Lesaka Technologies gets approval to buy Bank Zero for $63.8m

South Africa’s Competition Tribunal has approved Lesaka Technologies’ acquisition of Bank Zero for R1.1 billion ($63.8 million). The approval gives Lesaka direct control of Zero Research, the parent company of the digital-only bank. The deal was first announced in June 2025 and is now cleared, though it still requires approval from the Prudential Authority and Exchange Control.

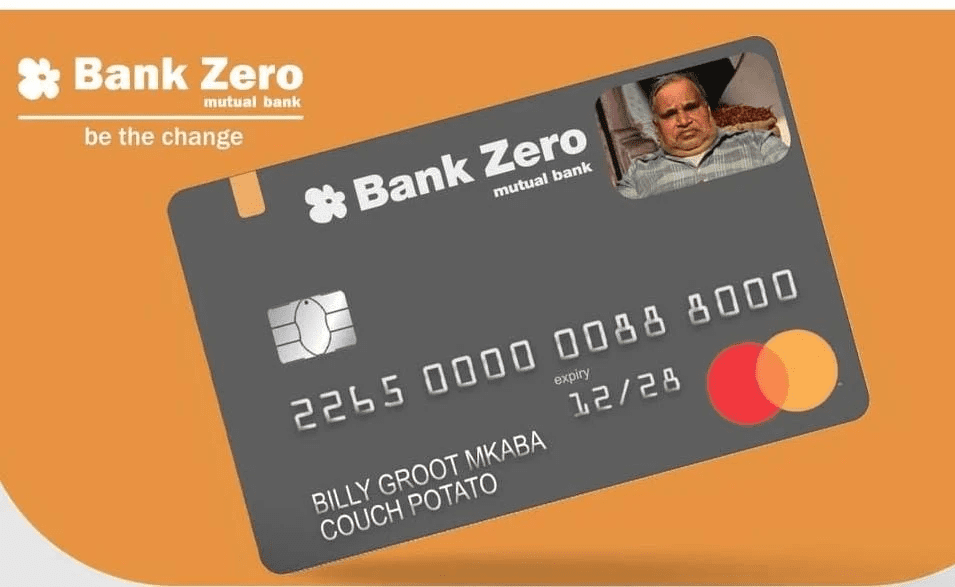

Launched in 2021, Bank Zero is a fully digital bank offering low-cost personal and business accounts accessible via its mobile app. Known for secure transactions on IBM’s LinuxONE platform and a patented anti-fraud card, the bank will retain its management team, including co-founder Michael Jordaan and CEO Yatin Narsai, after the acquisition.

Lesaka Technologies, formerly Net1, is a South African fintech company listed on the NASDAQ and Johannesburg Stock Exchange. It has recently expanded its financial services through acquisitions like Adumo and Touchsides, strengthening its presence in payments and enterprise solutions.

Lesaka to build unified digital banking platform with Bank Zero

With the acquisition, Lesaka plans to integrate Bank Zero’s technology into a single, scalable system. This move is expected to streamline operations, expand banking services for consumers and merchants, and improve the company’s overall infrastructure. The company also intends to offer cross-sell banking products, launch financial exchange solutions, and pursue opportunities for cross-border services.

The acquisition is designed to strengthen Lesaka’s balance sheet, reduce reliance on bank debt, and provide more funding for lending growth through customer deposits. The company expects the transaction to deliver long-term revenue benefits, enhance lending economics, and create room for new digital banking services.

For Bank Zero, the deal offers a chance to accelerate growth and reach more customers without changing its core management or digital-only approach. The bank has recorded deposits of roughly R400 million, with card spending totalling R415 million in 2024, and continues to grow its user base steadily.

Also read: Zenith Bank to expand into Kenya in 2026 with Paramount Bank acquisition

The integration may also bring some operational challenges. Lesaka will need to unify multiple platforms, migrate users, and ensure data security while maintaining seamless service. Customers could see new products, but any transition carries the usual risks of downtime or adjustment periods.

Once finalised, the acquisition positions Lesaka as a stronger player in South Africa’s digital banking sector, with expanded services for underserved communities and businesses. The deal highlights ongoing consolidation in the country’s fintech space, where companies are increasingly combining technology, customer bases, and infrastructure to scale digital financial services.

You May Also Like

Mystake Review 2023 – Unveil the Gaming Experience

Fed Decides On Interest Rates Today—Here’s What To Watch For