Solana price prediction 2026-2032: Trends and insights for investors

Key takeaways

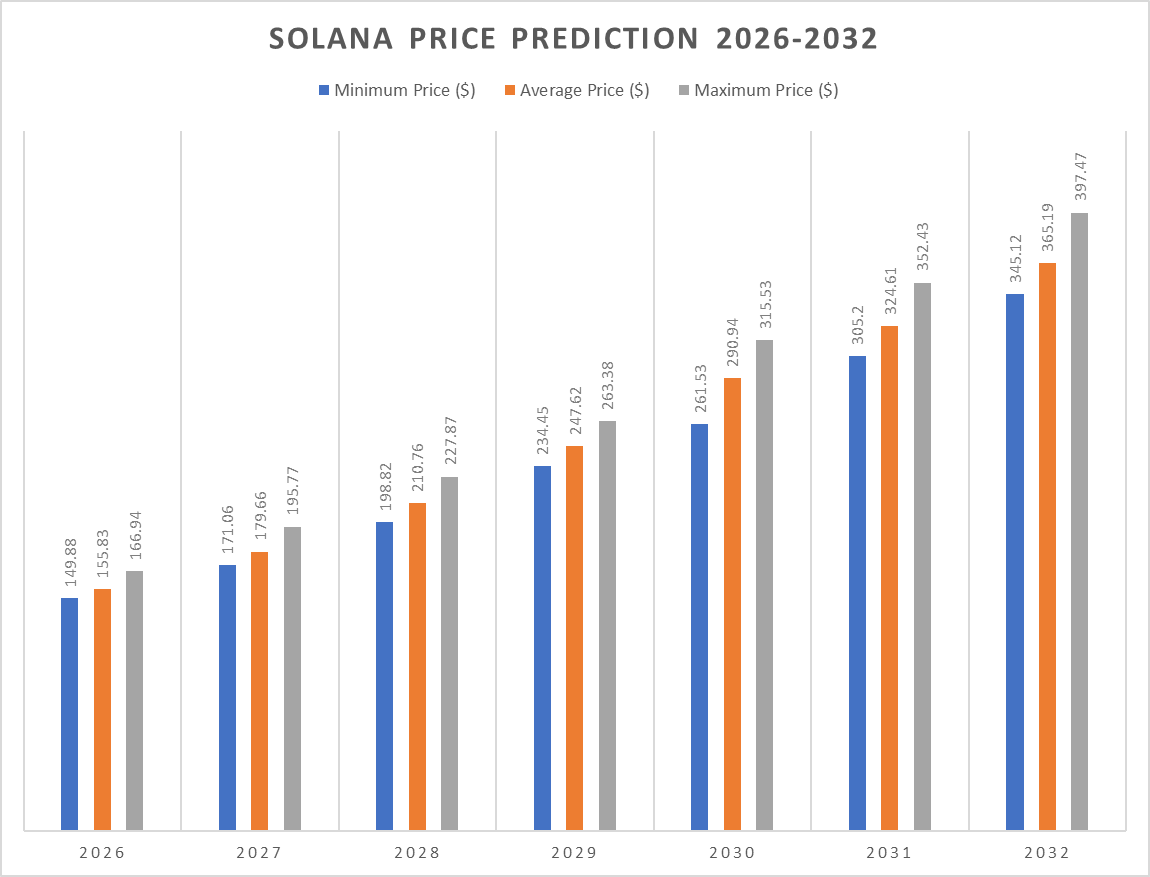

- Solana’s price can reach a maximum of $166.94 with an average trading value of $155.83 in 2026.

- By 2029, SOL is expected to reach a high of $263.38, supported by continued ecosystem growth and network adoption.

- Solana’s price could see further upside by 2032, potentially reaching $397.47 with an average trading price around $365.19.

