What CFTC Chair Nominee Michael Saylor Says About Crypto: Insights & Outlook

The Biden administration appears to be moving toward appointing a permanent chairperson for the US Commodity Futures Trading Commission (CFTC) as President Donald Trump’s nominee, Michael Selig, begins the vetting process. This development signals a potential shift in cryptocurrency regulation, especially as the industry continues to call for clearer oversight amid ongoing legislative debates.

- The Biden administration is considering Michael Selig for the CFTC chair position, marking a significant step in crypto regulation clarity.

- Selig brings extensive experience from the CFTC, SEC, and private legal practice, and is publicly pro-crypto.

- He advocates for viewing digital assets as commodities rather than securities, a stance influential to future regulatory frameworks.

- Legislative efforts to reclassify cryptocurrencies as commodities face delays due to government shutdown and political disagreements.

- Coordination between the SEC and CFTC is improving, but the ongoing shutdown hampers regulatory progress.

Who is Michael Selig, and where does he stand on crypto?

Selig, a graduate of George Washington University Law School, began his government career working with former CFTC Commissioner J. Christopher Giancarlo from 2014 to 2015. His background includes legal roles at Cadwalader, Wickersham & Taft and Perkins Coie, culminating in a partnership at Willkie Farr & Gallagher since January 2024. Recently, he served as chief counsel to the SEC’s Crypto Task Force and senior advisor to the SEC chairman.

Selig has openly expressed his pro-cryptocurrency stance. In a recent X post, he highlighted his ambition to position the U.S. as the “Crypto Capital of the World,” emphasizing a belief in a “Golden Age” for America’s financial markets and emerging opportunities in digital assets.

Michael Selig must first be nominated by the Senate. Source: Michael SeligDavid Sacks, White House’s AI and crypto policy czar, praised Selig’s dedication to modernizing digital asset regulation, noting his extensive experience from both the SEC and CFTC.

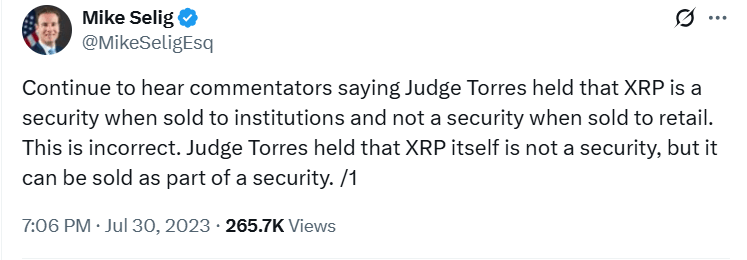

Industry analysts have pointed out Selig’s focus on treating digital assets like commodities. His commentary on the SEC v. Ripple case in 2023 reflects this view; he argued XRP “is simply computer code” and comparable to other fungible commodities like gold and whiskey.

He further mentioned, “the SEC can’t argue a $2 billion penalty against Ripple with a straight face, or definitively classify XRP as a security.”

Source: Michael Selig

Source: Michael Selig

This mainstream approach to digital assets—viewing them primarily as commodities—could influence future legislative efforts, especially as Congress considers reworking crypto regulation amid a political climate fraught with delays and disagreements.

CFTC and SEC seek to realign crypto oversight amid political gridlock

Legislators in the Senate are reviewing the Responsible Financial Innovation Act, which, if passed, would reclassify many cryptocurrencies as commodities, shifting regulatory authority primarily to the CFTC. Currently, the CFTC oversees derivatives and has anti-fraud jurisdiction in the crypto industry, but comprehensive regulation remains uncertain amidst ongoing political struggles.

The bill’s progress has slowed dramatically, with government shutdown threats and increasing bipartisan tensions preventing quick advancement past the September deadlines.

Meanwhile, the SEC and CFTC have attempted to coordinate their approaches. In September, SEC Chairman Paul Atkins announced a roundtable with the CFTC aimed at harmonizing crypto regulation for better market stability and innovation. However, SEC Chair Caroline Pham highlighted that the agencies often operate in rivalry rather than collaboration, affecting their efficiency.

Both agencies have been making joint recommendations through initiatives like the SEC’s Project Crypto and the CFTC’s Crypto Sprint. Still, these efforts are limited as long as a government shutdown hampers staffing and regulatory activity, according to former CFTC Chair Giancarlo.

With Selig’s pending appointment, the CFTC’s role in overseeing crypto markets could become clearer, but key political approvals and a functioning budget are prerequisites for decisive action. Industry leaders like the Winklevoss twins remain influential voices in these regulatory discussions, emphasizing the importance of swift legislative progress.

Read more on Solana vs. Ethereum ETFs, Facebook’s influence on Bitwise by Hunter Horsley

This article was originally published as What CFTC Chair Nominee Michael Saylor Says About Crypto: Insights & Outlook on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach