Crypto Salaries Drop Across All Roles Despite Bitcoin Rally – Only 10% of Jobs Are Entry-Level

Crypto salaries and token incentives declined across nearly all roles and regions in 2024 and early 2025 despite Bitcoin’s record-breaking rally, according to Dragonfly Capital’s latest compensation report released on Thursday.

The survey compiled data from 85 companies and approximately 3,400 employee and candidate datapoints collected in late 2024 and Q1 2025, revealing what researchers called “a down market” with compensation practices “still relatively immature compared to traditional sectors.”

Entry-Level Workers Hit Hardest as Executive Pay Climbs

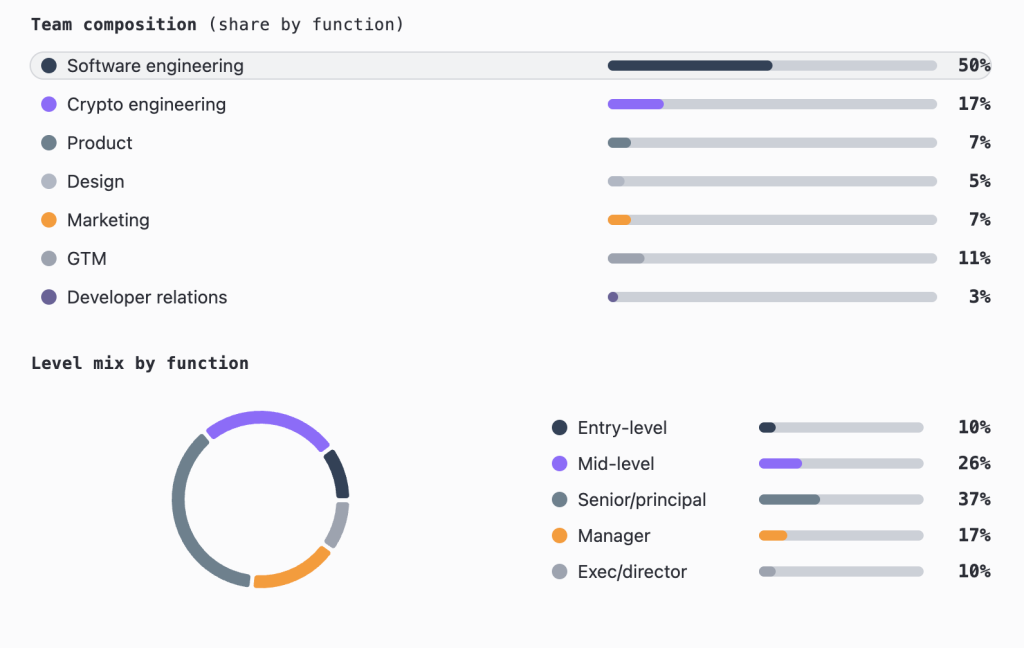

Entry-level positions accounted for only 10% of total roles, with these junior employees bearing the brunt of cuts through lower salaries and reduced token packages.

Source: Dragonfly

Source: Dragonfly

Senior and principal-level positions comprised the largest share at 37%, while engineering remained the dominant function, accounting for roughly 67% of total headcount.

The report found that only meaningful increases came at the executive level, creating what Dragonfly described as “a barbell effect” most visible across product and engineering roles.

International engineering executives out-earned U.S. peers for the first time, with total compensation ranging from $530,000 to $780,000, driven by token packages approaching 3%.

Product Management executives posted the highest salary of any role, between $390,000 and $484,000.

However, mid-level roles experienced flat growth while entry-level positions absorbed the steepest cuts, concentrating gains at the top while most of the workforce saw stagnating or shrinking pay.

The pullback contrasts sharply with earlier hiring booms documented in mid-2025, when crypto job postings surged 60% year-over-year according to CryptoJobs data.

A separate Taurex study from July showed the US topping the global list with 292 active job listings and an average salary of $148,100, while the UAE offered the second-highest average at $111,483.

Founder Compensation Surges While Entry-Level Positions Contract

Average founder salaries increased approximately 37% year-over-year, rising from $144,000 in 2023 to $197,000 in 2024/25.

Seed-stage U.S. founders held the highest equity ownership at 32%, while token ownership at Seed remained consistent across geographies at 9%.

At Series A, international founders earned higher salaries at $244,000 compared to U.S. founders at $198,000, though U.S. founders held more tokens at 13% versus 9%.

Bonus usage declined with company scale, peaking at the smallest company sizes of one to five employees and early stages, especially among companies with $5 million to $19.9 million in funding.

CeFi had the highest bonus adoption at 71%, while DeFi adoption sat at 50%. Infrastructure, Layer 1, and Layer 2 adoption was lower between 15% and 30%.

The report found hiring momentum was stable or increasing for the majority of companies, with 50% stable and 47% increasing.

Engineering-led growth with about 78% of teams expanding and only 1% cutting.

However, hiring speed averaged 3.8 weeks, involving about four interview steps, with 68% of offers accepted.

Compensation drove 83% of declines, split between compensation below expectations at 44% and better competing offers at 39%.

Western Europe remained the dominant international hiring hub, with 84% of Series B through E companies employing people there.

However, Asia’s presence nearly doubled year-over-year, rising from 20% to 41%.

Eastern Europe was utilized by 63% of later-stage companies, while Canada expansion was seen in 38% of companies between Series B and E.

The geographic expansion occurred as 81% of companies adopted global-first hiring strategies, recruiting in both the U.S. and internationally.

US-only hiring was virtually non-existent at 6%. Work policies remained heavily remote, with 54% fully remote, 30% hybrid, 14% remote-first, and only 2% fully in-office.

Cost-of-living adjustment adoption held steady year-over-year at 35% in 2023 versus 38% in 2024/25.

The average attrition rate stood at 7.8%, spiking at companies with 21 to 50 full-time employees at 9.2% and climbing to 10.6% at 100-plus employees.

International companies achieved stronger retention at 6.0% versus 8.9% for U.S. firms.

Primary attrition drivers were job mismatch or role expectations at 25% and better competing offers at 17%.

The top recruiting challenge was finding qualified candidates at 66%, while compensation expectations were the second biggest hurdle at 18%.

Despite the broader compensation pullback, specialized roles remain in high demand with premium pay.

Zero-knowledge cryptographers command salaries reaching $300,000 annually, while blockchain developers earn between $150,000 and $210,000. Smart contract engineers can make $160,000 to $250,000 for senior positions, with entry-level roles starting at $80,000.

Token economists earn $130,000 to $210,000, while compliance officers and legal counsel make $110,000 to $190,000 annually as regulatory frameworks solidify globally.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Cashing In On University Patents Means Giving Up On Our Innovation Future