HBAR News: HBAR Rejoins Coinbase 50 Index After Early Removal

HBAR is officially back in the Coinbase 50 Index. This re-inclusion follows an early removal, signaling renewed confidence and wider investment access.

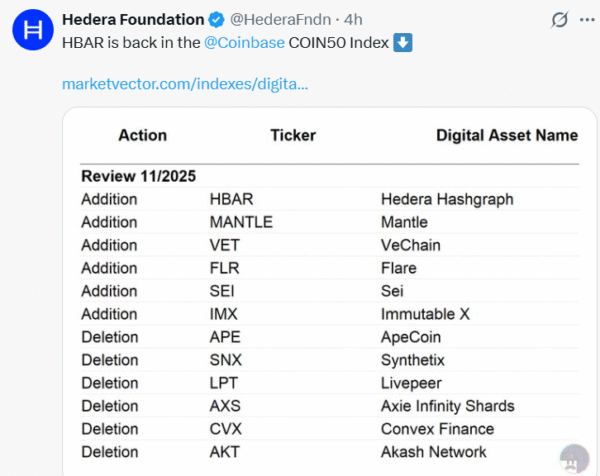

$HBAR is officially back in the Coinbase 50 Index (COIN50). It originally launched in the index, but was removed soon after. Now, it has made its first re-entrance. As it happens, the KraneShares Coinbase 50 ETF will now have the inclusion of $HBAR. This is a major advancement to the asset.

HBAR Readmitted to Coinbase 50 Index

HBAR is formally re-entering the Coinbase 50 Index (COIN50). This is after it was dropped soon after the first release of the index in late 2024. The re-inclusion implies that now HBAR will become a part of financial products. These track the COIN50 index. They are KraneShares Coinbase 50 ETF and Coinbase 50 Index Perpetual Future (COIN50-PERP).

On November 26, 2025, according to CoinMarketCap, Hedera (HBAR) was selling at an estimated price of about $0.143. The token was trading in between 0.1418 and 0.1431. One of the news outlets cited that the token shot up to $0.1479 in the short-run. This was done with above-average volume.

The price movement and factors contributing to the same were noted. The rise in institutional buying pushed the price past the important technical resistance points. As a result, this implies increasing trust in the asset.

Related Reading: Hedera News: Hedera Activates Seamless Cross-Chain Transfers via Axelar | Live Bitcoin News

The information concerning HBAR and Coinbase 50 Index is crucial. The native cryptocurrency of Hedera network is energy-efficient and called HBAR (Hedera Hashgraph). It is utilized in network payment. It is also resistant to network protection by method of proof-of-stake. This allows decentralized applications. Hedera relies on the hashgraph algorithm of consensus. This is unlike the traditional blockchain technology. It is characterized by speed, low charges and capacity of transacting.

Institutional Accumulation Drives HBAR’s Re-inclusion

Coinbase 50 Index (COIN50) is a market-based weighted index. It monitors the performance of up to 50 most liquid and biggest digital assets. They are traded in the Coinbase exchange. It was launched in November 2024. It is used as a reference point to the rest of the crypto market. This has been the case with S&P 500 in the case of stocks. Moreover, the index is rebalanced on a quarterly basis to factor in the changes in the market.

Source: X

Source: X

However, the first removal of HBAR was confusing. HBAR became a part of the COIN50 index when it launched in November 2024. It was, however, soon removed. This brought confusion and frustration to the Hedera fraternity. The cause of the initial deviation was not officially determined. The speculation was focused on whether it had the permissionless consensus requirements of the index.

As of November 26, 2025, HBAR would join the COIN50 index again. This re-inclusion is a large development for HBAR. Moreover, it introduces cryptocurrency to more investors. This is done by index-tracking products.

Additionally, it is a milestone that Hedera has been voted to trust its technology. The hashgraph consensus has certain advantages. It is especially appealing in speed and efficiency. This renders it an appropriate enterprise application.

The re-inclusion is also an indication of a resolution. Its permissionless consensus criteria might have been resolved in the first concerns. In addition, this gives clarity to the investors and the Hedera community.

Lastly, exposure to HBAR will now be provided in the KraneShares Coinbase 50 ETF. This offers a controlled investment resource. This enables the traditional investors to gain access to the asset. As a result, this makes HBAR even more institutionalized.

The post HBAR News: HBAR Rejoins Coinbase 50 Index After Early Removal appeared first on Live Bitcoin News.

You May Also Like

Over $145M Evaporates In Brutal Long Squeeze

DOGE ETF Hype Fades as Whales Sell and Traders Await Decline