Solana (SOL) Price: Breaks above $200 as Hong Kong Approves First Spot ETF

TLDR

- Hong Kong approved the world’s first spot Solana ETF, positioning SOL alongside Bitcoin and Ethereum in the institutional investment space

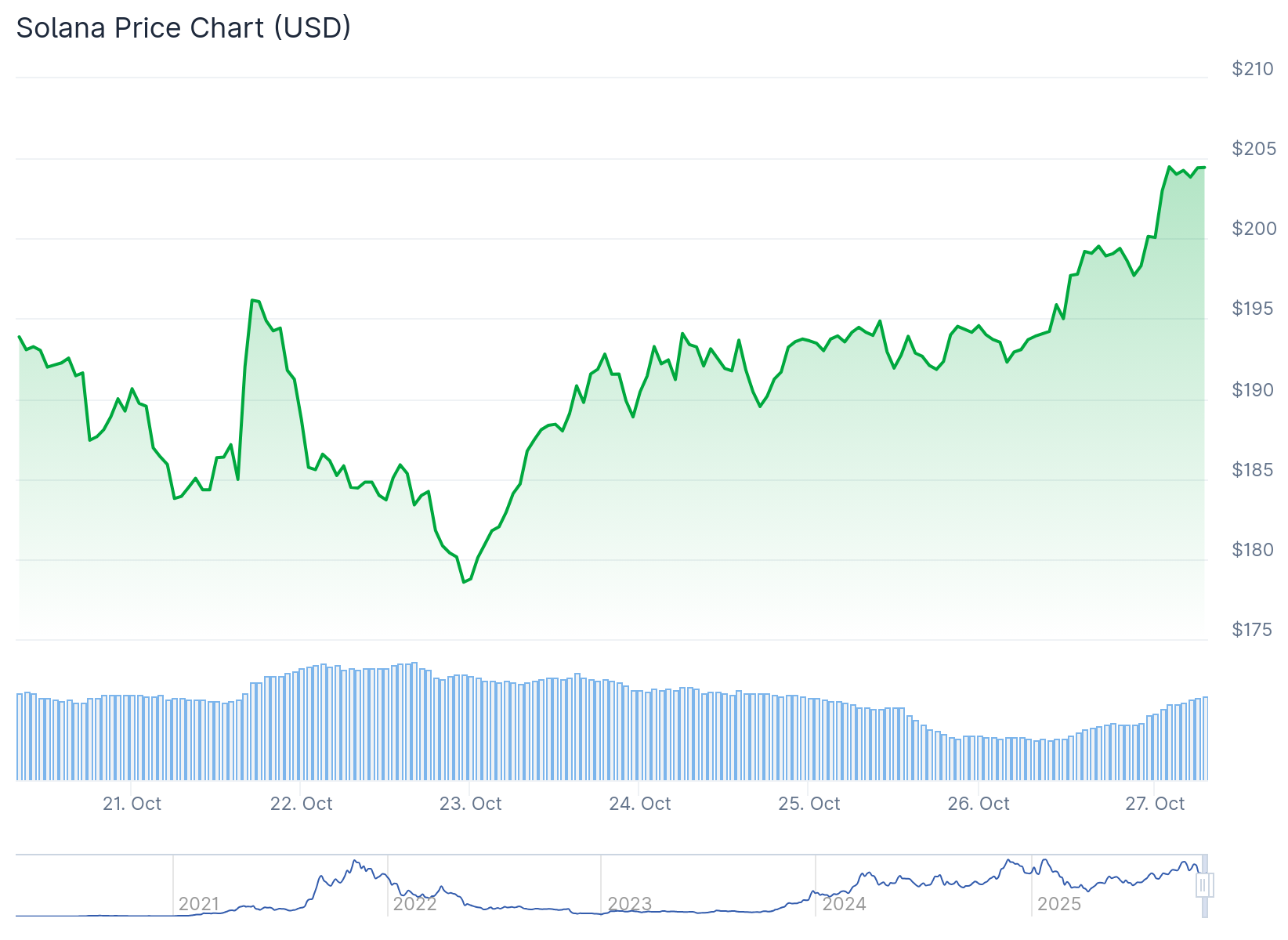

- Solana currently trades around $180-$193 after dropping from September highs near $250, with technical analysis showing potential breakout above $200

- The blockchain processes approximately 1,000 transactions per second with fees under $0.01, maintaining performance during recent market volatility

