Bitcoin Price Prediction: BTC Rebounds Above $91K As Trump Ally Discloses 6-Figure Bitcoin Purchase

The Bitcoin price rose over 1% in the past 24 hours to trade at $91,278 as of 2:50 a.m. EST on trading volume that plunged 27% to $82.7 billion.

This uptick in the BTC price comes as first-term House member Brandon Gill, a Bitcoin permabull, purchased up to $150,000 in shares of BlackRock’s spot Bitcoin ETF (exchange-traded fund).

Gill has been an active purchaser of the largest cryptocurrency by market capitalization, accumulating up to $2.6 million worth of the asset since his debut as a House Representative.

Cboe Futures Exchange To Provide Trading In Continuous Futures For Bitcoin

In another development, Cboe Global Markets Inc. announced that it will introduce its new Cboe Bitcoin Continuous Futures (PBT) and Cboe Ether Continuous Futures (PET).

The products are scheduled to begin trading on the Cboe Futures Exchange on Dec. 15, pending regulatory review.

Cboe’s Continuous Futures are designed to offer traders long-term exposure to BTC and ETH.

The contracts will have a 10-year expiration at listing and a daily cash adjustment, effectively creating perpetual-style exposure while eliminating the need to roll positions periodically.

Bitcoin Price Slips Toward 200 SMA As Double-Top Breakdown Intensifies

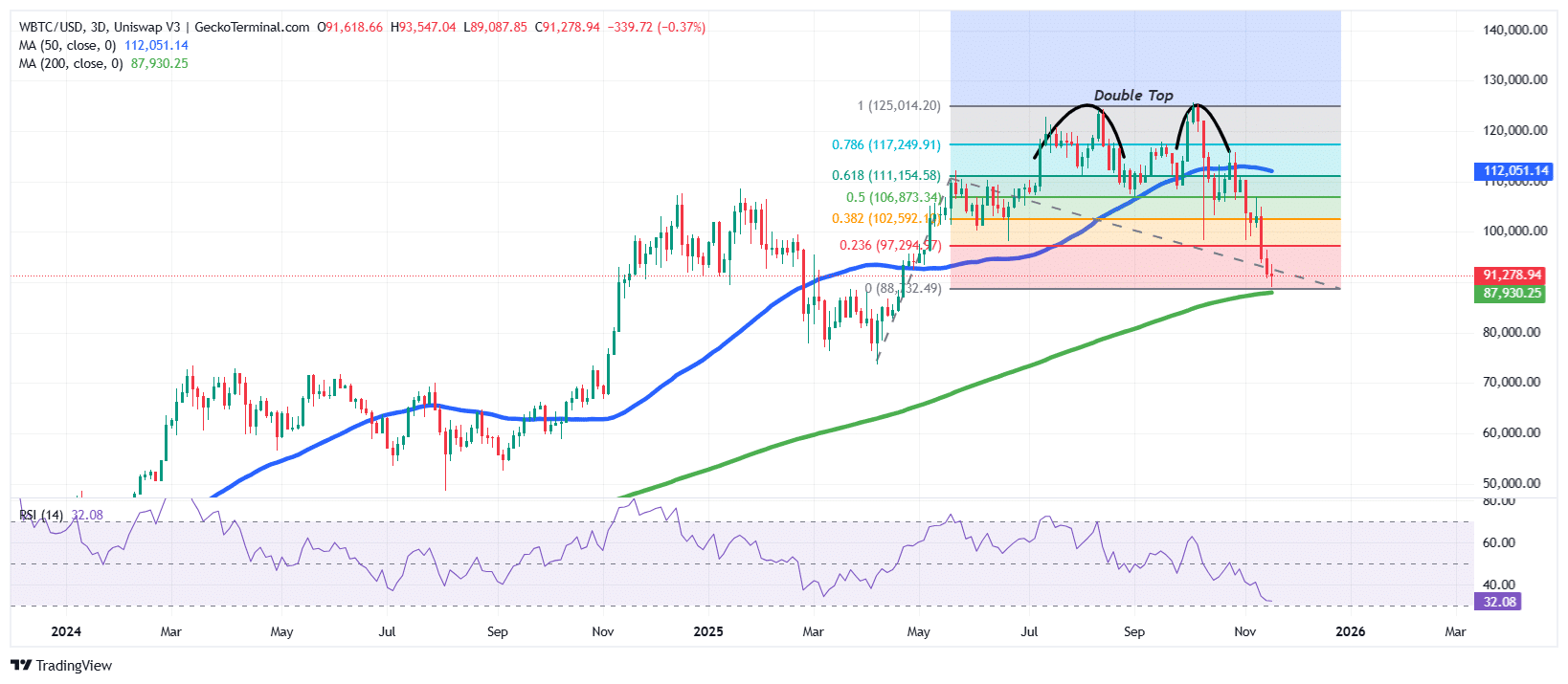

After rallying strongly from the $88,000 region earlier in the year, the BTC price met heavy resistance near the $126,000 zone. This area triggered repeated rejections, leading to the formation of a clear double-top pattern, which signaled exhaustion in the bullish trend.

From July through early September, the Bitcoin price consolidated beneath that ceiling, and has struggled to gain upward momentum.

Eventually, sellers took control, pushing the price of BTC below the neckline of the double-top structure. This breakdown marked the beginning of a sustained bearish phase.

Moreover, the bearish stance is supported by multiple failed recovery attempts around the 50 Simple Moving Average (SMA) on the 3-day chart.

As the downtrend continued, BTC moved decisively beneath the mid-range Fibonacci levels, losing the 0.382 and 0.5 retracements, which added to the bearish narrative.

Bearish pressure intensified recently as the price of BTC dropped to the critical 0.236 Fibonacci support near $97,000 and continued lower toward the long-term 200 SMA around $87,900.

Trading beneath the 50 SMA and moving toward the 200 SMA cements the weak trend, as bulls struggle to defend historically strong zones.

Additionally, the Relative Strength Index (RSI) on the 3-day timeframe has slid to 32, approaching oversold conditions. While not yet below the classic 30 level, the momentum is clearly bearish, supporting the overall strong selling dominance.

WBTC/USD Chart Analysis Source: GeckoTerminal

WBTC/USD Chart Analysis Source: GeckoTerminal

BTC Price Prediction

Based on the current BTC/USD chart analysis, bearish sentiment remains dominant as the BTC price trades well beneath the 50 SMA and approaches the long-term 200 SMA. The confirmed double-top breakdown supports the broader downward momentum, while the RSI near oversold territory suggests that selling pressure is intense but may be nearing exhaustion.

If the downtrend continues uninterrupted, the next support and cushion against bearish pressure aligns with the $87,930 region, on the 200 SMA. A breakdown below this zone could expose a deeper correction for the price of Bitcoin toward $84,000.

However, oversold conditions may fuel a short-term relief bounce. In such a scenario, initial resistance lies around the $97,000–$100,000 range, corresponding with the 0.236 Fib level and local horizontal resistance.

Ali Martinez supports that bullish outlook, as his analysis shows that the price of BTC could bounce to $99,000.

A stronger trend reversal would require reclaiming the 50 SMA ($112,051), which would signal weakening bearish momentum and open the door for a broader recovery.

Related News:

You May Also Like

XMR price pumps as a rare pattern points to Monero hitting $1,000

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets