Crypto market rebounds as Trump-Xi meeting leads to easing trade tensions

- Donald Trump’s meeting with Xi Jinping in South Korea led to a reduction in trade barriers.

- Bitcoin, Ethereum, and XRP edge up by nearly 1% on Thursday, recovering early losses.

- The cryptocurrency market recorded over $800 million in total liquidations in the last 24 hours.

The cryptocurrency market recovers gradually during the early European session on Thursday after US President Donald Trump’s meeting with Chinese President Xi Jinping in South Korea regarding trade barriers. Despite the positive meetup, liquidations in the crypto market exceeded $800 million over the last 24 hours, as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) recoup earlier losses.

Crypto market recovers after Trump, Xi smoothing out rough corners

US President Donald Trump and Chinese President Xi Jinping concluded the high-stakes trade meeting on an optimistic note in South Korea on Thursday, as previously reported by FXStreet. The key decisions made public from the meeting are that China will resume rare-earth exports with a one-year contract, purchase US soybeans, and discuss chips with NVIDIA, while the US has reduced tariffs to 47% from 57% and has fentanyl tariffs. The world’s two largest economies are smoothing rough corners, which could stabilize global financial markets and help cryptocurrencies extend their recovery.

Earlier in the day, the cryptocurrency market had previously extended losses following hawkish remarks from Federal Reserve (Fed) Chair Jerome Powell on Wednesday: "A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it," stated Powell after the Fed reduced the federal fund rates by 25 basis points to the 3.75%-4% range. Powell suggested that the lack of clarity in economic data, due to the US government shutdown entering its fourth week, could dissuade the agency from further rate cuts.

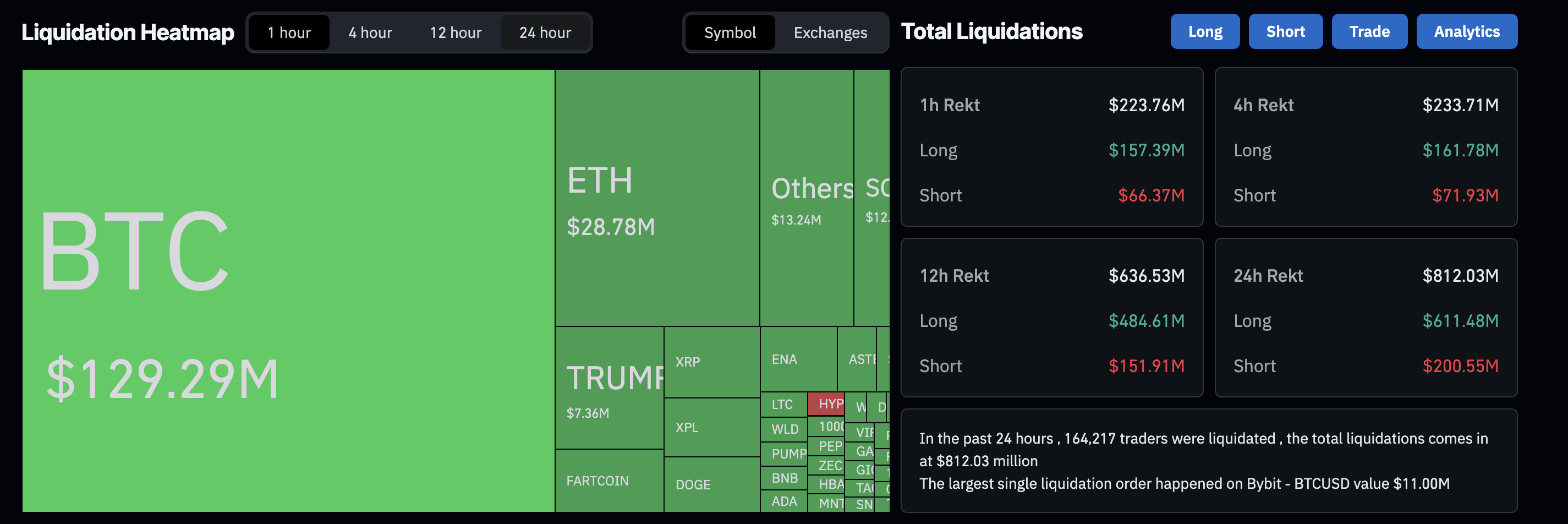

The recent volatility has led to major liquidations in the cryptocurrency market. CoinGlass data shows that $812.03 million in positions were liquidated in the last 24 hours, with $611.48 million in long positions and $200.55 million in shorts.

More recently, the total liquidations have reached $223.76 million in the last hour after the Trump-Xi meeting, with long liquidations of $157.39 million outpacing short liquidations of $66.37 million.

Crypto market liquidations data. Source: CoinGlass

The total cryptocurrency market capitalization stands at $3.73 trillion, up by 1% at press time on Thursday as Bitcoin, Ethereum, and XRP trade above $110,000, $3,900, and $2.55, respectively, and gradually recover from Wednesday's losses.

(This story was updated on October 30 at 07:55 GMT to reflect the latest price action.)

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm