As SOL ETFs Surge Alchemy Rebuilds Solana’s Infrastructure for Institutional Scale

Investors have poured more than $280 million into new U.S. Solana exchange-traded funds (ETFs) in just six trading days, with analysts now projecting as much as $5 billion in inflows over the next year.

As Solana becomes a centerpiece of institutional portfolios, questions are mounting over whether its infrastructure can sustain high-frequency activity across ETFs, wallets, and consumer apps.

Web3 infrastructure firm Alchemy said to meet this rising demand it has completely re-architected its Solana stack. The overhaul aims to deliver near-zero downtime, faster responses, and greater throughput, ensuring institutional and retail users experience a seamless network even under heavy load.

This week Solana appears to have shrugged off broader Fed-induced FUD, with policymakers reiterating that December rate cuts are “not a foregone conclusion” this week.

BSOL has opened the floodgates to $417 million in fresh capital for Solana’s ecosystem as a fresh touch point for U.S. investors to gain regulated access to SOL staking yields.

Built for Scale and Speed

Alchemy explains its Solana rebuild was the culmination of two years of collaboration with developers across the ecosystem. Working alongside teams from Bags.fm, Solflare, and Robinhood, the company studied the real bottlenecks developers faced when accessing Solana data and processing transactions.

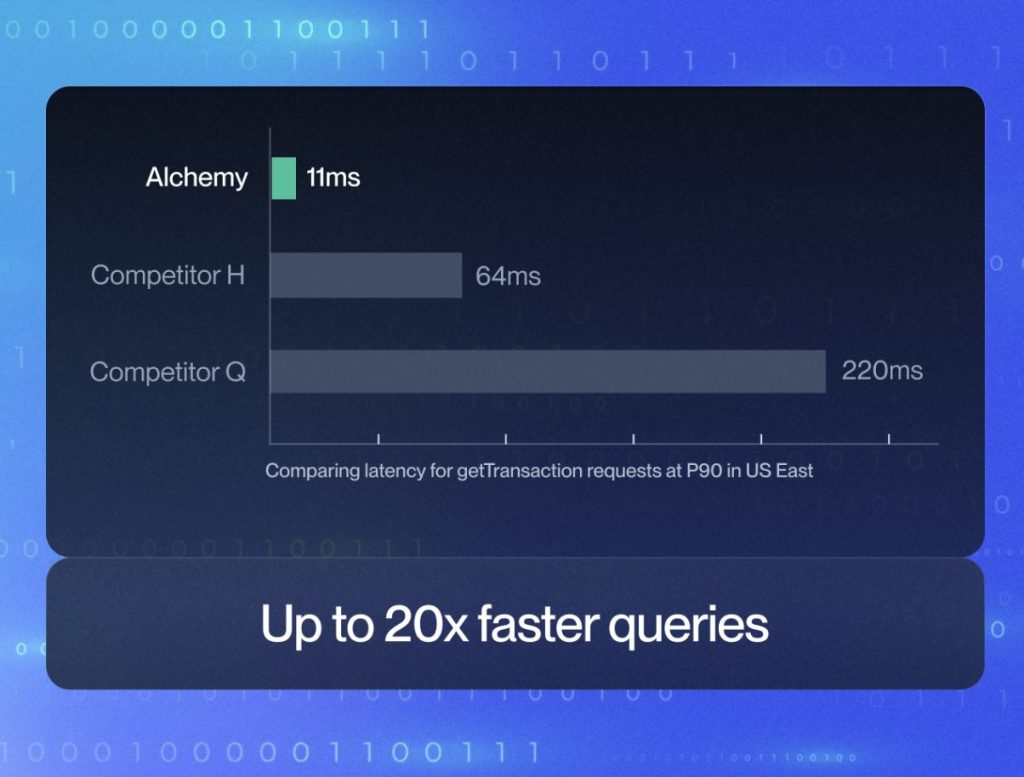

The result is an all-new generation of RPC and Streaming APIs built specifically for Solana. The upgraded infrastructure delivers 20 times faster archive calls, 99.95% uptime, and double the throughput of its previous version.

Alchemy’s engineering team has also improved the system to handle large data sets with greater reliability, enabling near-instant responses on transaction-heavy workloads. The result is faster user experiences on exchanges, wallets, and analytics platforms that depend on constant access to on-chain data.

Solving the “Chewing Glass” Challenge

Solana developers have long referred to the network’s complexity as “chewing glass” — a metaphor for the demanding technical environment they’ve embraced to build next-generation financial products. While Solana’s core protocol has matured, the surrounding tooling and infrastructure often struggled to keep pace.

Alchemy’s research found that many developers encountered recurring issues accessing historical data due to limitations in Bigtable-based RPC systems, which caused missing records, throttling, or incomplete data sets.

This forced teams to build complex workarounds that slowed iteration and inflated costs. The new Solana architecture eliminates those constraints, dramatically accelerating heavy data methods such as getTransaction and getProgramAccounts while maintaining reliability under scale.

Infrastructure for the Institutional Era

With ETF adoption accelerating and Western Union preparing to launch a stablecoin on Solana in 2026, the chain is entering an institutional era where uptime and precision matter as much as speed.

By rebuilding Solana’s “plumbing” from the ground up, Alchemy has positioned the network to handle sustained institutional traffic and mass-market consumer applications without compromising performance.

As Solana’s ecosystem matures, Alchemy’s overhaul signals a crucial inflection point — one where the network evolves from “chewing glass” to powering finance at scale.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt