Ethereum Is 58% ‘Undervalued’ Based On Intrinsic Metrics, Says Hashed CEO

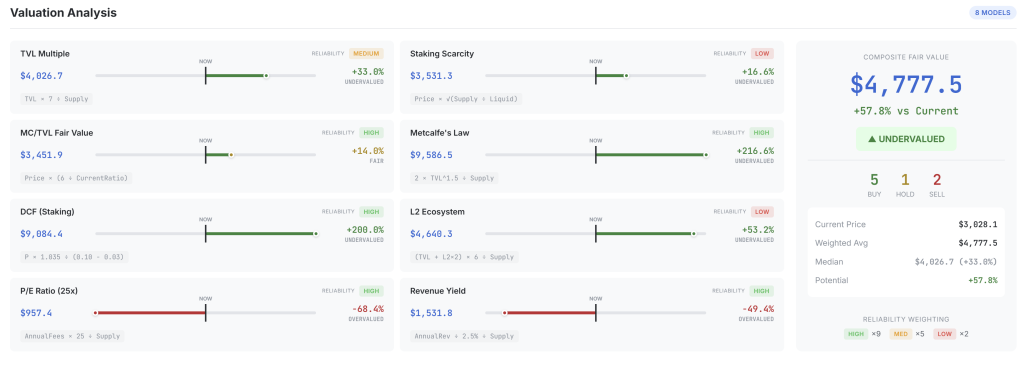

Ethereum is trading far below its modeled “intrinsic value,” according to a live valuation dashboard launched by Hashed CEO Simon Kim. On ETHval (ethval.com), the current snapshot shows Ethereum at a spot price of $3,034.0 while the reliability-weighted “Composite Fair Value” stands at $4,777.5, implying +57.8% upside versus the market. The median fair value across models is $4,026.68, or +33.8% above spot. The dashboard labels ETH “UNDERVALUED” and aggregates its eight models into five buy, one hold and two sell signals.

How The Fair Value Of Ethereum Is Calculated

Kim introduced the project on X with the explicit goal of shifting the discussion away from pure sentiment: “What is ETH actually worth? The crypto industry deserves better than price speculation. I built a dashboard to think about ETH’s intrinsic value with 8 models… Far from perfect and open to feedback.” ETHval makes those models and their outputs fully visible, along with their individual reliability tags.

The tool’s central panel breaks out each valuation. The TVL Multiple model, which prices ETH off total value locked in DeFi using a 7× TVL-to-market-cap anchor, assigns a fair value of $4,026.6, judging ETH 32.7% undervalued (reliability: medium). A more conservative MC/TVL Fair Value mean-reversion model, treated as high reliability, lands at $3,453.1, only 13.8% above spot and classified as “fair.”

Models that embed stronger network-effect or cash-flow claims are far more aggressive. The DCF (Staking) framework, which discounts an implied perpetual stream of staking rewards, values ETH at $9,101.9, indicating it is 200.0% undervalued. A high-reliability Metcalfe’s Law implementation, which scales value with TVL to the power of 1.5, is even more bullish at $9,585.9, or 216.8% above the current price.

The Ethereum L2 ecosystem model, which adds twice the TVL of major rollups to Ethereum mainnet TVL before applying a multiple, generates a fair value of $4,640.0, implying 52.9% undervaluation, although ETHval marks this model’s reliability as low. A Staking Scarcity model, also low reliability and based on liquid-supply contraction, prices ETH at $3,538.2, or 16.6% undervalued.

Two income-style models push in the opposite direction and still receive high reliability scores. The P/E Ratio (25×) model treats annualized protocol fees as “earnings,” applies a 25× multiple and arrives at a fair value of only $957.4, reading ETH as 68.4% overvalued. The Revenue Yield model reverse-engineers price from a target protocol yield of 2.5%; at current revenue levels it outputs $1,531.8, implying 49.5% overvaluation.

To synthesize these conflicting signals, ETHval applies a disclosed weighting scheme: high-reliability models are multiplied by 9, medium by 5 and low by 2 when computing the $4,780.7 composite. That weighting, combined with the extreme upside implied by the DCF and Metcalfe models, is what drives the overall conclusion that Ethereum is strongly undervalued despite two respected frameworks pointing to downside.

The dashboard itself stops short of making investment recommendations. Underneath the numbers, ETHval reiterates that the outputs are for reference only and that each model rests on explicit, debatable assumptions.

But by fixing the current ETH price at $3,034.0 against a live fair-value band stretching from $957.4 on the bearish end to $9,585.9 on the most bullish, Kim’s site quantifies a debate that usually plays out in anecdotes and narratives—and, for now, that quantified view leans clearly toward Ethereum being undervalued.

At press time, ETH traded at $3,029.

You May Also Like

CME Group to launch options on XRP and SOL futures

XRP Yield Strategies vs. Traditional Staking: Which Offers the Highest Returns for Long-Term Holders?