Bitcoin Price Dips Toward $81K, Liquidations Approach $2 Billion

Bitcoin’s price continues to drop, trading around $84,000 at the time of this writing. It dipped below $82,000 on Binance moments ago, triggering a wave of liquidated leveraged positions across exchanges.

Source: TradingView

Source: TradingView

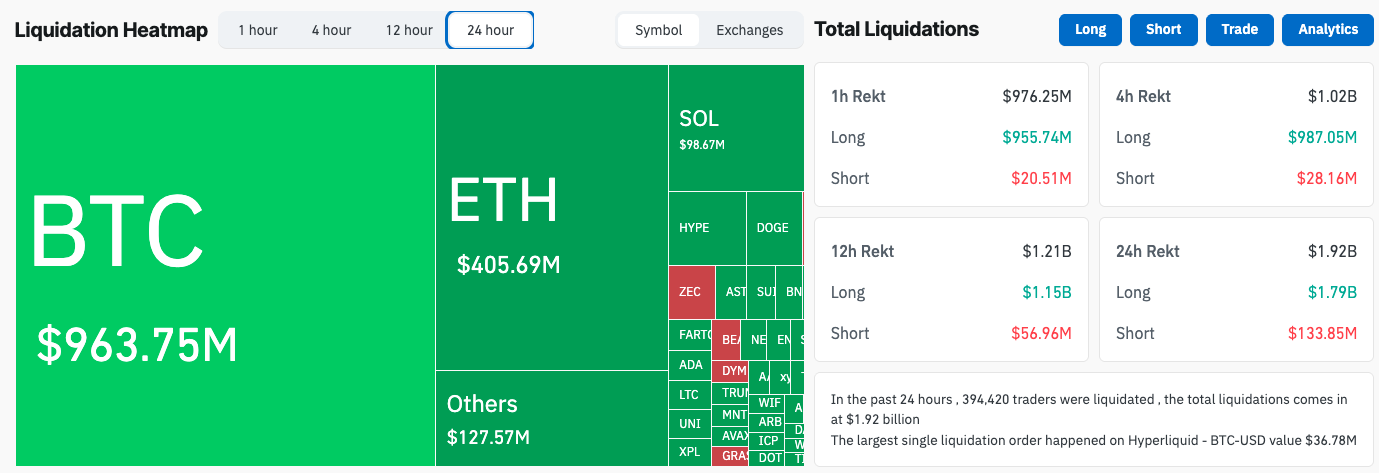

Data from Coinglass shows that the total value of liquidated positions has reached $2 billion over the past 24 hours.

Source: CoinGlass

Source: CoinGlass

As you can see, liquidated long positions approached $1 billion in the past hour alone, intensified by the fresh sell-off that pushed the market further down.

As CryptoPotato reported, the latest decline also means that the average spot BTC ETF investor is currently underwater. After all, the asset lost more than $20,000 in the past 10 days, having traded at around $107K on November 11th.

If you’re wondering why Bitcoin’s price is down today, ETF outflows reached a whopping $903 billion today, according to data from Farside.

On the flipside, the ongoing crash is also prompting many whales to buy the dip. There’s a notable market divergence, with flows shifting from dumping to accumulation by larger wallets, though the price action remains hectic.

The post Bitcoin Price Dips Toward $81K, Liquidations Approach $2 Billion appeared first on CryptoPotato.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets