Ethereum Price Prediction: ETH Price Eyes Bullish Breakout Above the Trendline as $3,000 Dip Sparks Strong Rebound Opportunity

Market participation has increased around key support levels, suggesting that traders are reassessing risk after several volatile sessions.

Although Ethereum continues to face macro and liquidity pressures—including ETF outflows and broader risk-off sentiment—its current structure shows early signs of stabilization. A sustained move above trendline resistance would be an important confirmation that buyers are regaining control.

Market Overview

Ethereum is attempting to stabilize after another sharp intraday swing that briefly pushed the price below the key $3,000 psychological level. The move came amid continued ETF outflows and investor caution driven by shifting U.S. rate expectations and broader macro uncertainty.

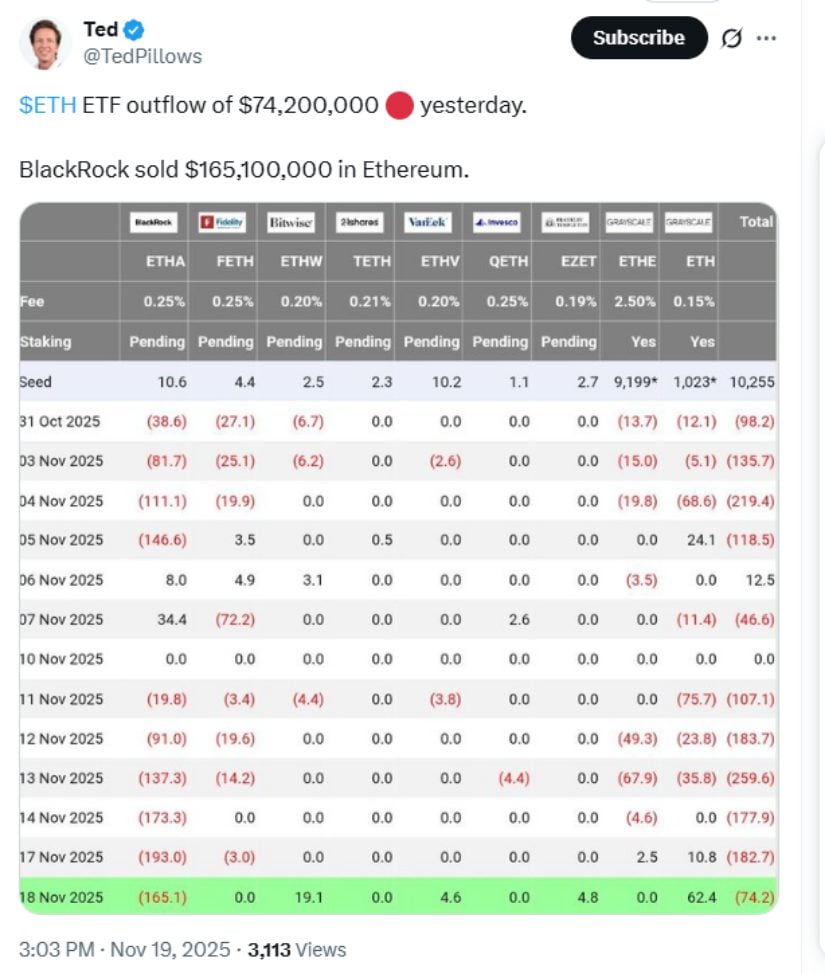

Yesterday, U.S. spot Ethereum ETFs saw a net outflow of $74.2 million, led by BlackRock’s $165.1 million sale of ETH. Source: Ted via X

Yesterday, U.S. spot Ethereum ETFs saw a net outflow of $74.2 million, led by BlackRock’s $165.1 million sale of ETH. Source: Ted via X

Data from SoSoValue, a widely followed digital-asset ETF analytics platform, shows consistent withdrawals across U.S. Ethereum ETFs throughout mid-November. Despite these headwinds, ETH has begun forming a short-term base near $2,950–$3,050, providing the initial structure for a potential recovery. At the time of writing, ETH is trading near $3,020.

Recent on-chain activity also confirms a reset in short-term speculative pressure. Funding rates and open interest both eased following the decline, creating conditions where a recovery becomes technically viable if momentum improves.

ETF Outflows Continue to Pressure Market Sentiment

According to flow data from SoSoValue, shared by institutional-flow analyst Ted Pillows, U.S. spot Ethereum ETF products saw $74.2M in net outflows on November 18, marking the sixth consecutive day of withdrawals. BlackRock’s Ethereum Trust had the largest decline with over $165M in outflows, while Bitwise (+$19.1M) and VanEck (+$4.6M) recorded modest inflows that were insufficient to offset the broader trend.

