Hyperliquid Price Prediction: HYPE Slips 1% Even As Bitwise Files For Spot HYPE ETF

The Hyperliquid price has tumbled almost 2% in the last 24 hours to trade at $42.26 as of 12.30 a.m. EST even as fund manager Bitwise filed for a Hyperliquid ETF.

The news of Bitwise’s HYPE ETF filing initially brought a short boost for the token, with the price popping about 4% to $42.50 before paring gains

The ETF is designed to provide investors with direct exposure to HYPE through regulated brokerage accounts, with Coinbase Custody serving as the custodian.

The ETF does not qualify for fast-track SEC approval because there are currently no regulated HYPE futures contracts. This means the process to get the ETF live might take months.

HYPE Price Tests Key $42 Support As Bulls Eye Rebound

On the daily chart, HYPE has been falling sharply from the recent high near $56, losing momentum as it crashed below its 50-day simple moving average (SMA) at $47.55. This moving average now acts as resistance and needs to be reclaimed for the bulls to gain back control.

The 200-day SMA is at $33.68, providing deeper long-term support if sellers continue to push.

Fibonacci retracement levels are in play: the coin is currently holding the 38.2% retracement level at $42.03. Below this, the next support stands around $37.72, the 50% retracement, and $33.41 at the 61.8% Fibonacci.

The $42 level is especially important. If it holds, analysts like Ali Charts see a potential springboard for a rebound to $55 or higher. But if it breaks, price could head towards $38 or lower.

HYPEUSDT Analysis Source: Tradingview

The RSI (Relative Strength Index) shows a reading near 38, which is close to “oversold” levels. This might suggest a bounce is possible soon if buyers return. The MACD indicator, on the other hand, remains bearish as the signal line is still negative, showing sellers have control for now.

Analysts remain split about near-term HYPE price direction. Some say that if the ETF news and treasury buy-ins can bring fresh hype, the price could quickly try to reclaim the $47.55 level and then move towards $50 and $55 resistance zones.

However, overall market sentiment is cautious, and most agree that a break below $42 would likely trigger a move to $38 or even the $33 range, where the 200-day moving average comes in as support.

Hyperliquid On-chain Analysis

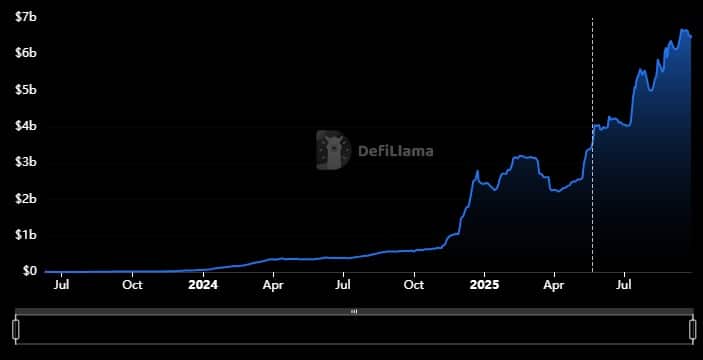

On-chain data shows that Hyperliquid continues to grow its decentralised finance ecosystem steadily. Total Value Locked (TVL) has reached over $5 billion, up from $3.5 billion at mid-year, reflecting a 70% rise in user funds locked into the protocol since January 2025.

Weekly inflows average $58 million, signalling consistent investor interest despite challenging market conditions.

Whale activity has been notable lately, with large purchases of HYPE tokens, including a recent $10 million buy by a single whale, shifting capital from vaults to spot accounts, demonstrating strong confidence from big holders.

Additionally, technical upgrades such as the upcoming HIP-3 market creation feature aim to decentralise the protocol further and draw in more community involvement. These on-chain metrics support a cautiously optimistic view of HYPE’s long-term fundamentals even as the price struggles mid-term

Big buys from institutional players like Hyperion DeFi, recently adding $10 million worth of HYPE to its treasury, are helping maintain confidence and provide a backstop on big price drops.

Related Articles:

You May Also Like

YZi Labs Binance Deposit: A $6.63M Signal That Could Shake the ID Token Market

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more