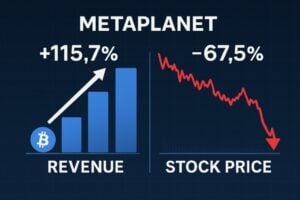

Metaplanet Q3 2025: Bitcoin revenue +115.7%, guidance doubled; stock -67.5%

Double-digit growth in revenues and a sharp drop in stock price. This is the gap marking Q3 2025 for Metaplanet: accelerating results, guidance revised upwards – as confirmed by CoinDesk and public trackers monitoring BTC reserves – see BitcoinTreasuries – but shares declined significantly in the quarter.

In this context, the picture offers mixed signals: operational solidity on one side, cautious sentiment on the other.

According to the data collected by our analysis team, the purchasing operations and revenue scalability are consistent with the company’s official communications updated as of September 30, 2025.

Industry analysts note that a holding of approximately 30.8k BTC significantly increases exposure to spot market volatility, making the risk/reward profile more sensitive to Bitcoin price fluctuations, as highlighted in the Bitcoin price analysis on Cryptonomist.

Q3 2025: operating results and revenue dynamics

In the third fiscal quarter of 2025, the Bitcoin income generation division recorded revenues of ¥2.438 billion (≈$16.56 million), an increase of +115.7% compared to ¥1.131 billion in Q2 2025 (≈$7.69 million) and +216.6% compared to Q1, as reported by CoinDesk. It should be noted that the growth rate intensified sequentially, indicating greater traction of the Bitcoin-related model.

Key Numbers

- Q3 2025 Revenue: ¥2,438 billion (≈$16.56 million)

- Q2 2025 Revenue: ¥1,131 billion (≈$7.69 million)

- Change vs Q2: +115.7%

- Change vs Q1: +216.6%

The growth is driven by operations related to Bitcoin and the expansion of the digital asset base. However, a paradox remains: while fundamentals improve, the stock significantly retreats on the market.

Indeed, the gap between revenues and stock performance highlights a perception of still high risk on the equity front, as discussed in the analysis of the MSTR stock collapse.

Guidance FY2025: revenue and operating profit revised upwards

Following the results, the company has updated its forecasts for the entire fiscal year 2025. The revenue forecast rises to ¥6.8 billion, compared to the previous ¥3.4 billion, and the expected operating profit increases to ¥4.7 billion from ¥2.5 billion, as highlighted by Bitcoin Magazine.

That said, the revision of the guidance indicates greater visibility on the cash generation drivers.

The reviews in summary

- New revenue target FY2025: ¥6.8 billion (+100% vs previous estimate)

- Operating profit FY2025: ¥4.7 billion (+88% vs previous guidance)

Bitcoin Treasury: Size and Positioning

Metaplanet reports having reached the target of 30,000 BTC by 2025. As of September 30, 2025, the company holds 30,823 BTC, including 5,268 coins purchased in the quarter for approximately $615.67 million, as reported by Yahoo! Finance.

In this context, the scale of the endowment becomes a central element of the strategy.

BTC Supply Data

- Purchases Q3 2025: 5,268 BTC (≈$615.67 million)

- Total Bitcoin held as of September 30, 2025: 30,823 BTC

- Share of total supply: >0.1% (estimate)

- Average cost of acquisition: $107,912 per BTC

- Reported YTD Bitcoin return: +497.1%

This allocation positions Metaplanet among the leading public holders of BTC globally, according to data from the tracker BitcoinTreasuries, and a detailed analysis of the company’s treasury volume is available in this Cryptonomist article.

Yet the size of the treasury, while strengthening the strategic profile, exposes the company to the inherent volatility of the digital asset.

Stocks -67.5% in the quarter: possible explanations

Between July and September 2025, Metaplanet stock lost 67.5%, while Bitcoin closed the quarter up 6.31%, as reported by Yahoo! Finance.

The divergence may reflect various specific equity and market factors. In other words, the market might have favored a more rigorous risk management approach, in line with what was seen in the analyses on Strategy’s stock performance.

Plausible drivers of the bear market

- Dilution from announcements or expectations of stock issuance – including any preferred shares – to finance the BTC treasury.

- Profit-taking after previous rallies and the typical volatility of the crypto sector.

- Potential lock-up expirations, portfolio rotations, or reduction of liquidity on the asset.

- Regulatory risks and uncertainty regarding the accounting/valuation treatment of digital assets, as described in the latest SEC updates.

- Local macroeconomic factors, such as fluctuations in the JPY and the cost of capital, which affect the risk premium.

In the absence of positive catalysts in the short term, the market may have priced in the risk of earnings volatility and the potential gap between the book value of the treasury and the equity price. That said, the reading remains influenced by the sensitivity of the stock to Bitcoin dynamics and news flows.

What it means for investors

- Revenues related to Bitcoin are accelerating and have driven the revision of the 2025 guidance.

- The BTC allocation strengthens the operational positioning in the crypto cycle, but increases exposure to volatility.

- The stock performance indicates investor caution regarding the sustainability of results and financing risks.

Takeaway

Metaplanet closes Q3 2025 with strong revenue growth and doubled guidance, supported by the Bitcoin strategy, as highlighted by CoinDesk.

However, the stock’s decline during the quarter highlights a gap between solid fundamentals and market sentiment, with particular attention to the risk of dilution and the inherent volatility of the crypto sector.

Ultimately, the operational trajectory remains on an upward trend, while the stock market valuation reflects marked caution, consistent with the analyses recently published on Cryptonomist.

You May Also Like

USDC Minted: 250 Million Dollar Stablecoin Injection Sparks Market Speculation

Shiba Inu’s (SHIB) Price Prediction for 2025 Points to 4x Growth, But Mutuum Finance (MUTM) Looks Set for 50x Returns