Crypto crash about to end? Top reasons for a new bull run

The crypto crash accelerated this week, with Bitcoin tumbling to the key support at $80,000 and the market capitalization of all tokens falling to $2.90 trillion.

- The crypto crash accelerated this week, with most coins being in the red.

- There are signs that a new bull run is around the corner, including the falling Fear and Greed Index.

- Bitcoin and most altcoins have moved into their oversold territories.

Most altcoins have fallen by double digits in the last seven days, with Ethereum (ETH), Ripple (XRP), Binance Coin (BNB), and Cardano (ADA) falling by over 12%.

Still, amid the ongoing doom predictions, there are signs that the crypto market crash is about to end. These signs, which have all happened in the past, have now aligned.

Crypto crash could end as Fear and Greed Index crashes

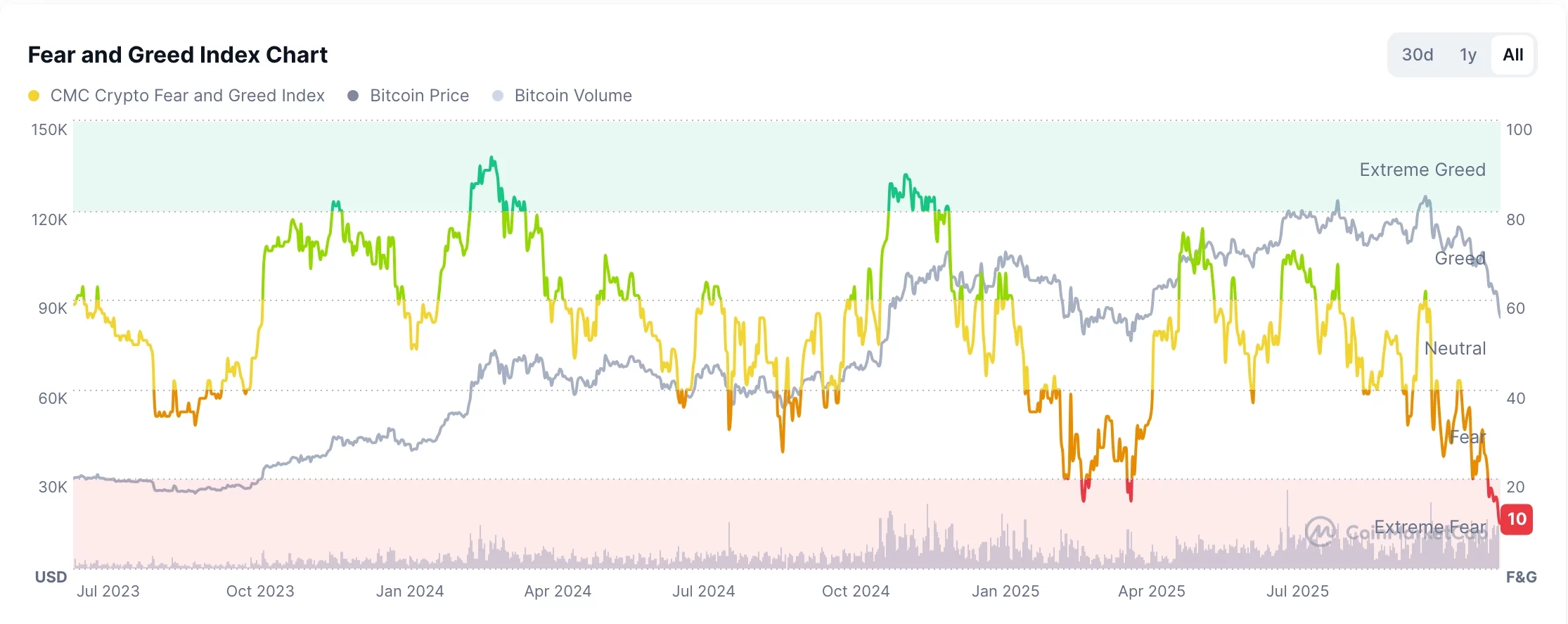

One of the potential catalysts for a new crypto bull run is that the closely-watched Fear and Greed Index has tumbled to the year-to-date low of 10.

Crypto Fear and Greed Index | Source: CMC

Crypto Fear and Greed Index | Source: CMC

This plunge happened as the momentum in the crypto industry waned, volatility jumped, and social media sentiment turned negative.

A closer look shows that most crypto bull markets start whenever the index is in the red. For example, Bitcoin (BTC) jumped to a new record high in May this year, a few weeks after the index moved to the extreme fear zone.

On the other hand, crypto bear markets always start when the index is either in the green or extreme greed zone. Therefore, with November nearing its end, there is a likelihood that December will be a better month for cryptocurrencies, possibly because of the Santa Claus rally.

Crypto market cap has become oversold

The other potential catalyst for the next crypto bull run is that the industry has now become highly oversold.

Data shows the Relative Strength Index of the Crypto Market Cap has dropped to the oversold level of 24. This means that the falling divergence pattern that has been going on since July this year is nearing its end.

Crypto Market Cap has become oversold | Source: TradingView

Crypto Market Cap has become oversold | Source: TradingView

Therefore, there is a likelihood that Bitcoin and other altcoins will start to bounce back in the coming weeks. Of course, this rebound will not be a straight line, with one possibility being the formation of a double-bottom pattern.

Crypto cleansing is ending

Another possible reason why the crypto crash is ending is that the ongoing cleansing in the industry is ending. This cleansing is seen in the ongoing futures open interest.

Data compiled by CoinGlass shows that the futures open interest has plunged to $123 billion, down from the year-to-date high of over $320 billion. Total liquidations since October 10 have jumped to over $40 billion.

The ongoing liquidations and the falling open interest mean that the crypto market will be a bit healthier in the future as investors use less leverage.

There are other potential catalysts for the next crypto bull run, including the elevated chances of Federal Reserve interest rate cuts, soaring M2 money supply, and the ongoing altcoin ETF approvals.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)