GENIUS Stablecoin Act Seen Ending Bank Interest ”Rip Off,” Apple, Google, Meta Poised To Pounce

The GENIUS stablecoin act could stop banks ripping off retail depositors, with tech giants Apple, Google, and Meta set to challenge them by embedding high-yield stablecoins into their platforms.

That’s according to Tushar Jain, a co-founder of crypto fund manger Multicoin Capital.

“The GENIUS Bill is the beginning of the end for banks’ ability to rip off their retail depositors with minimal interest,” Jain wrote in an X post. ”Banks are going to have to pay more interest to depositors and their earnings will significantly suffer as a result.”

Tech Giants Will Compete With Banks Using “Mega Distribution” Platforms

Jain said the tech giants will use their ”mega distribution” platforms to offer better yields to depositors, provide 24/7 payments, and improved digital experiences.

His post follows a June article by Fortune magazine that said that Apple, Google, Airbnb, and X were among some of the top tech companies exploring issuing their own stablecoins.

Bitwise Chief Executive Officer (CEO) Hunter Horsley has come to the same conclusion as Jain, arguing in a Oct. 6 post on X that the tech giants will likely launch their own wallets and then add stablecoin integration into them as the first move to take on banks.

“Software is eating the world,” he said. ”The financial system is next.”

Stripe CEO Patrick Collison wrote in a post on X over the weekend that the average interest rate for savings accounts in the US is 0.40%, and only 0.25% in Europe.

Rates for Tether’s USDT and Circle’s USD Coin (USDC) on the decentralized finance (DeFi) platform Aave stand at 4.02% and 3.69%, respectively.

“Consumer hostile” banks are in a ”losing position,” he said

$6.6 Trillion Could Leave The Banking System, US Treasury Warns

The US Department of the Treasury estimated in April that the mass adoption of stablecoins could lead to $6.6 trillion in outflows from the traditional banking system.

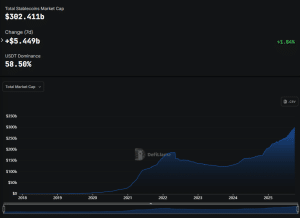

The market capitalization of stablecoins stands at a record high $302.411 billion, up from around $255 billion in July, according to DefiLlama.

Stablecoin market cap (Source: DefiLlama)

The sector’s market cap climbed by more than $5.4 billion in the past week alone.

But the continued growth of the stablecoin market may end up amplifying deposit flight risk, “especially in times of stress, that will undermine credit creation throughout the economy,” the Bank Policy Institute warned in August.

“The corresponding reduction in credit supply means higher interest rates, fewer loans, and increased costs for Main Street businesses and households,” it said.

Banking Groups Already Tried To Shutdown Stablecoin Yields

The GENIUS Act, which was enacted in July this year, establishes the regulatory guidelines for stablecoin firms looking to issue their tokens in the US.

It also prohibits stablecoin issuers from offering interest or yield to token holders, but doesn’t explicitly extend the ban to third parties such as crypto exchanges or business affiliates. This leaves the door open for stablecoin issuers to circumvent the ban and still offer yields to their clients.

For example, USD Coin (USDC) issuer Circle is not allowed to offer direct yields, but crypto exchange Coinbase can.

“The banking lobby tried to protect their profits with the Genius Act’s prohibition on passing interest to stablecoin holders but that is easily circumvented as you can see by Coinbase’s yield sharing with customers,” said Jain.

You May Also Like

The Channel Factories We’ve Been Waiting For

Ethereum Price Prediction: ETH Targets $10,000 In 2026 But Layer Brett Could Reach $1 From $0.0058