Crypto Analyst Spotted Bitcoin Whales Moving Amid Latest Market Crash

- The crypto analyst analyzed online data, according to which dormant whale wallets began to move bitcoins after the market crash.

- He called this movement a typical redistribution phase.

- Meanwhile, the value of the Exchange Whale Ratio reached a one-month high.

After the market crash on the night of October 10-11, 2025, which caused serious losses among retail investors, bitcoin whales changed their behavior dramatically. New online data shows three notable shifts: the activation of dormant wallets, the growth of the first cryptocurrency inflow to the exchange, and the dominance of whales in trading flows.

In particular, after the market crash, long-term inactive wallets started transferring bitcoins, which indicates growing pressure among old holders. For example, on October 14, about 14,000 BTC were transferred that had not been moved for 12 to 18 months.

The next day, on October 15, coins from the 3-5 year age category were activated — more than 4,690 BTC. Since the beginning of 2025, such addresses have already moved more than 892,000 BTC, which is a significant part of the total supply of coins.

Holders of coins with an age of 2-3 years have also become more active, moving 7,343 BTC this week alone. In addition, one of the whales made a transaction for 2,000 BTC, but still holds about 46,000 BTC — over $5 billion.

As a result, according to CryptoQuant, the Coin Days Destroyed (CDD) indicator has risen sharply, reaching its highest level in a month — the last such surge was observed in July, when whale activity caused bitcoin to fall from $120,000 to $112,000.

In addition, according to CryptoQuant, after October 11, there has been a sharp increase in the inflow of bitcoins to the exchange from wallets containing more than 1,000 BTC.

Analyst Maartunn also reported on October 15 that large holders sent 17,184 BTC to the exchange, the highest level of monthly transfers.

Typically, increased inflows are considered a short-term bearish signal, as the rush of assets to exchanges may indicate preparations for selling to lock in profits or cut losses.

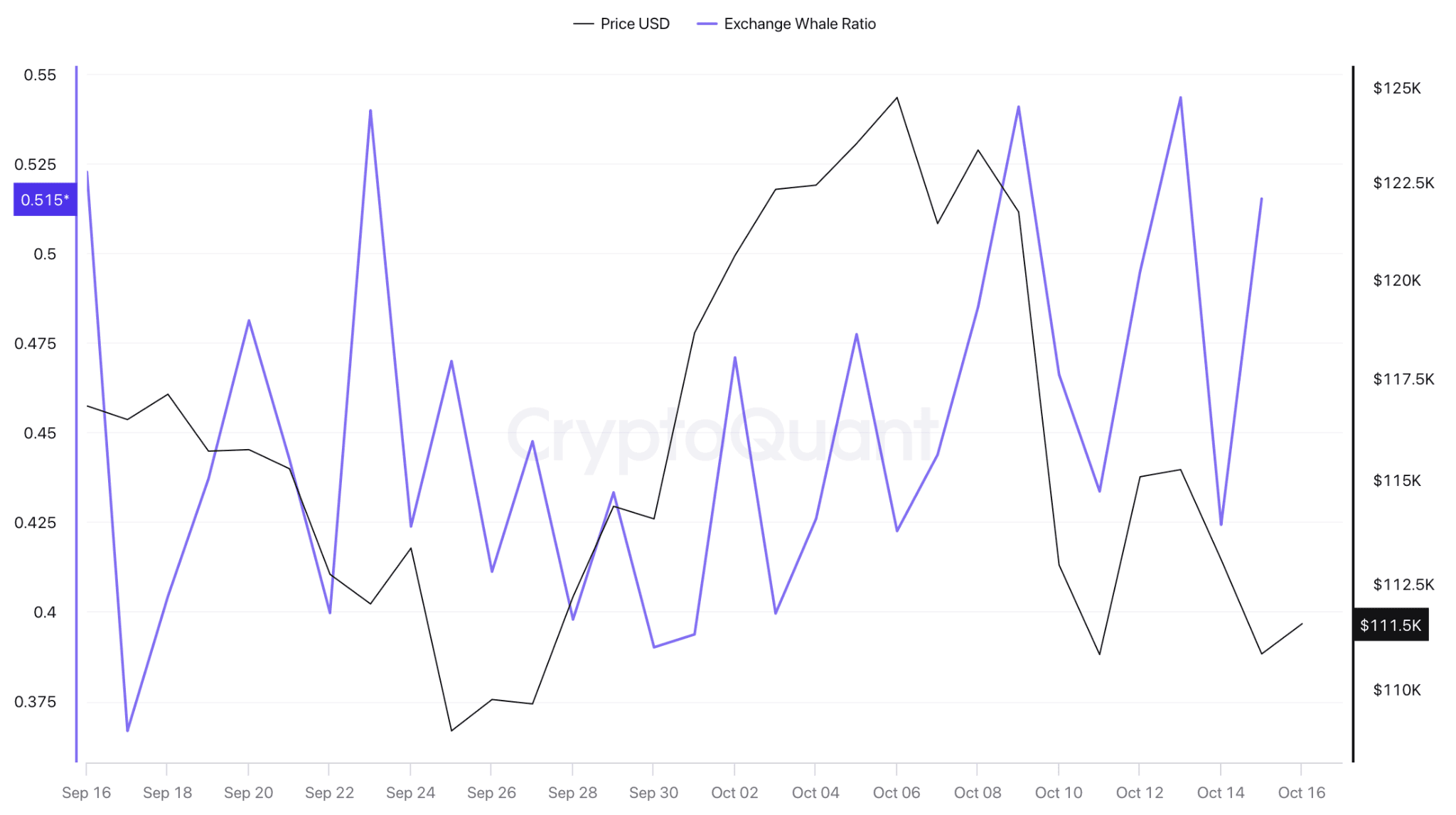

Another important indicator is the Exchange Whale Ratio, an indicator that reflects the share of the largest ten incoming transactions relative to the total volume of deposits on exchanges.

Exchange Whale Ratio for bitcoin. Source: CryptoQuant.

Exchange Whale Ratio for bitcoin. Source: CryptoQuant.

After the October crash, this ratio rose to its highest level in the last month, indicating that large players are increasingly using centralized exchanges to conduct large transactions. Such surges usually lead to increased volatility, as large transactions by the whales can easily change market liquidity.

As a reminder, CryptoQuant experts believe that bitcoin has entered the late stage of the bull cycle.

You May Also Like

Ukraine Gains Leverage With Strikes On Russian Refineries

Why Emotional Security Matters as Much as Physical Care for Seniors