Despite occasional challenges for the Solana network ecosystem, including network congestion and competition from other blockchain platforms, the current sentiment shows that Solana demonstrates resilience and adaptability, despite the current price fluctuations, positioning itself as a leading player in the decentralized finance (DeFi) and Web3 landscape.

Overall, the prevailing sentiment regarding the current Solana price within the Solana community reflects the current sentiment of confidence and excitement among investors, driven by the growing interest in Solana with stakeholders eagerly anticipating the platform’s continued evolution and impact on the broader crypto ecosystem.

While uncertainties persist, Solana’s innovative approach, along with its low transaction fees and robust infrastructure instill optimism for its future price action, as indicated by the technical factors and technical analysis. In this article, we’ll explore Solana price prediction and market dominance, particularly when evaluated against momentum indicators. This brings the question “How high can SOL go in 2026 and beyond?” and we’ll try to answer that.

Overview

| Cryptocurrency | Solana |

| Token | SOL |

| Price | $136.36(+1.11%) |

| Market Cap | $76.81 Billion |

| Trading Volume (24-hour) | $4.47 Billion |

| Circulating Supply | 562.9 Million SOL |

| All-time High | $294.33 Jan 19, 2025 |

| All-time Low | $0.5052, May 11, 2020 |

| 24-hour High | $136.17 |

| 24-hour Low | $133.23 |

Solana price prediction: Technical analysis

| Sentiment | Neutral |

| 50-Day SMA | $131.27 |

| 200-Day SMA | $172.95 |

| Price Prediction | $149.99 (10.80%) |

| F & G Index | 21.54 (extreme fear) |

| Green Days | 14/30 (47%) |

| 14-Day RSI | 66.02 |

Solana price analysis: SOL climbs back to $136

TL;DR Breakdown:

- Solana price analysis confirmed a bullish sentiment as price rises to $136

- The altcoin gained 1.19% of its value across last 24-hours.

- Support for SOL/USD is at $120.

As of January 5, the Solana price analysis reveals a bullish market sentiment as the price rises to the $136 mark. SOL is now headed to the $140 mark where it faces resistance.

Solana price analysis 1-day chart: SOL climbs back above $135

The one-day price chart of the Solana shows that the decline is continuing with the drop below the $125 mark before the bulls found support, enabling recovery. However, after failing to climb past $140 the price was headed down below $125 but finds support at $120 that has enabled recovery back to the $136 level where it faces resistance.

SOL/USDT chart by Tradingview

SOL/USDT chart by Tradingview

The distance between the Bollinger Bands defines the level of volatility. This distance between high and low bands is widening, leading to increased volatility. Moving ahead, the upper limit of the Bollinger Bands indicator, acting as the resistance band, has shifted to $134.91. The indicator’s lower limit, which shows a support level, has shifted to $117.15.

The Relative Strength Index (RSI) indicator is present in the neutral area but leans close to the overbought level. The indicator’s value has increased to index 60.61, and its upwards curve suggests a support forming at the level. If buying activities continue to intensify, further volatility in the market can be expected.

SOL/USD 4-hour price chart

The four-hour price analysis of the Solana token shows steady bullish activity as the bulls rise back above the $135 mark. The altcoin’s price declined to $134 but quickly rose to the current $136.

SOL/USDT chart by Tradingview

SOL/USDT chart by Tradingview

The Bollinger Bands have diverged, hinting at a higher volatility level. This level of volatility signifies increased market unpredictability. Moving forward, the upper Bollinger Band has shifted to $137.68, securing the resistance point. Conversely, the lower Bollinger Band has moved to $129.20, indicating support.

The RSI indicator is in the oversold region. Currently at 67.30 the RSI curve is pointing straight, suggesting neutral market sentiment at the level. The level of the index suggests little to no room for further upwards movement across the short-term. We can expect further increase if buying activities persist for a few more candles.

