WBT Skyrockets 18% Daily as BTC Price Settles Above $91K: Market Watch

Bitcoin managed to rebound from the recent seven-month low beneath $90,000, but its progress was halted at $94,000 yesterday.

Some of the most volatile larger-cap alts are ZEC and HYPE. The former has resumed its rally with another 9% surge, while HYPE has plunged by more than 6%.

BTC Settles at $91.5K

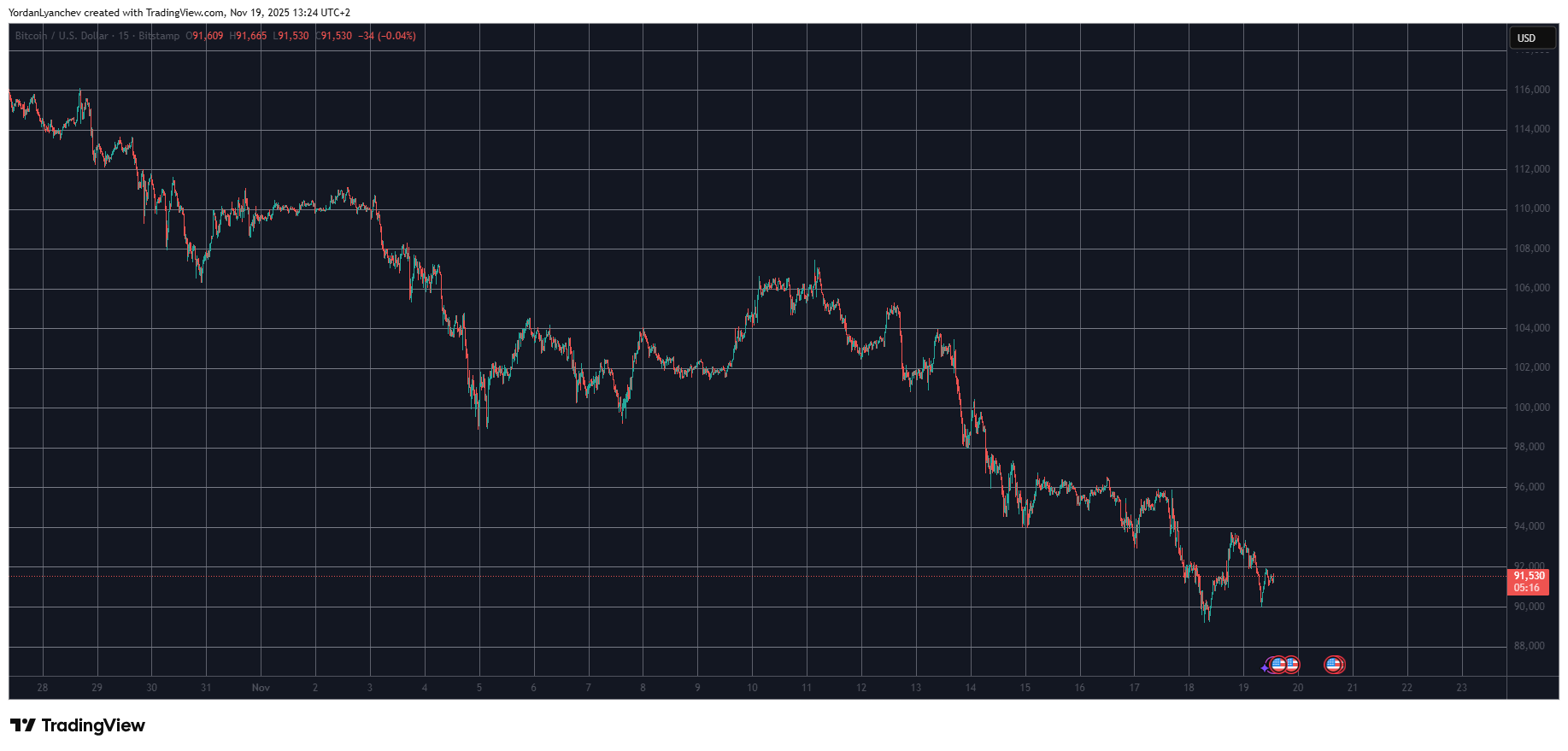

The primary cryptocurrency has been on an evident downfall since early October, which only worsened at the start of November. Just last week, the asset tapped $107,000 after some positive developments in the US, but was rejected and driven south hard in the following days.

By Thursday evening, it was below $100,000 once again, and it plummeted to $94,000 on Friday afternoon. After a brief recovery attempt during the weekend, the bears were back in control and drove it further south.

This time, the $90,000 support cracked and BTC dropped to $89,000 for the first time since April, marking a seven-month low. The bulls finally stepped up at this point and helped bitcoin bounce off to almost $94,000 yesterday.

Another rejection followed, and BTC tested the $90,000 line again, which held this time. As of now, the asset stands about a grand and a half higher, with a market cap of $1.830 trillion. Its dominance over the alts has taken another hit and is down 56.6% on CG.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

ZEC, WBT Up

Most larger-cap alts have produced minor moves over the past day. ETH, DOGE, SOL, BCH, and BNB are slightly in the green, while XRP, TRX, ADA, and LINK are with insignificant losses. HYPE and XMR have lost the most value from the larger-cap alts, with losses of up to 6-7%.

In contrast, ZEC has risen by almost 9% and trades close to $620 once again. CRO is up by 7%, while WBT has surged by 18% to $60. STRK has reentered the top 100 alts by market cap after a 24% surge.

The total crypto market cap has recovered $20 billion in a day and is up to $3.220 trillion on CG.

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

Cryptocurrency Market Overview Daily. Source: QuantifyCrypto

The post WBT Skyrockets 18% Daily as BTC Price Settles Above $91K: Market Watch appeared first on CryptoPotato.

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge