What Happened in the Crypto Market Today: XRP Price Today, Bitcoin Price Reacts to U.S. Jobs Report and latest Crypto News

The post What Happened in the Crypto Market Today: XRP Price Today, Bitcoin Price Reacts to U.S. Jobs Report and latest Crypto News appeared first on Coinpedia Fintech News

Good Morning, America! Here are the latest crypto news updates you missed during the Asian market hours

Bitcoin price today is fighting hard to recover after dipping to $92K earlier this week. It has now bounced above $93K, gaining over 4% in a few hours thanks to stronger tech-sector sentiment. Ethereum is trading weak but steady, while most altcoins are still flashing red.

Top 10 Crypto Prices (Today)

| Bitcoin (BTC) | $ 91,772.34812953 |

| Ethereum (ETH) | $ 3,014.78517422 |

| BNB | $ 901.20332458 |

| Solana (SOL) | $ 141.86293870 |

| XRP | $ 2.12788730 |

| Dogecoin (DOGE) | $ 0.15822434 |

| Cardano (ADA) | $ 0.46709631 |

| Avalanche (AVAX) | $ 14.41203952 |

| Toncoin (TON) | $ 1.71899778 |

| Shiba Inu (SHIB) | $ 0.00000873 |

Trending Crypto Today

Pi Network Price Today ( $ 0.25028725)– Pi Coin Price jumped 10% to hit its weekly high, supported by strong inflows and rising momentum indicators. It’s holding support at $0.246 and could move toward $0.260 if buyers stay active. But if it loses support, Pi may fall toward $0.234 or even $0.224, signaling a deeper correction.

Crypto Fear & Greed Index: Deep in Fear Zone

Sentiment is extremely fearful we’re sitting around the lowest levels of the year. When fear grips this hard, historically, accumulation quietly begins.

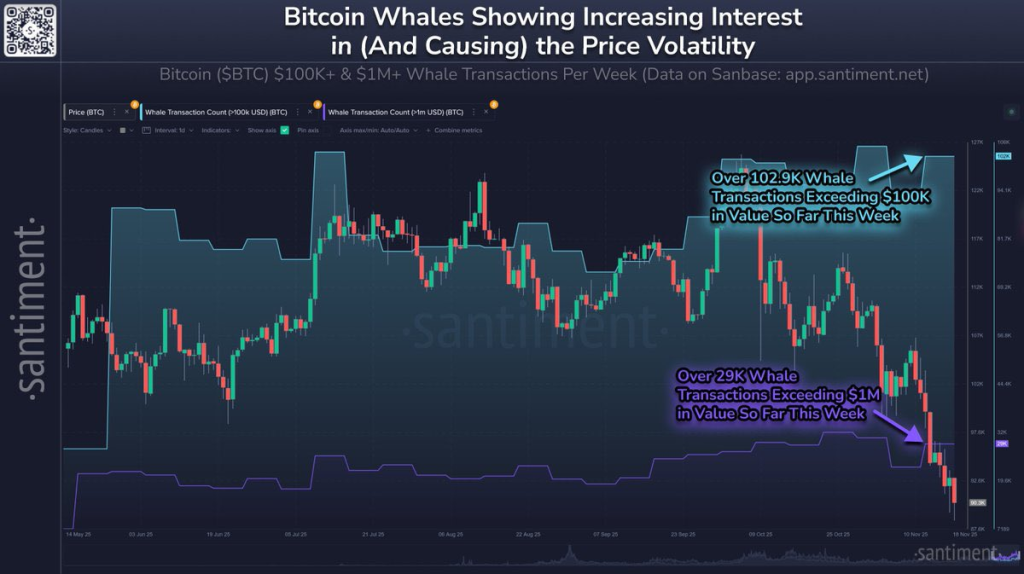

Bitcoin’s fall to $88,600 earlier this week scared the entire market, but guess what? Big whales came aliveand they came in loud.

Whale wallets executed 102,000+ large transactions above $100K and nearly 30,000 mega-whale moves above $1 million. That’s the highest whale activity of 2025. When whales swim like this, something big is usually brewing.

A massive block of liquidity is now sitting between $98K–$100K, and another around $110K. If BTC pushes past $98K, analysts expect a strong relief rally aiming for $110K, which many short-sellers are eyeing as their “ultimate short setup.”

The weird twist?

Nvidia dropped stunning earnings $35.1B in revenue and insane demand for AI chips — and that sparked a bounce in risk markets. BTC reacted instantly, jumping from $88K lows to over $93K.

Author’s POV:

The bounce looks real, but it’s not a full recovery yet. Whales are buying, liquidity is building, and volatility is rising this could lead to a strong move. But traders must stay careful. One negative macro headline can easily push Bitcoin back to the low $90K levels again.

Top Crypto Headlines Today

Now let’s talk about the real drama — the news stories shaking the entire crypto world.

1. Core Foundation vs Maple Finance, Legal War Begins

Core Foundation secured a court injunction against Maple Finance in the Cayman Islands. Core claims Maple used confidential data from their partnership to launch a competing BTC-yield product, breaking their 24-month exclusivity deal.

What’s more worrying? Maple recently admitted to “impairments” in its Bitcoin Yield product and said it might not be able to return all BTC to lenders.

My POV: This is huge, if Core proves misuse, the entire DeFi yield industry may face a new legal standard. And lenders tied to Maple should stay alert.

2. Base Co-founder Announces His Own Token

Jesse Pollak revealed his personal token $JESSE, launching soon on the Base app. He already warned users about fake impersonators popping up.Natural reaction: It’s 2025, personal tokens are normal but official verification is now more important than ever.

3. Binance Still Under Surveillance

CZ’s lawyer confirmed that although his name is partially cleared, both CZ and Binance remain under multiple U.S. agency restrictions. Regulators from FinCEN are still monitoring Binance’s compliance, despite their exit from the U.S. market.

4. India’s Rupee-backed ARC Stablecoin Coming in 2026

A huge shift: India will launch ARC, a fully rupee-backed stable digital asset. The goal is to stop liquidity from flowing into dollar stablecoins and support India’s domestic financial ecosystem.

5. Bitwise XRP ETF Launches Tomorrow

The Bitwise XRP ETF will start trading on NYSE with a 0.34% fee, waived for the first $500M. This is big for investors looking for XRP exposure without direct custody.

6. Metaplanet Launches MERCURY Equity Class

Metaplanet announced MERCURY, a 4.9% dividend preferred equity offering, supporting their aggressive Bitcoin treasury strategy.

7. ARK Invest Goes Shopping

ARK Invest bought $39M worth of crypto-related equities during the crash, Circle, Bullish, and BitMine. Cathie Wood loves buying red days.

8. Bitcoin Core Gets First Major Public Security Audit

Quarkslab completed the first fully disclosed Bitcoin Core audit no major vulnerabilities found. Huge confidence boost for BTC infrastructure.

9. BlackRock’s Staked Ethereum Trust Filing

A new Delaware filing confirms BlackRock is entering the staked ETH world. This signals institutional appetite for yield-bearing ETH products.

10. GANA Payment Hack , $3.1M Drained

A BSC exploit drained $3.1M. The hacker bridged funds, used Tornado Cash, and still holds a chunk. Another reminder that BSC is still a hotbed for exploits.

11. New Crypto Issuer on Nasdaq Stockholm

Germany’s DDA received approval to list new crypto ETPs more regulated European options incoming.

As the U.S. market opens, volatility could pick up again. All eyes will be on the Bitwise XRP ETF launch, which could bring fresh inflows and spark interest in large-cap altcoins. At the same time, traders are watching upcoming U.S. jobs data, which often impacts risk assets a strong report can boost confidence, while a weak one may trigger another round of selling.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B