Ethereum dipped below $3,000 again, and a recovery above $3,200 is needed to potentially drive a rally toward the $3,400–$3,600 range. Source: Ted via X

Pillows—known for tracking institutional crypto exposure—described the current behavior as an example of “uneven institutional allocation,” noting that Ethereum continues to lag behind Bitcoin as rate expectations, dollar strength, and equity-market volatility shape risk appetite.

These outflows highlight a key risk factor: even if technical indicators improve, sustained ETF weakness could limit the strength of any rebound.

Technical Landscape: Trendline Break Could Shift Short-Term Momentum

Ethereum’s latest pullback aligned closely with Bitcoin’s retracement from local highs. ETH lost momentum after failing to reclaim $3,150, a trendline level that has rejected price multiple times over the past week—signaling a temporary seller stronghold.

The drop extended below $3,050, with ETH forming a local low at $2,941 before stabilizing.

Market data from Kraken shows ETH remains below its 100-hour Simple Moving Average, reinforcing near-term bearish pressure. For context, ETH has not closed above this moving average for several sessions, indicating that short-term momentum still favors sellers until a decisive break occurs.

Ethereum may see a bullish move toward higher resistance today if it successfully breaks the trendline, indicating potential short-term upward momentum. Source: bahardiba on TradingView

Market strategist Aayush Jindal, known for his technical research across major crypto assets, noted that a clear move above $3,250 could “open the path toward the $3,320 resistance.” He further added that reclaiming $3,320 would be structurally important for a potential move toward the $3,450–$3,500 region.

Building on this, Pillows emphasized that a recovery above $3,200—the midpoint of recent range compression—remains the critical signal for bullish confirmation, but this setup remains heavily dependent on volume and continued defense of support zones.

Volume Profile Insights: Why the $2,950–$3,050 Area Matters

A Binance volume profile chart, shared in recent trader commentary, highlighted a dense cluster of volume between $2,950 and $3,050.This matters because high-volume areas typically represent regions where buyers and sellers previously found consensus, often acting as support during pullbacks.

The message highlights a Binance ETH volume profile: key high-volume zones may act as support/resistance, and price reactions there could signal a potential buying opportunity. Source: AliSignals on TradingView

From my analysis, ETH’s repeated reactions within this zone suggest that many traders consider this a fair-value area, making it more likely for the market to stabilize here unless broader risk sentiment deteriorates.

However, support alone is not enough—ETH must reclaim the descending trendline to shift momentum. Without that breakout, this zone risks becoming a consolidation area rather than a springboard for recovery.

Key Resistance and Support Levels With Interpretation

Resistance Zones

-

$3,150–$3,200: Major trendline and short-term seller zone; ETH has rejected this area multiple times.

-

$3,250: First breakout confirmation; clearing this strengthens the bullish structure.

-

$3,320: Next upside target; historically acts as a momentum checkpoint.

-

$3,450–$3,500: Broader bullish target but requires strong market participation.

Support Zones

-

$3,065: Nearest intraday support.

-

$3,020: Early bearish trigger; losing this resurfaces downside risk.

-

$2,950: Key pivot where previous volume concentration sits.

-

$2,880: Next structural support.

-

$2,750–$2,740: Deeper correction zone if broader markets turn risk-off.

From a structural standpoint, ETH must defend $3,020 to avoid retesting the $2,950 pivot. A breakout above $3,150–$3,200 would signal a shift toward short-term bullish momentum; however, this scenario remains contingent upon market conditions and ETF flows.

Market Sentiment and Outlook

Overall sentiment remains mixed. More than $70M in liquidations earlier this week emphasize how sensitive the market is to sudden price swings.

On the fundamentals side, recent ecosystem developments—such as Vitalik Buterin’s proposal for a new privacy-preserving framework—continue to generate discussion about Ethereum’s long-term direction. While not immediately price-moving, such updates contribute to long-term investor confidence.

Ethereum was trading at around 3,062.28, up 0.30% in the last 24 hours at press time. Source: Ethereum price via Brave New Coin

Looking ahead, traders remain divided as Ethereum sits between strong support and strong resistance. While the technical setup suggests the possibility of a bullish reversal, ETF outflows, macroeconomic pressures, and liquidity conditions remain key variables.

Final Thoughts

Ethereum remains at an important inflection point as the market watches whether the trendline can finally be broken. Strong volume support near the $3,000 region creates the foundation for a potential rebound, but broader sentiment—shaped by ETF flows and macro trends—continues to influence price stability.

If ETH successfully reclaims the $3,150–$3,200 zone with convincing volume, upside targets toward $3,320 and $3,450 become technically plausible. However, failure to hold $3,020 could push Ethereum back into a deeper retest of the $2,950–$2,880 supports.

For now, traders remain attentive, watching for whether the recent dip turns into a sustained recovery or another consolidation phase.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)

[Tambay] Tres niños na bagitos