Algorithm and Data Imbalance: Implementing the New IIL Benchmarks

Table of Links

Abstract and 1 Introduction

-

Related works

-

Problem setting

-

Methodology

4.1. Decision boundary-aware distillation

4.2. Knowledge consolidation

-

Experimental results and 5.1. Experiment Setup

5.2. Comparison with SOTA methods

5.3. Ablation study

-

Conclusion and future work and References

\

Supplementary Material

- Details of the theoretical analysis on KCEMA mechanism in IIL

- Algorithm overview

- Dataset details

- Implementation details

- Visualization of dusted input images

- More experimental results

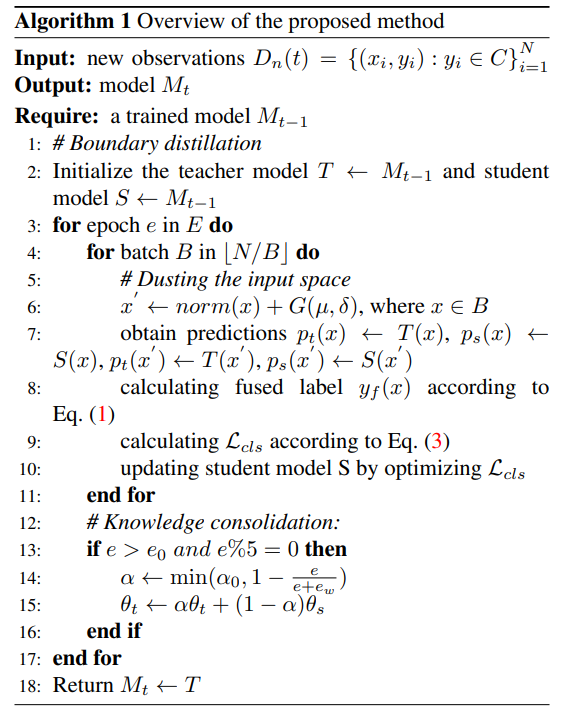

8. Algorithm overview

The whole process of the proposed method is illustrated in Algorithm 1. Codes will be released to public upon publication.

9. Dataset details

Corresponding to the definition of our new increment-alinstance learning (IIL) task, we reorganize the public dataset Cifar-100 [11] and ImageNet-100 [24] to establish the benchmark in this research topic.

\

\

\

\ As can be seen, the base dataset has a more balance sample distribution, where the largest class is class 6 with 279 images. The smallest class is class 29 and has 215 images. Incremental dataset “D5” has the most imbalance number of samples between classes, where the maximum number is 40 in class 58 and the minimum number is 12 in class 76. That is, the highest imbalance ratio is 3.33 : 1.

\

\

:::info Authors:

(1) Qiang Nie, Hong Kong University of Science and Technology (Guangzhou);

(2) Weifu Fu, Tencent Youtu Lab;

(3) Yuhuan Lin, Tencent Youtu Lab;

(4) Jialin Li, Tencent Youtu Lab;

(5) Yifeng Zhou, Tencent Youtu Lab;

(6) Yong Liu, Tencent Youtu Lab;

(7) Qiang Nie, Hong Kong University of Science and Technology (Guangzhou);

(8) Chengjie Wang, Tencent Youtu Lab.

:::

:::info This paper is available on arxiv under CC BY-NC-ND 4.0 Deed (Attribution-Noncommercial-Noderivs 4.0 International) license.

:::

\

You May Also Like

TD Cowen cuts Strategy price target to $440, cites lower bitcoin yield outlook

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings