Bitcoin October Volatility: Is There Hope for Recovery as Year-End Approaches?

October has been the month of volatility for bitcoin, with the digital currency falling 5.33%, its first negative October in six years. In general, BTC is strongest in Q4, and this year has been no exception to the rule; results have fallen short of expectations.

Traders are scrambling again as the price of Bitcoin whipsaws. Between Oct. 12 and 19, Bitcoin traded between $104,778 to $115,934, and people are left scratching their heads on where it goes next. Here is what’s driving Bitcoin’s recent wild price ride as the month comes to a close.

Bitcoin October Volatility

Bitcoin’s performance in October is far from normal. On the week, it fell 3.8%, setting traders’ nerves on edge. As of Oct. 19, the price of

Throughout history, Bitcoin has been known to see a strong showing in October, but the red month this year is even more apparent. Bitcoin remains at the whim of an uncertain market, and traders hunt for signs of stability or further drops.

Trump’s Influence on Bitcoin October Volatility

The U.S. President Donald Trump is one of the major factors in Bitcoin’s large movements this October. His social media missives, especially on Truth Social, have sent the price of Bitcoin wildly spinning in all directions.

Also Read: Bitcoin Price Prediction Q4 2025: Experts Signal a Potential $130K Breakout Before Year End

His comments such as the suggested U.S. SBR, has only added to the market’s instability. Getty Images His pro-crypto leaning has buoyed Bitcoin for some time, but his inconsistent views on tariffs and economic policy have left the coin even more volatile.

Technical Price Levels to Watch

With the volatility of Bitcoin in the recent weeks, traders are closely watching some crucial levels. The $103,000 to $106,000 area has been important for Bitcoin as it has failed to keep a rally going after hitting nearly $126,000 earlier this year.

A move below $103,000 could indicate a deeper drop, toward the $100,000 level. Conversely, a strong move higher above $123,000 could potentially lead to an extensive rally.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| October | $108,194.61 | $116,084.95 | $123,975.29 |

14.6%

|

| November | $111,250.55 | $115,870.38 | $120,490.20 |

11.4%

|

| December | $111,412.68 | $113,369.75 | $115,326.82 |

6.6%

|

Other analysts see it going up to $148,000 or even above $200,000 before the end of the year — but that’s if Bitcoin blows past some key resistance levels. But Bitcoin’s repeated failure to overcome $123,000 gives rise to concerns about further volatility.

The Role of Macroeconomic Policies

Macroeconomic concerns are also a driving force of Bitcoin October volatility. Time will tell – as liquidity flows, interest rate reductions and fiscal policy might finally be the tailwind that bitcoin needs to recover.

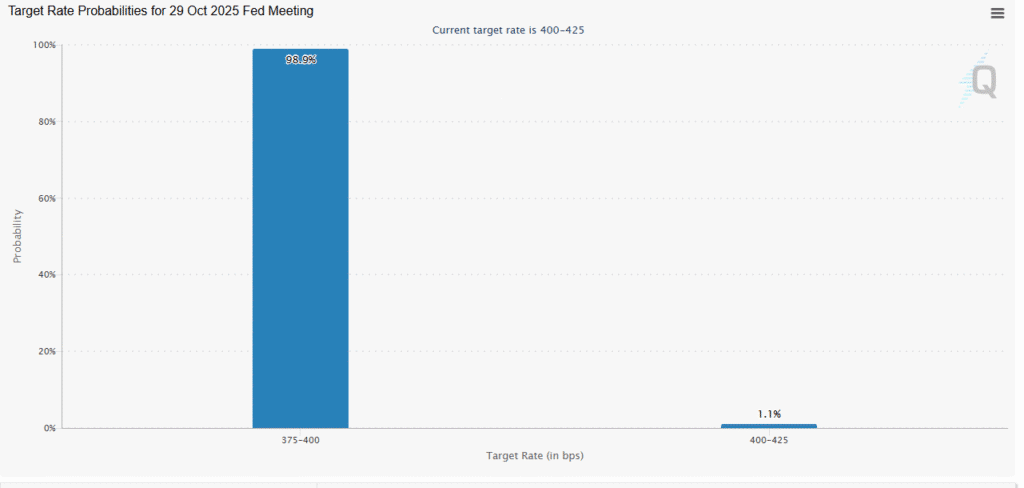

Analysts are closely monitoring the Federal Reserve’s actions, particularly its expected interest rate cuts. The CME Fedwatch tool currently shows a 98.9% probability of a quarter-point rate cut by the end of October.

