Largest US Union Federation Opposes Crypto Bill, Says It Exposes Workers’ Retirement Funds to Risk

The AFL-CIO has urged the Senate Banking Committee to oppose the Responsible Financial Innovation Act, warning that the legislation would expose workers’ retirement funds to crypto volatility while increasing systemic financial risk.

In an October 7 letter to Chairman Scott and Ranking Member Warren, AFL-CIO Director of Government Affairs Jody Calemine stated the bill would greenlight retirement plans like 401(k)s and pensions to hold risky crypto assets rather than insulating workers from instability.

The union federation represents millions of American workers whose retirement security could be affected by the legislation.

The opposition comes as President Trump signed an executive order in August allowing American workers to add alternative assets, including cryptocurrency, to their $12.5 trillion 401(k) portfolios.

More than 90 million Americans participate in employer-sponsored defined-contribution plans, with total US retirement assets valued at $43.4 trillion as of March 31, 2025.

House Financial Services Committee Chairman French Hill and Subcommittee Chairman Ann Wagner urged SEC Chair Paul Atkins on September 22 to implement the directive swiftly by recognizing FINRA-certified professionals as accredited investors.

Union Warns Bill Creates Shadow Markets and Exposes FDIC to Risk

The AFL-CIO claimed to have identified two immediate systemic risks in the legislation.

First, the proposal would expand the ability of FDIC-backed banks and bank holding companies to hold and trade crypto assets directly, rather than only on behalf of clients.

This, according to them, would expose banks to a heightened risk of losses and failures, while also putting the FDIC’s taxpayer-backed Deposit Insurance Fund at greater risk.

Second, the bill codifies the tokenization of securities and assets, allowing private companies to create shadow public stock outside SEC oversight.

Calemine warned these blockchain-based shadow stocks, notionally tied to traditional public stock but trading independently, would create new risks for both shadow stockholders and public stockholders who did not opt into unregulated markets.

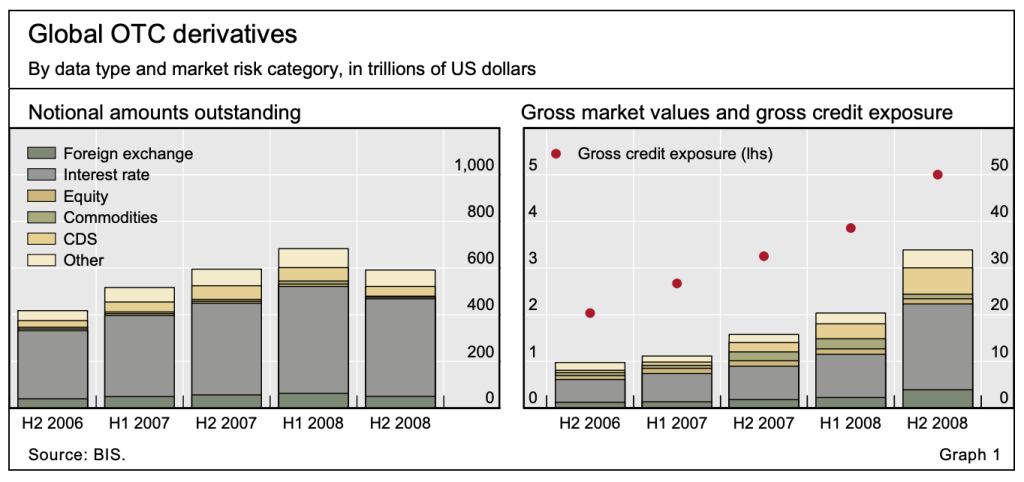

The union expressed deep concern about the potential impact on the stability of traditional financial markets and institutions, comparing the risks to unregulated derivatives markets that contributed to the 2008 financial crisis.

Source: BIS

Source: BIS

The legislation substantially weakens federal and state enforcement tools to police fraud and conflicts of interest, according to the AFL-CIO.

The bill creates avenues for securities issuers to evade SEC regulation through tokenization, reduces public disclosure requirements, and preempts state-level antifraud, securities, and consumer protection laws.

While most pensions currently do not carry crypto assets due to associated risks, Calemine claimed the bill provides a “facade of regulation” that may make crypto more mainstream in portfolios, allowing the proliferation of assets investors will wrongly perceive as safe.

Industry Pushes Forward as Regulators Signal Friendlier Stance

The draft Responsible Financial Innovation Act, released in July by Senate Banking Chair Tim Scott alongside Senators Cynthia Lummis, Bill Hagerty, and Bernie Moreno, proposes explicit recognition that digital assets referred to as “ancillary assets” are not inherently securities.

The legislation attempts to resolve jurisdictional tension between the SEC and the CFTC, with most digital assets regulated as commodities under the CFTC, while the SEC retains oversight of investment contracts and investor protection.

A revised September 7 draft introduced protections for DeFi developers and emerging blockchain sectors, such as DePINs, proposing the formation of a Joint Advisory Committee on Digital Assets comprising SEC and CFTC members.

Developers contributing to decentralized protocols, validators, liquidity providers, and wallet builders would not automatically fall under traditional financial regulations if protocols aren’t centrally controlled.

Airdrops, staking rewards, and liquid-staking outputs are defined as “gratuitous distributions” rather than securities offerings.

Last month, SEC Chair Paul Atkins announced the agency would end “regulation by enforcement,” giving firms preliminary notices of technical violations and up to six months to address issues before enforcement is considered.

Since taking office in April, Atkins has dropped several high-profile cases inherited from Gary Gensler’s tenure and launched a Crypto Task Force.

He rejected the broad classification of cryptocurrencies as securities, showing openness to tokenized stocks and bonds that mirror existing instruments.

Little before then, CFTC Acting Chair Caroline D. Pham outlined on September 8 a cross-border framework allowing foreign crypto exchanges to operate under U.S. regulatory frameworks, potentially widening market access for American traders.

Pham noted many American crypto firms moved operations abroad, citing a lack of clear rules, with jurisdictions in Europe, Asia, and the Middle East developing digital asset frameworks that drew companies away.

You May Also Like

The Channel Factories We’ve Been Waiting For

XRP Price Prediction: Ripple CEO at Davos Predicts Crypto ATHs This Year – $5 XRP Next?