Bitcoin (BTC) Price: Profit-Taking Frenzy Sends Markets Lower. Watch These Levels

TLDR

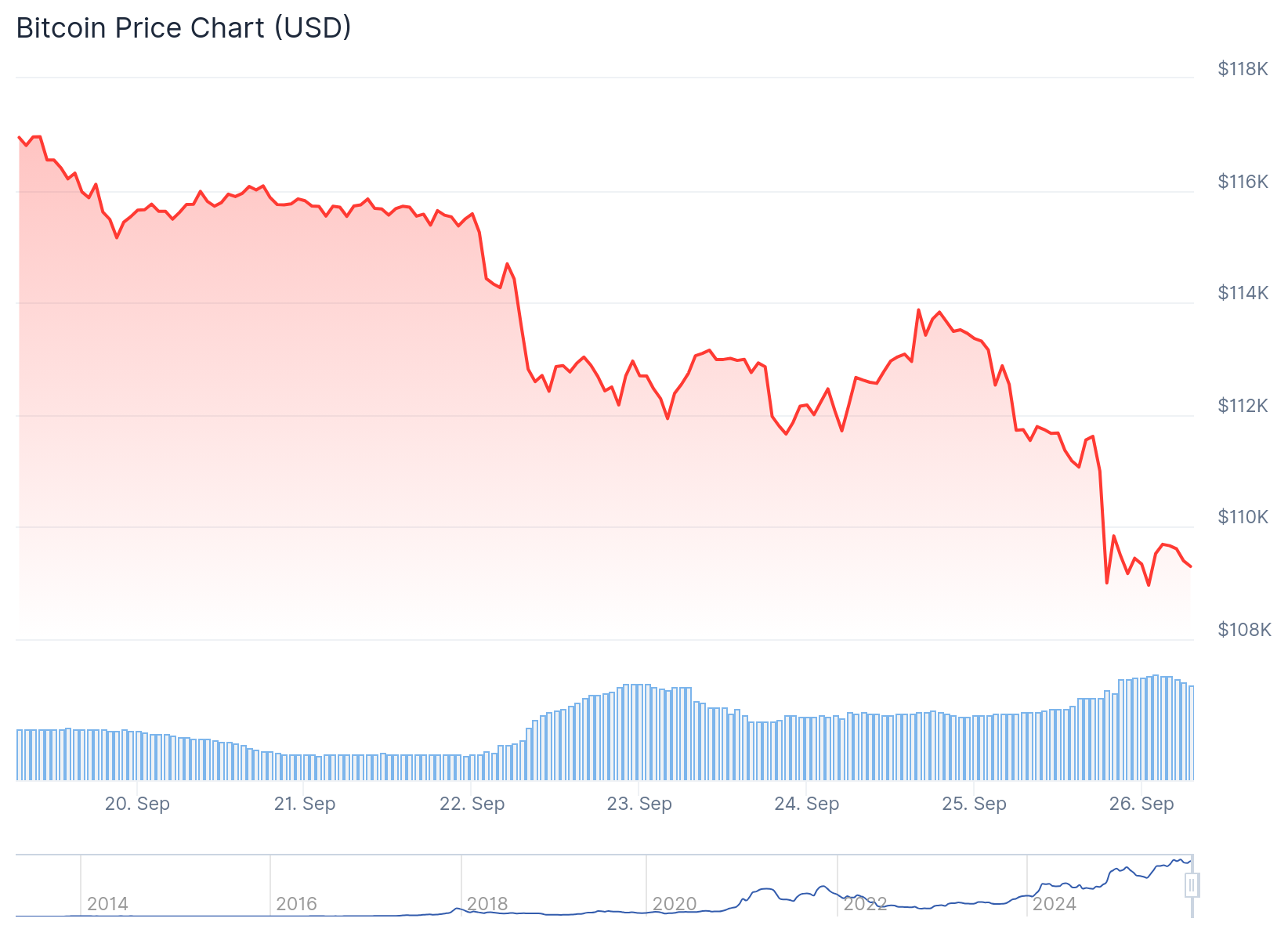

- Bitcoin dropped to a four-week low of $108,700 on Thursday, falling below key $112,000 support levels

