Hyperliquid (HYPE) Price Prediction: Traders Eye $30–$35 Accumulation Zone for a Bounce

Despite a sharp pullback from its recent highs, Hyperliquid has managed to hold key demand levels. The current setup has made Hyperliquid Price Prediction a hot topic, with analyst pointing out how repeated corrections have often paved the way for stronger rallies.

Hyperliquid Price Entering Another Corrective Round

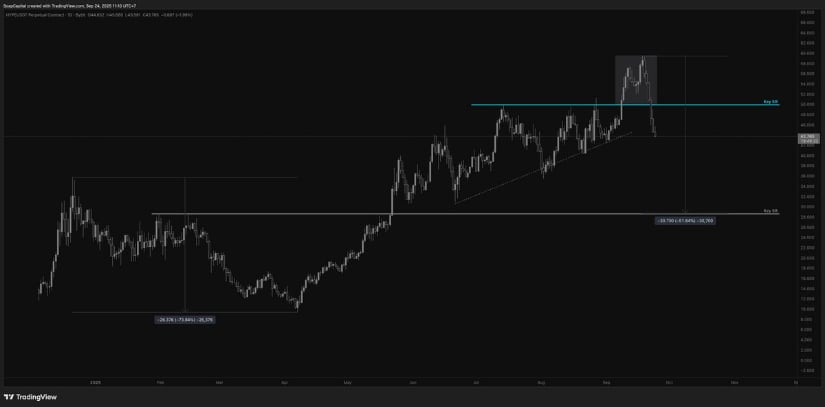

Hyperliquid has slipped back around 20% from its recent highs, a move that lines up with its past retracement behavior. Analyst Ardi highlights that this is the fourth time in three months HYPE has seen a similar pullback after touching new all-time highs. Rather than breaking the structure, the chart shows the correction is part of a repeating cycle, where each dip has eventually set the stage for another leg higher.

Hyperliquid slips 20% from recent highs but continues to mirror its repeating corrective cycle. Source: Ardi via X

From a technical standpoint, the zone between $46 and $48 is being tested as immediate support. If buyers defend this area, the broader uptrend remains intact with room to revisit $60 and beyond.

Hyperliquid Key Demand Zone Highlighted

Analyst Tyler has marked the $30 to $35 range as his main accumulation zone. The chart shows how this area lines up with both historical demand and the broader trendline structure, making it a logical place for buyers to step in. After the recent breakdown, this deeper pullback brings the price into a level where risk-to-reward begins to favor accumulation.

Hyperliquid’s $30–$35 zone emerges as a key accumulation area, aligning with historical demand and trendline support. Source: Tyler via X

If HYPE holds between $30 and $35, a bounce back towards mid-range resistance around $42 to $44 becomes the first upside objective. Clearing that zone would then put the $50+ region back in play.

Liquidity Maps Show Where Price Could Head Next

Coin Bureau points to Coinglass data showing a heavy buildup of long liquidation levels stacked below Hyperliquid’s current price. With HYPE trading around $47, the chart highlights clusters of long positions vulnerable to liquidation if the price dips further. This kind of setup often creates added pressure in the short term, as cascading liquidations can accelerate downside moves if support zones fail to hold.

Liquidity maps reveal stacked long positions below $47, raising risks of cascading liquidations if support breaks. Source: Coin Bureau via Coinglass

The key now is whether buyers can step in to absorb the selling before those deeper levels are triggered. If $46 to $47 breaks, the next significant areas of liquidity sit lower, potentially pulling the price into the mid-$30s.

Hyperliquid Still Dominating on Fees

Even with the recent correction in price, Hyperliquid continues to stand out on-chain. Data shared by Coin Bureau shows HYPE leading all major chains in fee generation over the last 24 hours, ahead of BNB Chain, Solana, and even Ethereum.

Hyperliquid tops fee generation charts, outpacing Ethereum, Solana, and BNB despite recent price corrections. Source: Coin Bureau via X

For participants, this provides a more positive backdrop amid the volatility. Strong fee revenue often reflects sustainable network health, and in Hyperliquid’s case, it reinforces why large players have continued to accumulate even during pullbacks.

If HYPE Hyperliquid price holds this supportive region around $46 or falls lower to the $35 levels, it could emerge as an opportunity for the participants.

Final Thoughts

Hyperliquid’s recent dip might look like a setback, but the bigger picture suggests this is just another step in its repeating cycle. With fee dominance still leading the market and strong demand zones lining up, the project continues to show resilience even when price momentum cools. Participants watching the $46 to $48 support, or the deeper $30 to $35 range, may find that these areas define the next important swing.

At the end of the day, Hyperliquid remains one of the few names combining strong on-chain revenue with active market participation. From a Hyperliquid Price Prediction perspective, if support holds and liquidity risks are absorbed, the stage could be set for another push toward $60 and beyond.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Robinhood Chain Public Testnet Launch: A Strategic Pivot into Ethereum’s Layer 2 Ecosystem