R25 Launches Yield-Bearing rcUSD+ Stablecoin Protocol on Polygon

R25 launched its real-world asset and stablecoin protocol on Polygon POL $0.16 24h volatility: 5.7% Market cap: $1.68 B Vol. 24h: $143.04 M on Nov. 14, introducing rcUSD+ as a yield-bearing token backed by traditional finance assets. The protocol selected Polygon as its exclusive EVM blockchain for deployment.

The rcUSD+ token maintains a 1:1 peg to the US dollar while generating yields from a portfolio of real-world assets including money market funds and structured notes, according to Polygon’s announcement. Returns flow directly to token holders from low-risk investments.

The platform selected Polygon for its deep liquidity, low-cost transaction infrastructure, and institutional trust in payments and real-world asset applications.

The protocol aims to bridge traditional finance yield into DeFi with transparency and institutional oversight.

Launch Details and Verification Gaps

The rcUSD+ portfolio invests in money market funds and structured notes to generate returns for holders. The protocol maintains institutional oversight while providing transparency for on-chain assets.

Key technical and operational details were not disclosed in launch materials. R25’s official documentation at docs.r25.xyz and main site at r25.xyz were inaccessible at publication time. The contract address for rcUSD+ on Polygon was not disclosed, which prevents independent on-chain verification of token supply and transactions.

Multiple verification points remained unavailable at launch. No security audit reports were accessible, and the specific yield calculation methodology was not disclosed. Team member information and regulatory approval specifics were also absent from launch materials.

Market Context

The tokenized RWA market reached $36.06 billion as of Nov. 14, up 5.91% from 30 days prior, according to rwa.xyz data. Total stablecoin value stood at $299.76 billion (up 0.79%) across 202.89 million holders (up 3.39%). Monthly stablecoin transfer volume reached $4.99 trillion (up 28.73%) with 37.46 million active addresses (up 26.51%).

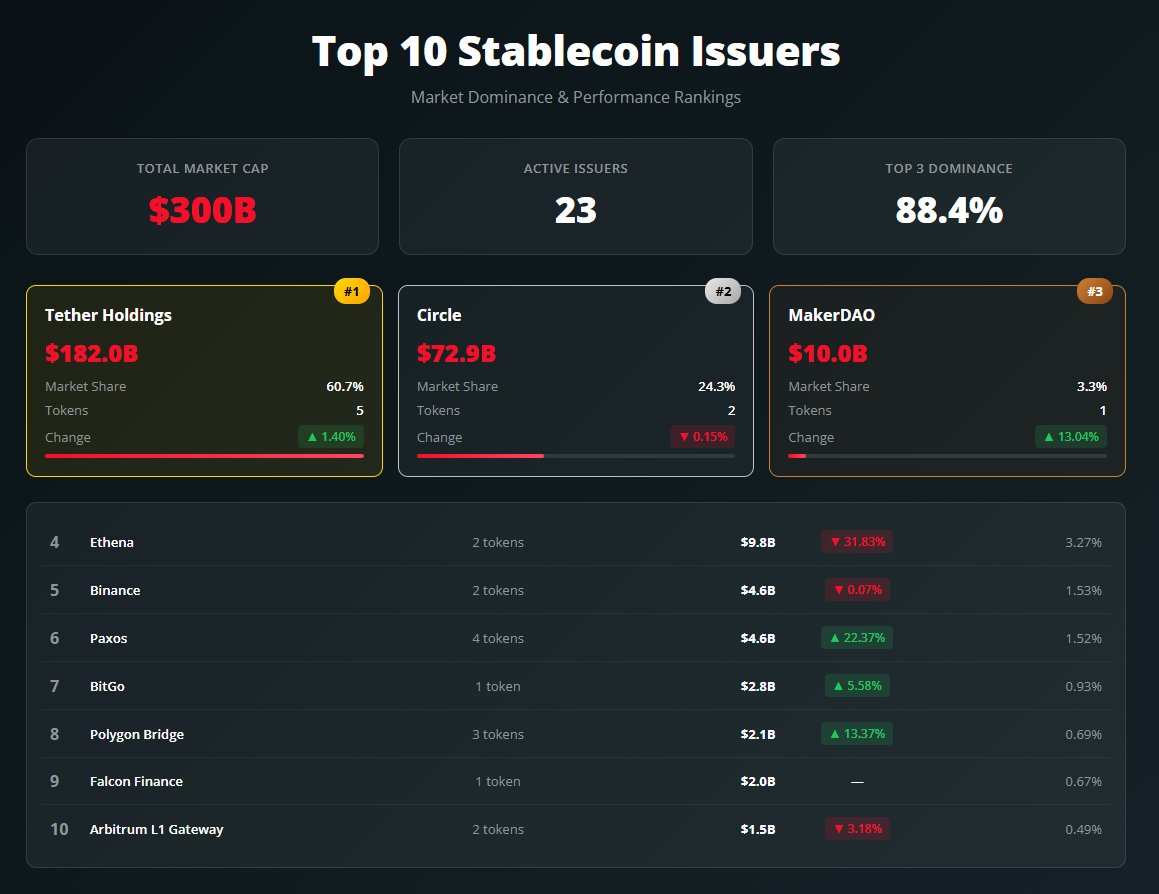

The stablecoin market is dominated by established issuers:

Dashboard showing stablecoin market status. | rwa.xyz

Yield-bearing stablecoins could help address the gap between crypto assets generating yields (8-11%) and traditional finance (55-65%), according to RedStone analysts. Billions in stablecoins already circulate on Polygon, which powers retail payments and DeFi liquidity.

Comparable yield-bearing RWA protocols include Ondo Finance’s USDY token backed by US Treasuries, Centrifuge’s private credit RWAs, and Maple’s on-chain credit for institutions.

Real-world asset tokenization has gained momentum globally, with Hong Kong announcing AI and tokenization as core pillars of its Fintech 2030 strategy.

nextThe post R25 Launches Yield-Bearing rcUSD+ Stablecoin Protocol on Polygon appeared first on Coinspeaker.

You May Also Like

X to cut off InfoFi crypto projects from accessing its API

X Just Killed Kaito and InfoFi Crypto, Several Tokens Crash