XRP Long-Term Holders Shift From Euphoria to Anxiety as NUPL Signals Trouble

XRP is under heavy selling pressure as fear spreads across the crypto market, pushing sentiment into one of its most fragile stages of the cycle. What was once a euphoric rally earlier this year has steadily shifted into denial among long-term holders — and now anxiety is beginning to dominate. With XRP flirting dangerously with a drop below the $2 mark, investors are watching closely, aware that this level carries major psychological and structural weight.

For now, XRP has managed to hold above $2, but the defense of this threshold is becoming increasingly difficult as liquidity thins and macro uncertainty intensifies. A break below this zone could trigger a deeper reset, while a successful rebound would reinforce it as a key long-term demand area.

This shift in sentiment is also reflected in on-chain metrics: long-term holders, previously sitting comfortably in profit, are now watching their unrealized gains compress. Historically, transitions from euphoria to denial and into anxiety have often preceded major market inflection points, making the current moment especially significant.

XRP NUPL Signals Growing Market Anxiety

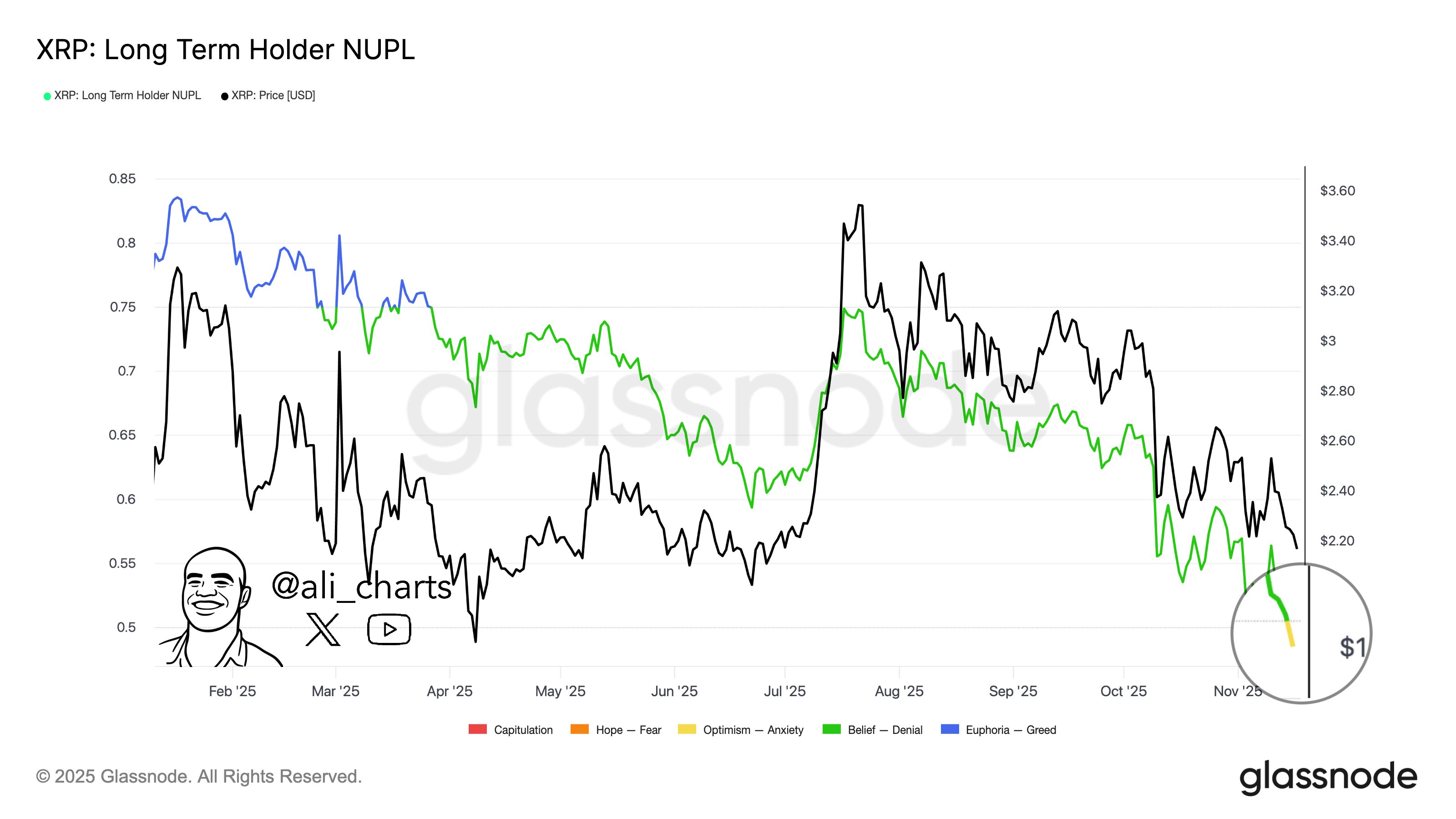

Analyst Ali Martinez shared new data showing that XRP’s Long-Term Holder Net Unrealized Profit/Loss (NUPL) has now dropped below 0.5 — a level that historically marks a transition from confidence to growing anxiety among holders.

NUPL measures the difference between the total unrealized profit and loss in the network, helping identify where investors stand emotionally within the market cycle. When NUPL is above 0.5, it typically reflects optimism or belief, often associated with rising prices and strong conviction. But when it falls below 0.5, sentiment weakens, indicating that investors are no longer comfortably in profit.

XRP dipping below this threshold means a significant portion of the market is losing confidence as unrealized gains shrink. Investors who were previously sitting on sizable profits are now seeing those margins erode, pushing them into a more defensive psychological state. Historically, this signals that the market is shifting toward anxiety — a stage where many holders begin doubting whether upside momentum will return.

This decline in NUPL aligns with XRP’s current price behavior near the $2 support level, emphasizing how fragile the market has become. While anxiety can fuel panic selling, it has also marked the beginning of long-term accumulation phases in past cycles. The next move for XRP may depend on whether fear intensifies — or whether strong hands step in to absorb supply.

Testing Critical Support as Selling Pressure Deepens

XRP continues to trade under heavy selling pressure, with the chart showing a clear series of lower highs and persistent failures to reclaim key moving averages. The price is now hovering near $2.14, testing a crucial support zone that has repeatedly acted as a psychological and structural level for buyers throughout the year. Each attempt to break above the 50-day and 200-day moving averages has been met with rejection, signaling that momentum remains firmly on the side of the sellers.

Volume has gradually increased during recent downswings, suggesting that the sell-offs are driven more by capitulation than simple profit-taking. The sharp decline toward $1.20 in October still stands out as a sign of extreme volatility and liquidity stress, and although XRP quickly recovered from that anomaly, it highlighted how fragile the market structure had become. Since then, price has failed to establish a sustained uptrend, instead forming a tighter and more compressed consolidation beneath the major moving averages.

If the $2 support level breaks decisively, XRP could revisit deeper liquidity pockets around $1.75–$1.90, where buyers previously stepped in during September. However, holding above $2 would keep the possibility of a recovery alive, especially if market sentiment stabilizes.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

China Launches Cross-Border QR Code Payment Trial

Zero Knowledge Proof Auction Limits Large Buyers to $50K: Experts Forecast 200x to 10,000x ROI