- Long-term holders realized 3.4 million Bitcoin in profits while ETF inflows slowed, showing signs of market exhaustion

- The Spent Output Profit Ratio (SOPR) indicates some Bitcoin holders are now selling at a loss at 1.01

- Cumulative realized profits have reached levels seen in previous market cycle tops three separate times this cycle

- Liquidations totaled $1.5 billion in long positions earlier this week as thin liquidity worsened the sell-off

Bitcoin has fallen to its lowest level in four weeks as market data suggests the current rally may be losing steam. The cryptocurrency dropped to $108,700 on Coinbase during late Thursday trading.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The decline comes after Bitcoin failed to maintain support above $112,000. This represents a retreat from recent highs and marks the first time Bitcoin has approached these levels since early September.

Long-term Bitcoin holders have realized 3.4 million Bitcoin in profits according to Glassnode data. This large-scale profit-taking coincides with slowing inflows into Bitcoin exchange-traded funds.

The combination of profit-taking and reduced institutional demand signals what analysts call “exhaustion” following the Federal Reserve’s recent rate cut. Market participants appear to be taking profits rather than adding to positions.

Profit-Taking Reaches Cycle Peak Levels

Glassnode reports that Bitcoin’s realized profit/loss ratio shows profit-taking has exceeded 90% of coins moved three separate times during this market cycle. The market has just stepped back from the third such extreme reading.

These peaks have historically marked major cycle tops in previous Bitcoin market cycles. The data suggests probabilities favor a cooling phase ahead for Bitcoin prices.

The Spent Output Profit Ratio currently sits at 1.01, indicating some holders are beginning to sell at losses. This metric typically signals market stress when it approaches or falls below 1.0 during bull markets.

Short-Term Holder Net Unrealized Profit/Loss is approaching zero. This threatens to trigger additional liquidations as newer Bitcoin holders may quickly cut their losses.

Earlier this week, liquidations totaled approximately $1.5 billion in long positions across cryptocurrency exchanges. Reports indicate thin market liquidity and heavy leveraged betting worsened the sell-off.

The liquidation wave dragged Bitcoin from above $115,000 to the low $112,000 area. This move unsettled sentiment across the broader digital asset market.

Source: TradingView

Source: TradingView

Economic Data Influences Market Sentiment

U.S. economic data has added to cautious sentiment in cryptocurrency markets. The economy expanded at a 3.8% annualized pace in the second quarter, above the initial 3.3% reading.

However, economists warn that growth is expected to slow to about 1.5% for the full year. Trade-policy uncertainty weighs on future economic activity.

Labor market data shows initial unemployment claims fell to 218,000 for the week ended September 20. While layoffs remain low, hiring has slowed considerably.

Federal Reserve Chair Jerome Powell stated there was “no risk-free path” in setting monetary policy this week. He warned that easing too quickly could stoke inflation while moving too slowly risked harming job growth.

Other Fed officials reinforced this cautious stance in separate remarks. They emphasized that further monetary easing will be highly dependent on incoming economic data.

The August personal consumption expenditures price index report is due Friday. Core inflation is forecast to show a 2.9% year-over-year reading, still above the Fed’s 2% target.

Bitcoin was trading at $109,645 at the time of writing, having lost 6.5% over the past week

The post Bitcoin (BTC) Price: Profit-Taking Frenzy Sends Markets Lower. Watch These Levels appeared first on CoinCentral.

You May Also Like

XMR Technical Analysis Jan 22

Watch Out: Numerous Economic Developments and Altcoin Events in the New Week – Here’s the Day-by-Day, Hour-by-Hour List