Source: CME Group

Source: CME Group

That would potentially give Bitcoin the tailwind it needs to push through resistance levels. But there could also de potential inflation fears and banking instability that could scupper the emergence, which makes the market capricious.

ETF Developments and Institutional Interest

The surge in Bitcoin October Volatility is also driven by the increasing presence of Exchange-Traded Funds (ETFs) and institutional investors. This trend should persist in 2025 with institutions ruling the Bitcoin ETFs roost.

Any new approvals of ETFs or inflows could drive up Bitcoin’s price; access to the cryptocurrency is widening. Corporate treasuries are also hoarding Bitcoin, which has reduced supply and assuaged investor sentiment.

Mining Metrics and Network Strength

Part of the reason that Bitcoin has been so volatile this October is because of its mining network. The hash rate, or amount of computational power that has been used to mine the virtual currency Bitcoin, is at an all-time high. This illustrates that miners continue to believe in the future of Bitcoin.

But as mining difficulties rise and their yield in hash prices drops, smaller scale miners might not be able to compete. Hashrate falling off a cliff could indicate that miner capitulation is on the way, and this has been traditionally followed by price corrections.

Conclusion

October, Bitcoin is far from done being volatile. Traders are focused on political and macroeconomic developments as well as technical levels to infer a direction.

Regardless of whether Bitcoin moves through resistance or collapses into further uncertainty, one thing is undeniable: Bitcoin’s October volatility has demonstrated that volatility is a kinetic force due to political and monetary reforms, and technical difficulties.

Also Read: Bitcoin Volatility Surges Will BTC Hold Above $105K or Break Lower?

Summary

- Bitcoin drops 5.33% in October, marking its first negative October in six years amid volatility.

- Trump’s statements and fiscal policies fuel Bitcoin’s volatility, adding uncertainty to the market.

- Bitcoin faces key resistance at $123,000; strong mining network signals long-term growth potential

Appendix: Glossary of Key Terms

Bitcoin Price Volatility: The ups and downs in bitcoin price, caused by political, economic or technical factors.

Resistance: A level that Bitcoin finds difficulty to break through above a certain price point.

Bitcoin ETFs: Funds available to institutional investors that help them get access to Bitcoin, impacting the price.

Hashrate: The amount of computing power involved in Bitcoin mining to determine network health and price movements.

Correction: Drop in the price of Bitcoin from a recent investment mania or mining network change.

Institutional Investors: Corporations, funds and so on that influence Bitcoin’s price by making big investments.

Frequently Asked Questions Bitcoin October Volatility

1: What’s causing Bitcoin’s volatility in October?

Bitcoin’s volatility this October is driven by a combination of political factors, including President Trump’s erratic statements, as well as macroeconomic policies and technical price resistance levels.

2: Will Bitcoin recover before the end of 2025?

Bitcoin could recover if it breaks through resistance at $123,000. However, its volatility remains high, and market conditions will need to stabilize for a sustained rally.

3: How do Bitcoin ETFs impact its volatility?

Bitcoin ETFs have attracted institutional investors, which can push Bitcoin’s price up. However, ETF outflows or regulatory changes could add to the volatility.

4: How does Bitcoin’s hashrate affect its price?

The hashrate reflects the strength of Bitcoin’s mining network. A drop in hashrate could signal a price correction, while continued strength suggests confidence in future price growth.

Read More: Bitcoin October Volatility: Is There Hope for Recovery as Year-End Approaches?">Bitcoin October Volatility: Is There Hope for Recovery as Year-End Approaches?

You May Also Like

The US dollar's share of global foreign exchange reserves has fallen below 60%.

Younger Americans Back Crypto Survey: Why Digitap ($TAP) is the Best Crypto Presale for the Next Generation