The Best Wallet Token Presale Breaks $17M as $BEST Readies a DeFi Super-App

Takeaways:

- $BEST token has raised $17M+ in presale and positions itself as an access key to lower trading fees, higher staking yields, and priority launchpad access inside Best Wallet.

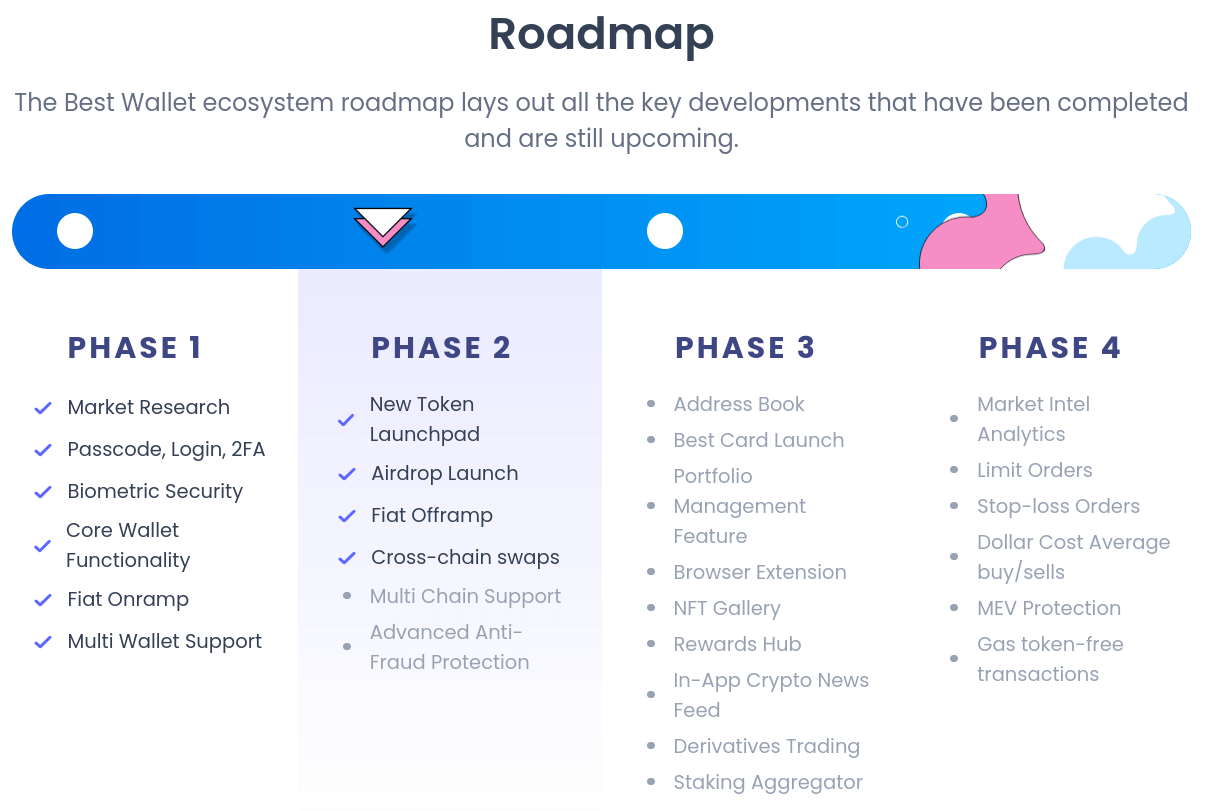

- The project’s roadmap points to a wallet-as-terminal model. A staking aggregator, market analytics, advanced order types, MEV protection, and a crypto debit card are all under development.

- Now priced at $0.025935, the $BEST token is available for a low presale price until November 28.

Crypto’s wallet wars are heating up again. User growth is back, on-chain volumes are sturdier, and the conversation is shifting from ‘Which chain?’ to ‘Which wallet actually does everything?’

Into that gap steps Best Wallet Token ($BEST). This crypto project is fundraising for a comprehensive wallet-plus-DeFi stack set to turn your phone into a full trading and yield terminal. The $BEST utility token has now cleared $17M raised in its ongoing presale.

