail and institutional investors alike. The sharp rise highlights how newer tokens with proven adoption are beginning to stand out against established players consolidating in familiar ranges.

Cardano Price Faces Pressure: Momentum Weakens After Summer Gains

The Cardano price slipped under pressure after an active trading session, closing at $0.82 with losses of more than 6%. Sellers pushed daily volume above 230 million, marking one of the heavier days of activity this month. The sudden drop pulled ADA below short-term moving averages, hinting at a weakening trend in the near term.

Source

Cardano had enjoyed a strong run through the summer, rallying from June’s low of $0.51 to highs above $1.01 in late July. That climb restored confidence in the token, with steady consolidation following through August. Now, with the latest red candle breaking below support, ADA’s chart signals that momentum is shifting away from buyers.

The 5-day and 10-day moving averages are now lower, and long-term indicators are closer to neutral. This is indicative of consolidation, but there is still potential to go lower should selling continue.

Despite this setback, Cardano continues to trade well above its June lows, with a large cushion of gains. The current Cardano price prediction chart indicates that the market is undergoing a test of support level, and the equilibrium between such buyers and aggressive sellers will determine the next direction.

Why Rollblock Is Becoming a Top Pick for Institutional Investors

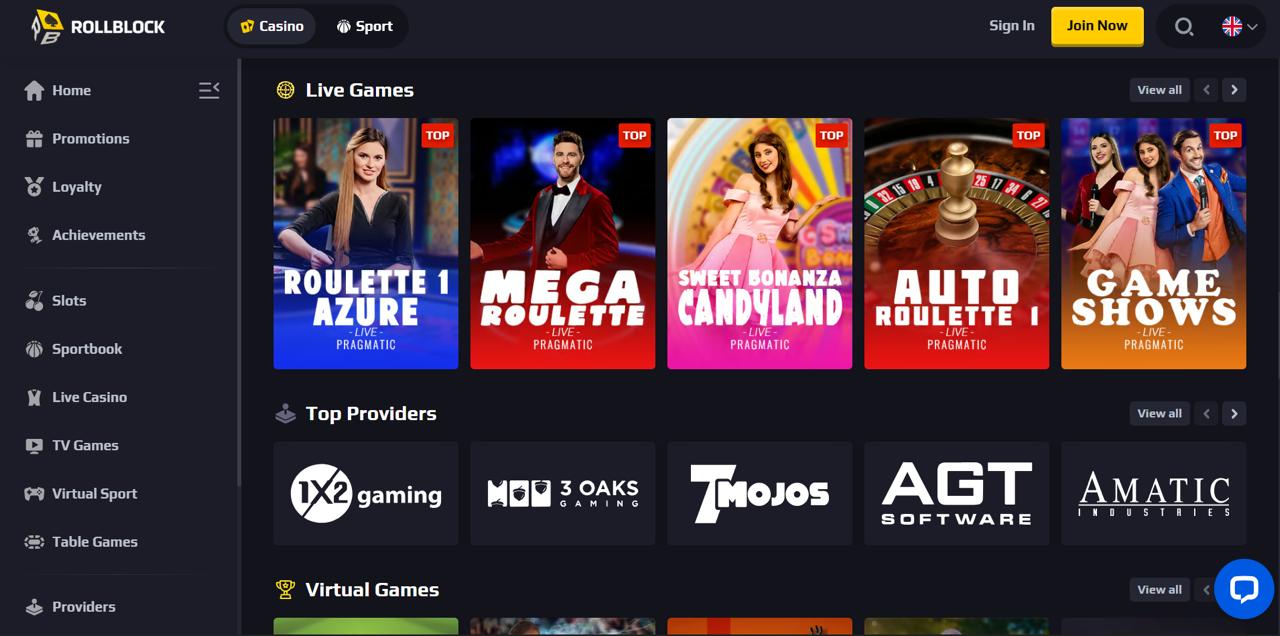

While ADA remains a fixture in the market, Rollblock (RBLK) is steadily capturing institutional attention. The project has already moved beyond speculation by running a licensed, revenue-generating gaming ecosystem that continues to show strong traction.

With its foundation built on Ethereum, audited by SolidProof, and licensed under Anjouan Gaming, Rollblock offers a level of security and oversight that investors take seriously.

Its ecosystem stretches far beyond casual play. More than 12,000 games are live, from poker and roulette to blackjack, AI-driven titles, and a sportsbook covering events across the NBA, UFC, and UEFA. The platform’s frictionless onboarding, requiring only an email paired with sign-up bonuses, has accelerated adoption, bringing in tens of thousands of users.

What makes Rollblock attractive to institutions is its sustainable tokenomics. Each week, revenue is split to drive token buybacks, burns, and staking rewards. This creates a shrinking supply alongside steady income for holders, making it one of the few models where growth directly benefits participants.

Key drivers behind Rollblock’s momentum include:

- Licensed operations backed by independent audits.

- Over 12,000 live games plus a global sportsbook.

- Straightforward user onboarding with competitive rewards.

- A deflationary token model balancing scarcity and yield.

With the token price at $0.068, Rollblock’s trajectory signals why larger investors are beginning to accumulate ahead of broader exchange listings.

Institutions Turn Toward Rollblock

Rollblock’s presale success marks a sharp contrast to ADA’s cautious charts. While the Cardano price prediction now highlights downside pressure, Rollblock is expanding with adoption, licensing, and strong tokenomics. This clear growth story is why traders and institutions alike believe RBLK could soon leap past Cardano as one of the most critical projects in crypto’s next cycle.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Cardano Price Prediction Turns Bearish As Institutional Investors Accumulate Rollblock appeared first on Coindoo.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach