Gemini Launches a New Mastercard for U.S. Businesses, Converting Everyday Spend Into Crypto

Gemini’s new American Business Card lets U.S. business owners earn 1.5% back in cryptocurrency on all spending with no annual fee, depositing rewards directly into a Gemini exchange account as transactions post. Issued by WebBank and built on the Mastercard Business World Elite network, the card supports mobile wallets and offers travel and purchase protections. Sole proprietors can apply now, while LLCs and corporations can join Gemini’s early-access list.

- Earn 1.5% back in bitcoin, ether, or other supported assets, with rewards auto-deposited into your Gemini account for flexible holding or conversion.

- Get a $500 crypto welcome bonus after $6,000 spend in 90 days, plus no foreign transaction fees for global vendor payments.

- Crypto rewards can fluctuate with the market, unlike fixed cash back, introducing both upside potential and volatility.

- The card integrates with existing financial workflows through the Mastercard network, aligning crypto rewards with routine business operations.

- Businesses should review IRS digital asset tax guidance to understand reporting requirements.

Gemini has introduced the American Business Card, a Mastercard product for U.S. business owners that provides crypto rewards on everyday business expenses. The card operates on the Mastercard network and deposits rewards directly into a user’s Gemini exchange account as transactions post. It is currently available to sole proprietors, while LLCs and other business entities can join Gemini’s early-access program for upcoming availability.

A Business Credit Card Built for Crypto Rewards

The American Business Card provides 1.5% back in cryptocurrency on every purchase, with no spending categories, caps, or annual fees. It is issued by WebBank and operates on the Mastercard Business World Elite network, which includes travel protections, fraud monitoring, purchase security, and business-focused benefits. Businesses can add the card to Apple Pay, Google Pay, and Samsung Wallet for mobile payments across supported devices.

At launch, the card is available to sole proprietors, while LLCs and corporations can request early access through Gemini’s Business Card page. Once a transaction posts, rewards automatically appear in the cardholder’s Gemini account, where businesses can choose rewards in bitcoin, ether, or other supported digital assets.

Source: Gemini

This setup allows companies to hold or convert their crypto rewards at any time, depending on their operational or treasury preferences.

Welcome Bonus and Reward Flexibility

Gemini is offering a $500 crypto welcome bonus, unlocked by spending $6,000 within the first 90 days. The card also has no foreign transaction fees, which may benefit businesses that work with international vendors or travel frequently.

