Bitcoin Price Today: BTC Drops to $98K as $658M Liquidations Shake Crypto Market

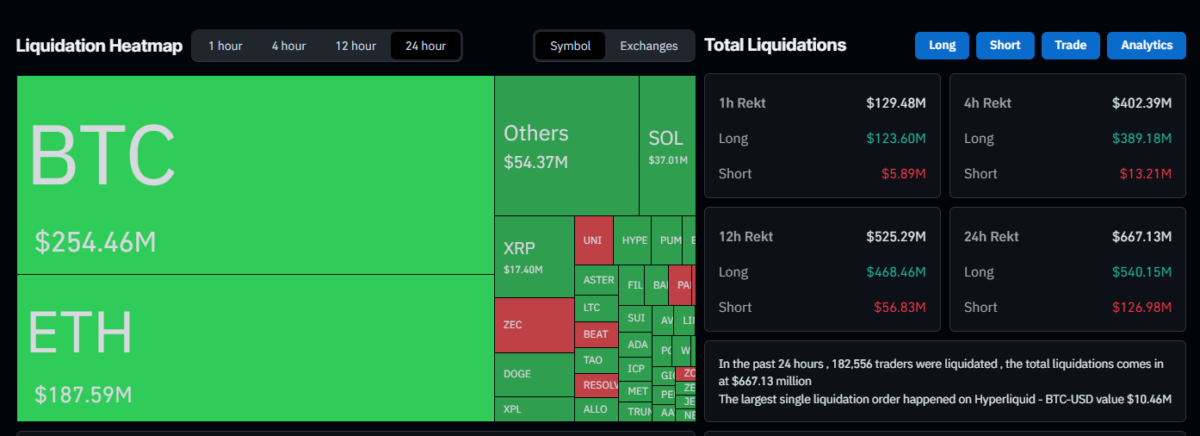

Cryptocurrency markets recorded $657.88 million in liquidations over 24 hours as Bitcoin BTC $98 756 24h volatility: 2.8% Market cap: $1.96 T Vol. 24h: $96.20 B dropped to $98,377 on Nov. 13, according to CoinGlass data.

Long positions accounted for $533.57 million of forced closures, while shorts represented $124.31 million. The liquidation cascade accelerated from $513.15 million at the 12-hour mark.

Total Market Liquidation Heatmap | Source: Coinglass

CoinGecko API data shows the cryptocurrency reached its third sub-$100,000 low of November on Nov. 13 at $98,377, following breaches to $99,607 on Nov. 4 and $99,377 on Nov. 7. The November lows mark a 22% correction from the Oct. 6 peak of $126,080.

Bitcoin Price Chart | Source: Trading View

Ethereum ETH $3 192 24h volatility: 6.8% Market cap: $382.90 B Vol. 24h: $45.19 B traded at $3,267, Solana SOL $142.2 24h volatility: 7.8% Market cap: $78.78 B Vol. 24h: $6.53 B at $147.91, and XRP XRP $2.30 24h volatility: 2.1% Market cap: $137.69 B Vol. 24h: $6.69 B at $2.36 on Nov. 13, according to CoinGecko data. The broader cryptocurrency market experienced similar volatility earlier this month, as previously reported by Coinspeaker.

What’s Behind Bitcoin’s Drop?

Analyst Satoshi Stacker noted US-based selling pressure contributed to the breach. “The Coinbase $BTC discount indicates that US-based selling has reaccelerated today and helped push Bitcoin below $100,000,” Stacker wrote.

Trader Maartunn identified the $100,000 level as a key liquidity zone. The drop ended a 189-day streak of Bitcoin closing above $100,000, spanning from May 8 through Nov. 12, according to analyst Ghost.

Strategist Liz Thomas noted divergence with gold performance. “Dollar weakness hasn’t helped Bitcoin, but it’s helped gold,” Thomas observed.

Traders Bet on Further Downside

Polymarket traders priced a 66% probability of the cryptocurrency reaching $95,000 in November, while Kalshi participants assigned 37% odds to another S&P 500 company announcing Bitcoin purchases this year.

ETF redemptions contributed to downward pressure, while liquidation events marked Q4’s largest forced closure day.

nextThe post Bitcoin Price Today: BTC Drops to $98K as $658M Liquidations Shake Crypto Market appeared first on Coinspeaker.

You May Also Like

Pi Coin Price Failed 60% Breakout — What Happens Next?

Low Cap Altcoins to Watch in 2025: BlockchainFX, Little Pepe, and Unstaked Could Be the Next Big Crypto Coins