XRP, Cardano, And PEPE Fade In Q4 2025, While Investors Shift To A New Ethereum Based Meme Coin

SPONSORED POST*

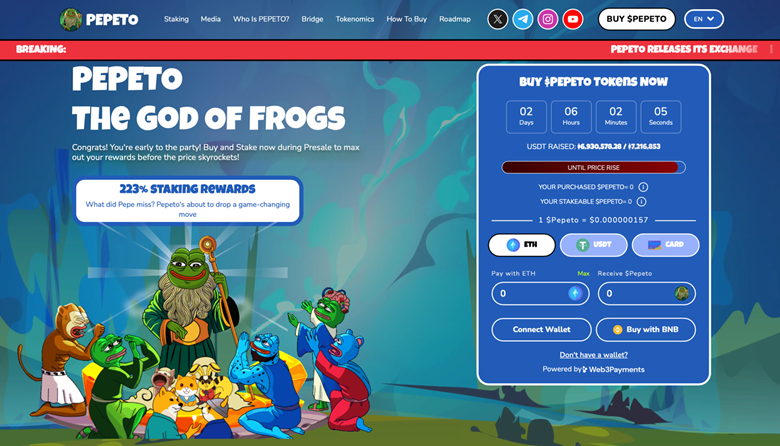

XRP, Cardano, and PEPE had their moment. They created overnight winners in past runs, but momentum is fading now. The same investors who chased those waves want the next rocket, and many are turning to Pepeto, PEPETO. With over $6.9M raised in presale, this Ethereum based memecoin is building heat fast, mixing real utility with meme power. Could Pepeto be the best crypto to buy now in this bull run, and even the breakout that sets 2025. Mentions around Blockdag, Bitcoin Hyper, Snorter, and Maxi Doge also show how analysts are screening across narratives, then landing on Pepeto’s mix of tools and timing.

Q4 Read On XRP, PEPE, And Cardano

Heading into Q4, XRP, Pepe, and Cardano show strain. XRP price action still leans on shaky ETF chatter and broad headlines instead of internal progress, leaving holders betting on news they cannot steer. PEPE looks softer, with activity sliding, volumes thinning, and whales trimming. Cardano keeps pointing to a long path, but delivery feels slow versus a market that wants results today. These signals explain why money is rotating away from older stories that depend on hope and toward projects shipping now. That shift opens the door for new leaders to appear quickly.

History favors early movers. The biggest wins rarely come from waiting on tired giants, but by spotting the next breakout before it erupts. That is why sharper investors are rotating into Pepeto in Q4 while others pause.

Why Pepeto Is The Best Crypto To Buy Now For Q4 Upside

Pepeto tackles the problems weighing on XRP and PEPE by doubling down on its own products. As an Ethereum memecoin with working tools, it brings what many rivals lack. PepetoSwap delivers zero fee trading. PepetoBridge handles fast and secure cross chain moves. Powering that utility is a presale price of $0.000000157, giving investors the early window XRP and PEPE no longer offer this cycle.

The team designed a growth flywheel aimed at asymmetric gains. Presale buyers can stake right away at 223% APY, turning idle capital into compounding exposure. That setup rewards committed holders and builds an engaged base from day one, helping insulate Pepeto from the same volatility that has pressured PEPE.

Pepeto’s Community Spark For Lift Off

Pepeto’s Q4 runway also benefits from a community first push with strong incentives and presale rewards. The momentum here rests on tangible value, not noise. For context, if Pepeto simply revisits the levels PEPE once reached, an entry at $0.000000157 could still turn a $2,500 allocation into more than $1 million. With traction building, that path looks possible. Early believers know these windows are brief and tend to close without warning.

While XRP waits on court outcomes and PEPE cools across social feeds, Pepeto is accelerating adoption with live tools, 223% APY staking, and a community already above 100,000. That mix of shipped products and smart community design gives Pepeto the full recipe for a breakout, placing it among the best crypto to buy now. Momentum compounds fast when utility meets culture, and Pepeto is built for exactly that.

Final Word: Why Capital Is Shifting To Pepeto

The story is repeating with a new lead. XRP, Cardano, and PEPE already printed overnight winners, but their momentum has slowed. Investors chasing the next big run are moving into Pepeto because it brings what those giants are not delivering now, real infrastructure built for growth. With PepetoSwap’s zero fee trading, PepetoBridge cross chain transfers, audits by SolidProof and Coinsult, and 223% APY staking, this presale is more than hype, it is a system designed to scale.

At only $0.000000157, Pepeto offers the rare blend of small entry price and serious utility. That is why many see it as the best crypto to buy now in this bull run, the next coin with a real shot to mint new millionaires, just as DOGE and PEPE once did.

Disclaimer

Always buy Pepeto only from the official website: https://pepeto.io

Beware of scams using the project’s name.

Official Links

Website: https://pepeto.io

Whitepaper: https://pepeto.io/assets/documents/whitepaper.pdf?v2=true

Telegram: https://t.me/pepeto_channel

Instagram: https://www.instagram.com/pepetocoin/

Twitter/X: https://x.com/Pepetocoin

*This article was paid for. Cryptonomist did not write the article or test the platform.

You May Also Like

Thyroid Eye Disease (TED) Treatments Market Nears $4.3 Billion by 2032: Emerging Small Molecule Therapies Targeting Orbital Fibroblasts Drive Revenue Growth – ResearchAndMarkets.com

Virtus Equity & Convertible Income Fund Announces Special Year-End Distribution and Discloses Sources of Distribution – Section 19(a) Notice