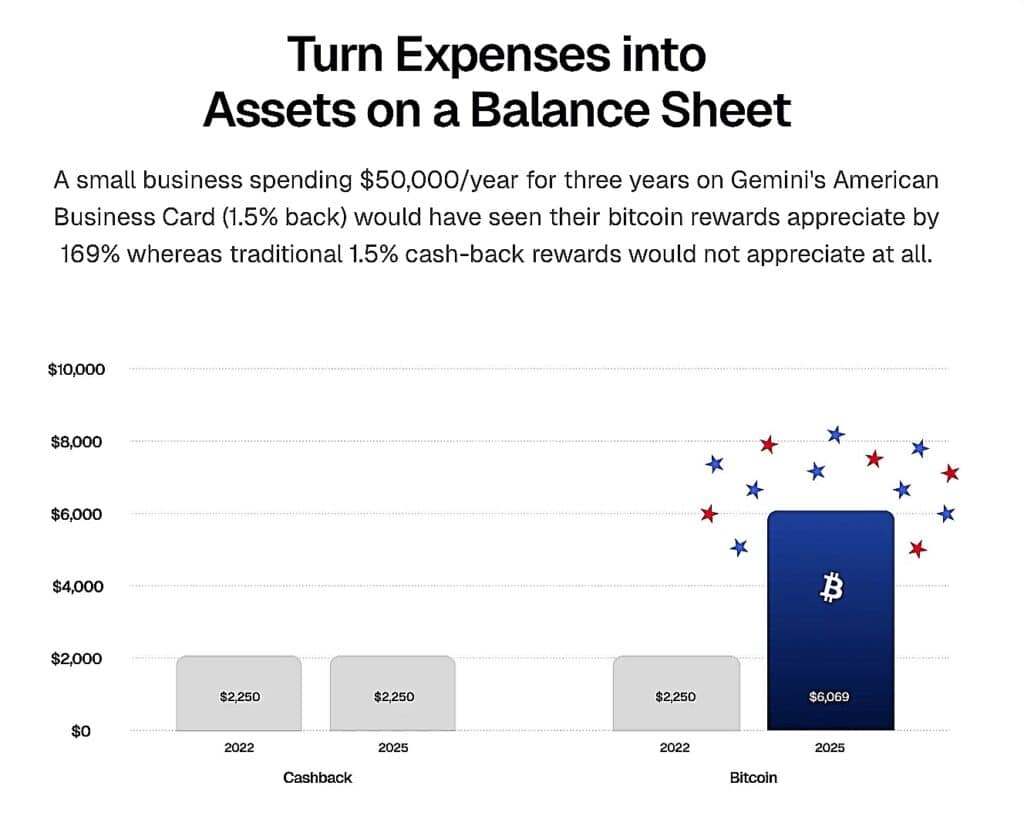

Gemini illustrates the potential variability of crypto rewards by presenting a hypothetical scenario: a business spending $50,000 annually over three years could have seen different outcomes if its bitcoin rewards reflected BTC’s performance between October 2022 and September 2025. The company makes clear that this is only an example and that the card was not available during that period.

The comparison highlights a basic distinction: traditional 1.5% cash back remains fixed, while crypto rewards may fluctuate and could appreciate if the market rises. Businesses already holding bitcoin or using digital assets may find this structure aligned with their financial approach.

How the Card Fits Into Gemini’s Growing Financial Ecosystem

The American Business Card builds on Gemini’s earlier consumer credit card and reflects a broader move toward integrating crypto features into everyday financial tools. By focusing on business spending, a segment known for higher transaction volumes and longer-term card use, Gemini is extending its reach beyond trading activity and into routine financial operations.

Its use of the Mastercard network connects the product to established payment infrastructure and aligns crypto rewards with systems businesses already rely on. Additional information about network benefits is available through Mastercard’s Business World Elite overview.

This expansion indicates a long-term strategy: combining traditional financial frameworks with crypto-based utilities in products suited to both established companies and digitally oriented firms.

Why Some Businesses Will Find Strong Value

The card’s usefulness depends on a company’s financial strategy, appetite for volatility, and interest in digital assets. Many firms may see value because:

-

Earning bitcoin or other digital assets aligns with existing crypto-treasury approaches.

-

Crypto rewards have the potential to fluctuate with the market, unlike fixed cash-back structures.

-

Automatic reward deposits into a Gemini account reduce the friction of adopting digital assets.

-

With no annual fee, businesses can test the card without ongoing cost.

Companies already using Gemini for trading or custody may also find the card fits naturally into their current workflows.

Considerations and Potential Drawbacks

The card will not suit every business. Some may hesitate due to:

-

Price volatility, which can affect the value of earned rewards.

-

Accounting and tax requirements, as holding crypto adds reporting complexity.

-

Internal policies that limit or prohibit crypto exposure on the balance sheet.

-

Regulatory or compliance constraints within certain industries.

For accounting considerations related to digital assets, businesses can review the IRS digital asset tax guidance on IRS.gov.

A Step Forward for Crypto–Traditional Finance Integration

Gemini’s American Business Card reflects a deeper connection between digital assets and established payment infrastructure. By building the product on the Mastercard network instead of creating a standalone, crypto-only tool, Gemini positions the card within everyday financial operations used by U.S. businesses.

As crypto adoption continues to grow across startups, mid-size companies, and larger firms, tools like the American Business Card show how digital assets are gradually merging with traditional systems. The card’s long-term relevance will depend on how many businesses are comfortable turning routine spending, such as office supplies, software, advertising, and travel, into ongoing exposure to crypto markets.

You May Also Like

Crypto Casino Luck.io Pays Influencers Up to $500K Monthly – But Why?

Brera Holdings Rebrands as Solmate, Raises $300 Million for SOL Treasury