Initially launched in late 2024, and with the end date set for November 28, 2025, presale momentum has been steady over the months. This is a signal that the project’s utility-first approach has already cut through the noise and grabbed investors’ attention.

Instead of bouncing between swap apps, analytics tabs, staking portals, and a separate card, Best Wallet users and $BEST token holders will soon get a single interface with multi-chain swaps, portfolio tracking, a staking aggregator, and a debit card to use for in-store purchases.

The Best Wallet app is already live with integrated fiat on/offramps, multi-chain support, and cross-chain swaps.

The Best Wallet app is already live with integrated fiat on/offramps, multi-chain support, and cross-chain swaps.

The product whitepaper and roadmap detail these upcoming perks, alongside derivative trading features like limit/stop orders, MEV protection, and market analytics.

Users expect this kind of stack from trading terminals, not mobile wallets, and this kind of convenience has already made Best Wallet a hit. If the next leg of the bull cycle rewards tools that reduce friction, a wallet that stacks trading, yield, and card rails in one UX is built for that flow.

That’s why the new presale matters. If Best Wallet keeps working toward that ‘do-it-all’ goal, $BEST holds value as the access key giving reduced fees, staking boosts, ecosystem governance, and more perks as the project expands.

The Best Wallet App – A Multi-Chain Wallet That Acts Like a DeFi Terminal

Best Wallet already outlines multi-chain support across Bitcoin, Ethereum, Solana, and BSC, with 50+ more networks next in the pipeline.

The app also has built-in cross-chain swaps aggregating liquidity from hundreds of DEXs and bridges for smarter routes, lower slippage, and fewer failed trades. MPC security, another feature now live, eliminates seed phrases and coordinates secret key shares for safer recovery, stronger phishing resistance, and seamless non-custodial control.

Later in the roadmap, the app will add a staking aggregator, market intel analytics, order types, and DCA tools for traders. If this rollout is successful, this is a wallet that could behave like a more user-friendly DeFi terminal, minus the browser tab sprawl. For users, that means fewer hops, tighter fee control, and better execution inside one app.

Best Wallet’s utility token, $BEST, is the fuel within this ecosystem. Its tokenomics are straightforward: a 10B max supply with allocations to product development (25%), marketing (35%), the project’s treasury (5%), and exchange liquidity (10%).

The community also gets allocations for airdrops (10%), staking rewards (8%), and community rewards (7%). Utility sits at the center, and $BEST goes beyond airdrops and staking.

The team also advertises dynamic staking rewards during the presale phase (now at 77% APY). Paired with a roadmap that includes in-app analytics, DeFi trading, and yields, the project targets both passive and active users. It’s a practical blend: passive rewards to keep tokens parked, plus pro-grade features to keep capital productive.

That dual track fits today’s crowd that wants to farm and trade without switching wallets. The bottom line: if you’re tired of tab-surfing, Best Wallet’s ‘single pane of glass’ approach reduces operational overhead while making DeFi feel less like a scavenger hunt.

Check out $BEST’s full product roadmap.

The Best Wallet Token Presale – $17M+ Raised and Just Two Weeks Left

Best Wallet Token’s presale has surpassed $17M, with the current token price at $0.025935. That puts $BEST in the ‘late presale, still sub-listings’ window where utility delivery becomes the key catalyst.

Liquidity, audits, and market presence will matter at launch to keep the ball rolling. The tokenomics already dedicate a large chunk to marketing and project dev. Meanwhile, the site links to an external audit, and the documentation was refreshed in August 2025; useful housekeeping for a token courting mainstream wallet users.

What justifies keeping $BEST on the watchlist is the product story, not only the math. The wallet leans on cross-chain swaps, portfolio management, security primitives like MPC, and a curated launchpad that routes early access inside the app.

If the staking aggregator lands cleanly and the analytics suite delivers useful market context, the wallet becomes a hub where holding $BEST isn’t just speculative but functional. That’s the credible path for a wallet token to avoid the ‘governance-only’ trap.

Join $BEST before November 28.

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own researchs.

The post The Best Wallet Token Presale Breaks $17M as $BEST Readies a DeFi Super-App appeared first on Coindoo.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm