VeChain Treasury Falls to $167M as VET Struggles

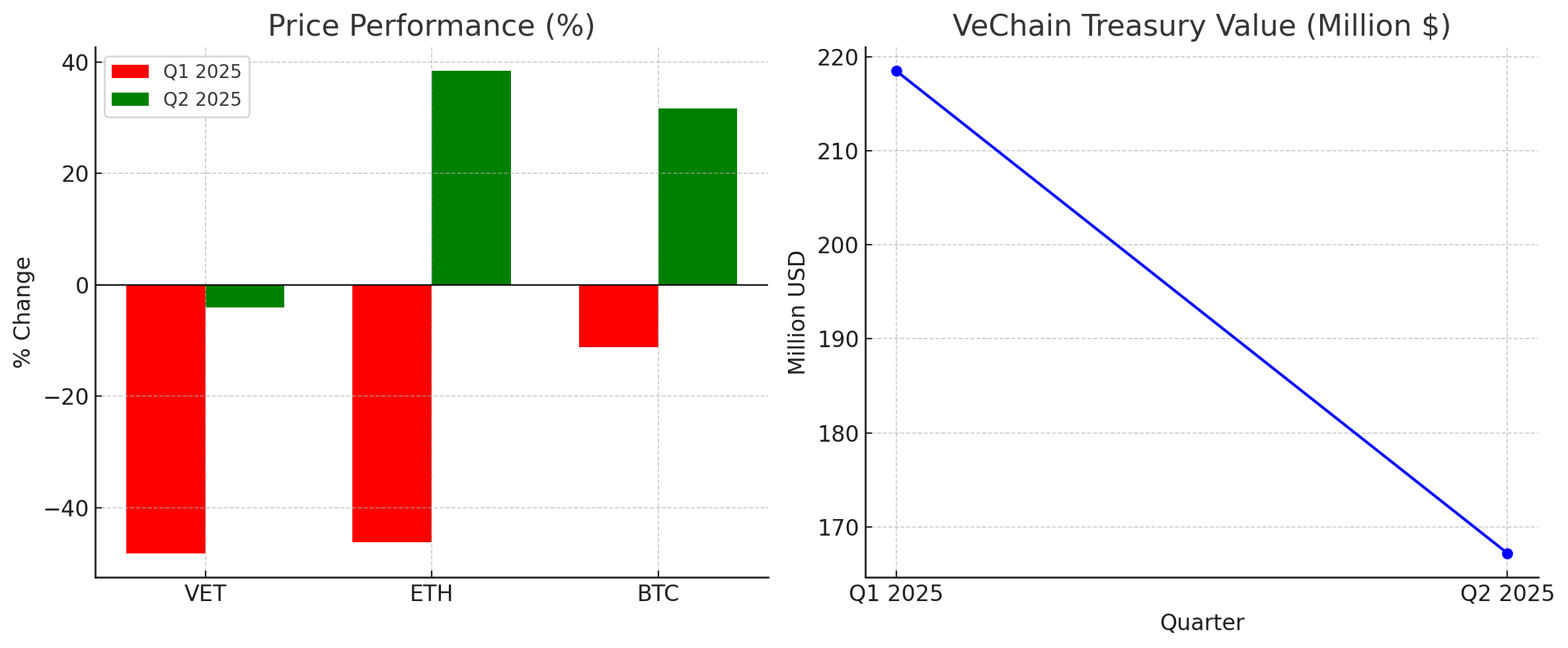

The Foundation confirmed that its treasury dropped to $167 million by the end of June, a sharp fall from earlier in the year, even as the broader crypto market saw a recovery.

Market Struggles Despite Upgrades

Bitcoin and Ethereum both posted strong double-digit gains in Q2, yet VET slipped another 4%, extending losses that have now pushed the token more than 90% below its all-time high. Analysts say this underperformance highlights the gap between VeChain’s ambitions and current investor sentiment.

At the same time, the team has been rolling out major tokenomics changes. VTHO generation is now tied exclusively to staking and ecosystem usage, an attempt to limit inflation and push the model toward a more sustainable, possibly deflationary path.

READ MORE:

Altcoins Face Billions in Unlocks Just as Q4 Rally Season Begins

Building Long-Term Foundations

Alongside treasury management, VeChain has been investing in the expansion of its VeWorld super app, designed to bring NFT and Web3 services into a more user-friendly experience. The Foundation argues that these moves, while costly in the short term, are meant to set the stage for renewed growth once the market stabilizes.

Signs of a Potential Turn

Despite the heavy declines, some analysts remain cautiously optimistic. On longer timeframes, VET appears to be forming a base, with strong support levels preventing deeper losses. Market observers suggest that if liquidity improves, VeChain’s reforms could act as a springboard for a breakout in the coming months.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post VeChain Treasury Falls to $167M as VET Struggles appeared first on Coindoo.

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Fed Decides On Interest Rates Today—Here’s What To Watch For