Solana technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $ 156.80 | SELL |

| SMA 5 | $ 147.62 | SELL |

| SMA 10 | $ 134.86 | BUY |

| SMA 21 | $ 128.06 | BUY |

| SMA 50 | $ 131.14 | BUY |

| SMA 100 | $ 160.45 | SELL |

| SMA 200 | $ 166.48 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $ 129.90 | BUY |

| EMA 5 | $ 136.63 | SELL |

| EMA 10 | $ 153.62 | SELL |

| EMA 21 | $ 171.34 | SELL |

| EMA 50 | $ 178.13 | SELL |

| EMA 100 | $ 174.09 | SELL |

| EMA 200 | $ 169.93 | SELL |

What to expect from Solana price analysis?

SOL/USDT chart by Tradingview

SOL/USDT chart by Tradingview

The Solana price analysis suggests a mixed prediction based on ongoing market events for the day. The SOL/USD pair increased to $136 over the past 24 hours. before retracing slightly. If selling pressure continues, we might see the price fall below $130. On the other hand, if buyers return to control the price chart, we might see a price increase to retest the resistance level at $140.

Is SOL a good investment?

Solana is a high-performance blockchain platform known for its robust scalability and speed due to various technological advancements, particularly in the crypto space boasting a substantial Total Value Locked (TVL). The network continues to hit key development milestones. Despite a challenging month, price predictions indicate a more positive outlook, suggesting the potential for Solana’s growth and future growth.

Why is SOL up?

After failing to cross past the $140 mark, SOL declined rapidly to the $120 mark where it found support. Now the price has climbed to $136 where it faces strong selling pressure.

What is Solana going to be worth in 2026?

The Solana (SOL) price prediction for 2026 suggests a minimum value of $155 with an average price of $113, driven by fundamental factors in the market. The price could reach a maximum of $163 during the year.

Will SOL reach $1,000?

The price forecasts indicate that SOL could reach the $1000 mark by 2030, influenced by trends in the broader crypto market . Given the bullish scenario and the projected positive market sentiment and growth trend, SOL might reach $1,000 within the next five years.

Can Solana reach $5,000?

Reaching $5,000 is plausible but would likely take several years beyond the current forecast period. However, a snowball in the asset’s adoption might bring the moment sooner.

Does SOL have a good long-term future?

Yes, Solana has a good long-term future, with a promising market capitalization and exciting potential ROI due to its high scalability, which makes Solana an attractive investment. Its growing adoption, strong developer community, and strategic partnerships further enhance Solana’s forecast of its potential for sustained growth.

Recent news/updates on Solana

Solana announced the launch of SolFlare prediction markets powered by Kalshi

Solana price prediction January 2026

The SOL price prediction 2026 for January suggests a range of outcomes based on current market trends, greed index, and analysis. The forecast anticipates SOL to fluctuate between a minimum of $113.48 and an average of $125.24, and potentially attain a maximum of $155.83.

| Month | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| January | 113.48 | 125.24 | 155.83 |

Solana Price Prediction 2026

Solana (SOL) is predicted to reach a minimum of $113.48 in 2026. Experts suggest that future price movements indicate the coin could climb to a maximum of $166.94, with an average price around $155.83.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 113.48 | 155.83 | 166.94 |

Solana (SOL) price prediction 2027-2032

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2027 | 171.06 | 179.66 | 195.77 |

| 2028 | 198.82 | 210.76 | 227.87 |

| 2029 | 234.45 | 247.62 | 263.38 |

| 2030 | 261.53 | 290.94 | 315.53 |

| 2031 | 305.20 | 324.61 | 352.43 |

| 2032 | 345.12 | 365.19 | 397.47 |

Solana Price Prediction 2027

In 2027, Solana’s price is forecasted to be around a minimum of $171.06, reflecting the solid growth of the Solana blockchain. The coin may reach a maximum value of $195.77, with an average trading price of $179.66.

Solana Price Prediction 2028

If the bullish trend continues into 2028, driven by improving transaction speeds, SOL may see a minimum price of $198.82, a maximum of $227.87, and an expected average of $210.76.

