Hyperliquid (HYPE) Price Prediction: Can Bulls Defend $35 Support or Will Sellers Push Lower?

Hyperliquid has hit a rough patch, sliding sharply after losing momentum above $60 and now testing fragile support zones. The sudden shift in volume and rising competition from ASTER has only added pressure, leaving participants questioning if HYPE can hold its ground or if deeper levels will be tested next.

Hyperliquid Chart Shows Growing Weakness

Hyperliquid’s recent price action has broken down sharply, sliding more than 10% in a single move and pushing the token closer to its rising trendline support. The chart shared highlights a clear series of lower highs forming after the rejection above $60, showing that momentum has shifted firmly in favor of sellers. With price now pressing the $41 to $42 region, the market is testing a level that needs to hold if bulls are to avoid further damage.

Hyperliquid slips over 10% in a sharp breakdown, testing critical support near $41–$42. Source: dxrnelljcl via X

If this zone fails, the structure leaves room for a deeper leg lower, potentially opening the way back towards $38 or even $35. For now, the setup leans bearish as each bounce attempt is being met with heavier selling pressure.

Key Levels to Watch for HYPE Hyperliquid

Hyperliquid has broken down from its rising wedge structure, a pattern that usually signals bearish continuation. The rejection above $60 confirmed weakness, and the drop has already pushed the HYPE token into the mid-$40s. The chart shared by Don highlights a possible path where price may revisit the green demand block, with $35 to $32 emerging as the critical zone that could act as a bottom. This area has historical importance, and buyers will likely be watching closely to defend it.

Hyperliquid’s wedge breakdown points to deeper downside, with $35–$32 marked as the key demand zone to watch. Source: Don via X

If $35 to $32 does hold, the setup allows room for a consolidation phase before any meaningful recovery attempt. The sketched projection suggests a bounce from these levels could rebuild structure and potentially target back into the $50 to $55 range.

Market Flow Signals Shift From HYPE to ASTER

The recent dip in Hyperliquid has coincided with a clear rise in ASTER, suggesting that capital is rotating between the two. The chart shared by Elja shows how HYPE has been in a distribution phase, shedding value while ASTER is showing accumulation and steady growth. This type of liquidity flow is common in crypto markets, where emerging projects can attract attention at the expense of others already under pressure.

Liquidity rotation highlights ASTER’s rise as Hyperliquid weakens, signaling a shift in market focus. Source: Elja via X

For HYPE, this shift adds another layer of weakness on top of its existing technical breakdown. While its structure is pointing towards deeper support levels, the fact that ASTER is now pulling liquidity makes recovery harder in the short term.

Weakening Fundamentals: The Reason Behind HYPE’s Weakness?

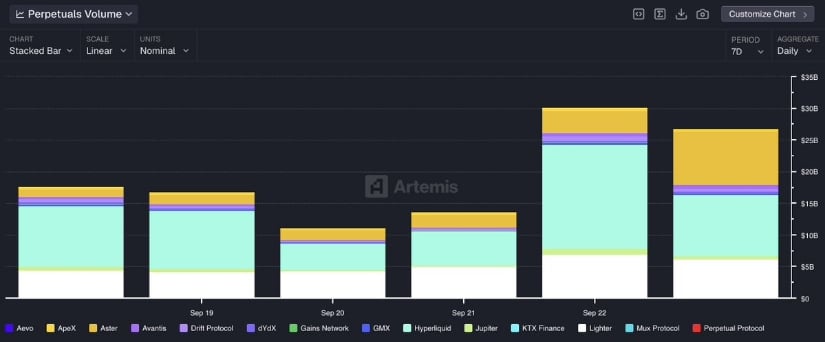

HYPE’s latest performance is being overshadowed by growing competition in the futures market, particularly from ASTER. Data shared by Coin Bureau shows ASTER’s daily perpetual volume surging to $8.4B, closing in on HYPE’s $9.7B. Just a few days earlier, HYPE was still comfortably ahead at $16B, but the rapid shift highlights how quickly market share can erode when attention begins to rotate.

Hyperliquid’s futures volume slips from $16B to $9.7B as ASTER rapidly gains ground, raising fresh concerns over HYPE’s dominance. Source: Coin Bureau via X

This trend raises concerns for HYPE’s near-term outlook. For Hyperliquid, futures volumes remained a major indicator, and losing momentum here suggests weakening fundamentals. Combined with the recent price breakdown, this decline in dominance could make it harder for HYPE to stabilize unless demand returns strongly. For now, the data confirms that HYPE is not only battling technical pressure on the charts but also losing ground in the fundamental side.

Final Thoughts

Hyperliquid is clearly facing a testing moment, with both the charts and fundamentals leaning against it. The steady rejection from higher levels, coupled with shrinking futures volume, shows that sentiment has shifted away from the token for now. Unless demand steps back in quickly, the $35 to $32 range could be the next real battleground for bulls to defend.

You May Also Like

Optimism will cease support for op-geth and op-program on May 31.

South Africa Fuel Price Increase Takes Effect