Stablecoins Help Africa Beat Inflation as Best Wallet Token Gains Momentum

They help people survive inflation, dodge currency crashes, and move money faster than banks ever could. Amina in Kenya invoices Berlin in the morning and gets paid by the afternoon through M-Pesa.

Between July 2023 and June 2024, Nigeria alone saw nearly $22B in stablecoin transactions – the highest in Sub-Saharan Africa.

It’s not about speculation anymore. It’s about survival. When the local currency melts and banks take a week to clear payments, stablecoins are the new cash.

And that wave of adoption is about to meet its next upgrade with Best Wallet Token ($BEST).

The Stablecoin Revolution: Cheaper, Faster, Fairer

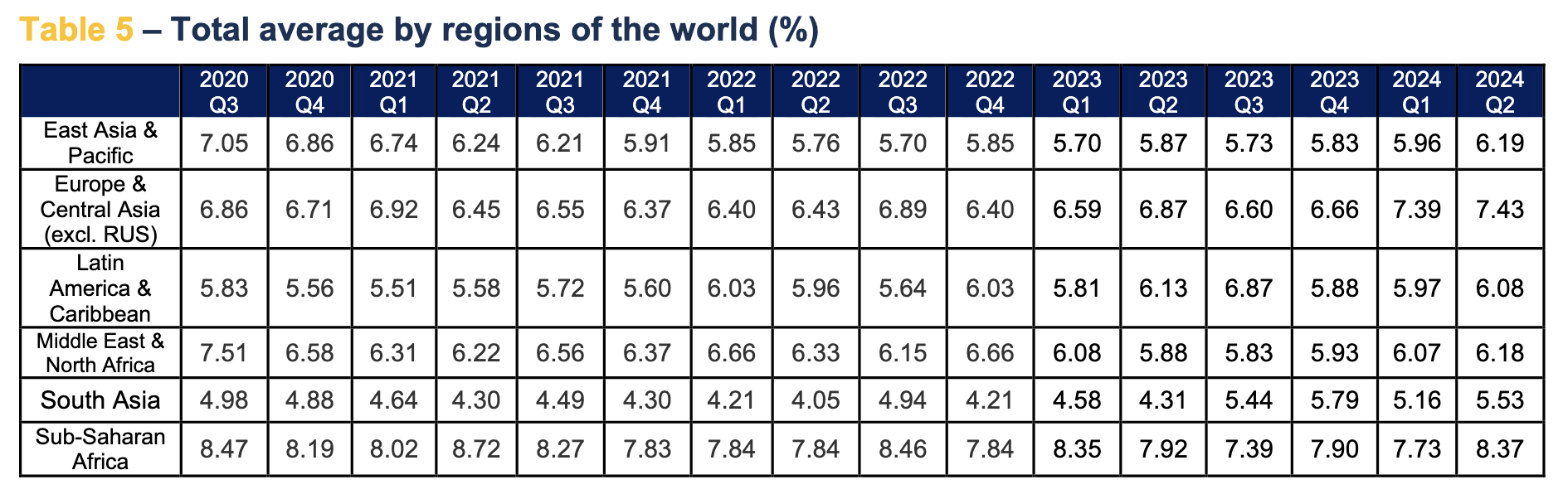

Inflation in Nigeria is still around 21.88%, and remittance costs in Sub-Saharan Africa average a painful 8.45%.

Source: The World Bank’s Remittance Prices Worldwide report

People send $200 to family, and $17 disappears in fees.

Stablecoins flipped that script. Services like Yellow Card and Kotani Pay now link $USDT or $USDC directly to mobile wallets, bringing cross-border transfers down to just a few percent.

The trend is clear: digital dollars are winning hearts, phones, and bank accounts. But while stablecoins keep value steady, what’s still missing is a way to make crypto usable everywhere.

What Best Wallet Token Is Doing Right

Best Wallet Token ($BEST) sits at the center of one of crypto’s most promising projects – Best Wallet, a next-generation app designed to challenge outdated tools like MetaMask with smoother performance, higher security, and real-world usability.

It’s the first of a new wave of wallets built not just for traders, but for everyone using digital assets as money.

What makes Best Wallet stand out is its utility-first design. The app merges payments, crypto storage, and Web3 identity into one simple interface.

Its backbone is Fireblocks’ MPC-CMP technology, providing top-tier protection against hacks and lost keys – a level of security trusted by major financial institutions.

But the feature turning heads is Upcoming Tokens, a game-changing tool for presale buyers. Instead of hunting down risky links and scam mirror sites, users can safely join token presales right inside the app.

Best Wallet Token already has a 70K-strong community and is growing at 50% month-on-month – a rare metric that hints at serious traction.

It’s fast, familiar, and built to scale. The $BEST token fuels this entire ecosystem, acting as the key that unlocks its best features and rewards.

Why People Are Buying $BEST

The $BEST token is more than a utility coin – it’s a stake in the future of digital payments.

Holders gain access to exclusive perks like fee discounts, governance rights, and higher staking rewards, creating both financial and functional value.

Priced at $0.025745, with $16.2M already raised in presale, $BEST has become one of the best presale stories of 2025.

Its timing couldn’t be better. As stablecoins fuel daily commerce from Nairobi to Lagos, people are looking for secure, integrated wallets that make crypto practical.

That’s exactly what Best Wallet delivers, and $BEST gives users a front-row seat to the stablecoin-powered revolution transforming global finance.

Africa’s Inflation Crisis Has a Digital Escape Hatch

Stablecoins changed how Africa moves money. Now, Best Wallet Token wants to change how people use it – seamlessly, securely, and globally. It’s a project with heart, backed by tech, and driven by necessity.

Crypto isn’t just speculation anymore. In places like Lagos and Nairobi, it’s survival – and $BEST looks ready to lead that next chapter.

This article is for informational purposes only and shouldn’t be considered financial advice. Always do your own research (DYOR) before investing in crypto.

You May Also Like

XRP Hits ‘Extreme Fear’ Levels - Why This Is Secretly Bullish

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income