How Solana Price Can Climb to $140 Despite Persistent Long Liquidations

- Solana requires over 8% surge to reach $140 target from current levels.

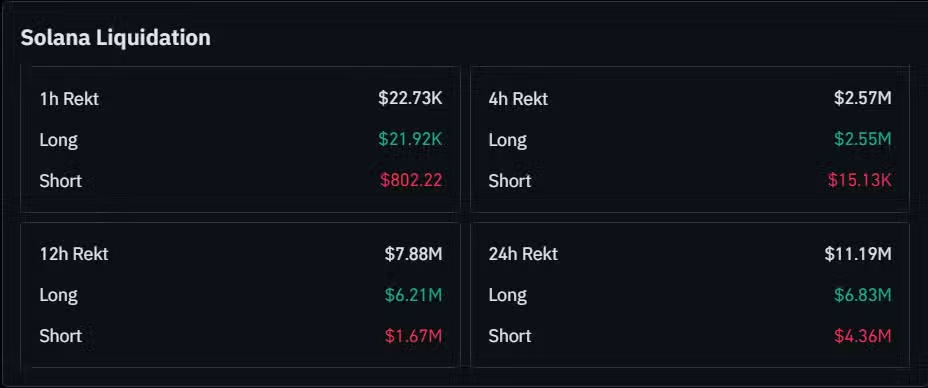

- Long liquidations total $6.83 million over 24 hours compared to $4.36 million in shorts.

- RSI hovers around 44-45 below neutral 50 line, signaling mild bearish bias remains intact.

Solana trades under pressure but key support and momentum levels still leave room for a rebound. The broader crypto market remains under pressure after a sharp risk-off turn in November, with leading altcoins giving back a sizable portion of prior gains.

Intraday action remains choppy, but bias across most large caps has tilted lower as traders react to fading upside momentum. Solana’s latest performance underlines this mood.

Technical structure defines path higher

SOL maintains a market capitalization around $72 billion on more than $4.6 billion in daily volume. The price has fallen approximately 9.2% over the past week and more than 33% in the last month. This environment sets the stage for closer examination of price structure, indicators, and key support zones.

On the 4-hour chart, the Fibonacci Retracement tool maps the latest downswing from approximately $144.65 to $121.65.

Trading above $129, SOL sits just above the 0.236 level at $127.08, which represents the next important support. A decisive break below it would expose the prior low near $121.65, while recovery back over the 0.5 Fibonacci would reopen the path toward the $136-$140 zone.

Leverage flush targets long positions

Conversely, a push above 60 on RSI alongside reclaim of 0.5 Fibonacci would be an early sign that buyers are regaining control and stronger relief rally may form.

Latest liquidation data for Solana shows leveraged traders have taken losses on both sides of the market, with long positions bearing most damage. The 4-hour window recorded approximately $2.57 million in liquidations, almost entirely composed of long positions at about $2.55 million.

This shows how recent downside price action has primarily punished overleveraged buyers. In the last 12 hours, total liquidations stand near $7.88 million, of which approximately $6.21 million are longs and $1.67 million are shorts.

Across the full 24-hour period, roughly $11.19 million in Solana positions have been liquidated, with longs accounting for around $6.83 million and shorts about $4.36 million. This mix suggests sharp swings are flushing out leverage in both directions, yet with clear tilt toward long capitulation as price grinds lower.

You May Also Like

China Launches Cross-Border QR Code Payment Trial

Zero Knowledge Proof Auction Limits Large Buyers to $50K: Experts Forecast 200x to 10,000x ROI