Solana Price Prediction 2029

Analysis shows that Solana could continue its upward momentum in 2029, with the price potentially hitting a minimum of $234.45, a maximum of $263.38, and an average of $247.62.

Solana Price Prediction 2030

Based on projections for 2030, Solana may trade at a minimum of $261.53, with an average price around $290.94 and a possible peak of $315.53.

Solana Price Prediction 2031

Solana’s price is expected to reach a minimum of $305.20 in 2031. Experts forecast a maximum value of $352.43 and an average trading price of $324.61.

Solana Price Prediction 2032

In 2032, Solana is projected to trade at a minimum of $345.12, with an average price of $365.19, while the maximum price could reach $397.47 if positive market conditions persist.

Solana Price Prediction

Solana Price Prediction

Solana market price prediction: Analysts’ SOL price forecast

| Firm Name | 2026 | 2027 |

| Changelly | $229.77 | $341.01 |

| DigitalCoinPrice | $166.94 | $195.77 |

Cryptopolitan’s Solana (SOL) price prediction

Our predictions show that SOL will achieve a high of $166.94 in 2026. In 2029, it will range between $234.45 and $263.38, with an average of $247.62. In 2032, it will range between $345.12 and $397.47, with an average of $365.19.

However, it is advised to do your own research and conduct expert opinion before investing in the volatile crypto market.

Solana (SOL) historic price sentiment

Solana Price History

Solana Price History

- Solana was launched in April 2020 and has gained popularity over the last 18 months. Its price surged from $0.75 to a high of $214.96 in early September.

- Following NFT hype and growing demand in the DeFi community, the cryptocurrency Solana (SOL) price more than tripled during the summer of 2021. Solana (SOL) token became the fastest-growing cryptocurrency and is currently ranked fifth with a live market cap of nearly $66 billion.

- 2022 saw Solana leap to its all-time high of $260, but SOL failed to close the year anywhere near that high, as the price came crashing down to below $40 by June. The bearish markets were marked by high skepticism as trading volumes declined throughout the crypto markets.

- The price continued to trade below the $40 level until November 2023, when Solana gained momentum and started a bullish rally again to close the year at $101.84.

- In 2024, Solana (SOL) saw significant growth, with its price rising from $83.62 in January to a high of $202.87, fueled by its dominance in DeFi, NFTs, and decentralized exchanges. However, the price fluctuated through the year, retracing to $131 in September after struggling to maintain key levels.

- October brought a positive rebound as SOL rose from $152 to close at $167, but early November started bearish, with the price dipping to $160.

- However, Solana bounced back sharply and closed the month above the $230 mark. December, on the other hand, has observed a slow start as price volatility remains low.

- Solana’s (SOL) price rose significantly in January 2025 from below the $190 level to close the month above $210. However, the latter half of the month saw the price decline from the $230 mark, a trend that continued through February ending the month below $150.

- In March the price continued falling as the bears continued dominating the short to mid term markets ending the month below $125. In April the bearish rally has only continued as the price falls towards $100. However, the bulls bounced back in the middle of the month and ended the month around $150.

- In May the price continued to rise and ended the month above the $165 price level, a trend that could not extend through June as the month saw a decline falling below the $150 price level to end the month.

- July saw a sharp rise to the asset’s volatility with SOL crossing the $200 mark. However, the price could not be maintained and SOL ended the month below the $180 level. In August, on the other hand, SOL made strides and managed to close the month above the $205 mark.

- In September, the volatility rose sharply as the price rose to the $250 price level but failed to maintain the level and ended the month at $230. In October, the decline increased sharply as SOL ended the month below $170. In November, and December the decline continued with SOL ending the year at the $125 mark.

You May Also Like

Kraken's Big Hint: Pi Coin Set for Exchange Listing In 2026

US Stock Market Could Double By End Of Presidential Term