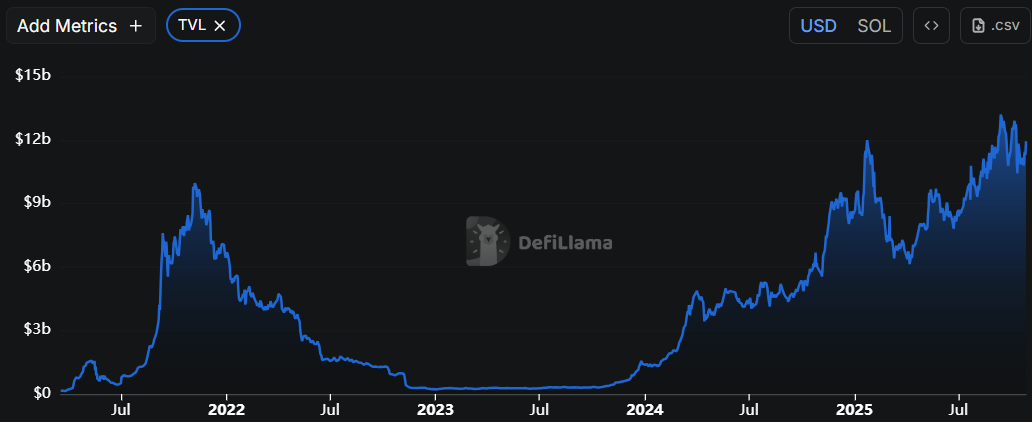

- Solana holds $11 billion in DeFi total value locked, growing from $6 billion a year ago, though still behind Ethereum’s $83 billion

- Several US fund managers have filed for spot Solana ETFs with provisional SEC approval already granted to 21Shares

Hong Kong has approved the world’s first spot Solana ETF. The approval marks a major step for the blockchain’s institutional recognition.

Solana currently trades around $180 as of October 22. The token reached nearly $250 in September before the recent pullback.

The token hit an all-time high of $294 earlier this year. Current levels represent a decline from those peaks.

Solana (SOL) Price

Solana (SOL) Price

The Hong Kong ETF launch positions Solana alongside Bitcoin and Ethereum in institutional markets. This approval comes from Asian regulators known for early adoption of technology assets.

The ETF could unlock new liquidity for Solana. Institutional investors who cannot buy tokens directly now have an alternative investment option.

Technical Picture Shows Key Levels

Technical analysts point to $200 as a critical resistance zone. The price has been consolidating below this level with support around $175.

The ascending trendline from $175 shows strong demand on price dips. A daily close above $200 could trigger movement toward $220.

Weekly charts show Solana retesting the 0.886 Fibonacci retracement level between $174 and $176. This level often marks the end of corrective phases.

The $180 level acts as a key pivot within an ascending channel pattern. Technical projections suggest potential moves toward $230 and $290 if the trend continues.

Blockchain Performance Remains Strong

Solana processes approximately 1,000 transactions per second according to Chainspect data. The network has a theoretical maximum capacity of 65,000 transactions per second.

The blockchain ranks as the second-fastest in terms of transaction speed. Only Internet Computer processes more transactions per second.

Transaction fees on Solana typically cost less than $0.01. Ethereum processes about 20 transactions per second by comparison.

Recent market volatility provided a stress test for the network. Solana continued processing thousands of transactions per second without fee increases while some other blockchains experienced issues.

DeFi Growth Shows Progress

Solana currently has $11 billion in total value locked across DeFi applications according to DeFiLlama. This represents growth from approximately $6 billion one year ago.

Source: DefiLlama

Source: DefiLlama

Ethereum still leads the DeFi market with $83 billion in total value locked. That represents 63% of the entire DeFi market.

The stablecoin market shows similar patterns. Ethereum holds $165 million in stablecoin value while Solana has $15 billion.

Solana ranked as the top blockchain ecosystem for new developers in 2024. The network continues attracting both users and developers.

US ETF Applications in Progress

Several US fund managers have filed applications for spot Solana ETFs. The SEC has granted provisional approval to an application from 21Shares.

A final review is still needed before US approval. This process was delayed due to the government shutdown.

Approval could come before the end of 2025. Bitcoin ETFs have received $62 billion in inflows while Ethereum ETFs have attracted $14 billion.

The proof-of-history system combined with proof-of-stake validation gives Solana its speed advantage. This efficiency helps the network attract more users and developers.

Hong Kong’s approval brings the first spot Solana ETF to market as the token consolidates above key support levels.

The post Solana (SOL) Price: Breaks above $200 as Hong Kong Approves First Spot ETF appeared first on CoinCentral.

You May Also Like

Polymarket Prices 86% Odds Of Sub-$80 – Will $83 Break?

ADA Price Prediction: Here’s The Best Place To Make 50x Gains