Gold Weekly Forecast: Bulls Show Interest as Fed Cut Odds Grow

Gold (XAU/USD) gained momentum early in the week as expectations for a Federal Reserve rate cut strengthened. Markets then slowed due to the US Thanksgiving holiday, yet the metal still rose more than 2% on the week.

With the Fed’s blackout period starting on Saturday, investors will now shift focus to incoming US data.

Gold Rises as Fed Doves Grow Louder

Gold opened the week strong as traders reassessed the probability of a 25-basis-point cut in December.

Late last week, Fed Governor Stephen Miran said he would support a 25 bps cut if his vote became decisive. His recent stance contrasts with his earlier preference for a 50 bps cut in previous meetings.

New York Fed President John Williams also signaled openness to easing. He said monetary policy remained “modestly restrictive,” adding there was room for a further adjustment soon.

Gold jumped more than 1.5% on Monday. It edged higher again on Tuesday before closing flat. ADP data showed that private employers shed an average of 13,500 jobs each week through November 8.

Fresh US data on Wednesday showed 216,000 initial jobless claims for the week ending November 22, down 6,000 from the prior period.

Durable goods orders rose 0.5% in September, beating expectations of 0.3%. These numbers did not alter Fed expectations, and Gold held firm above $4,100 ahead of the holiday.

Trading remained thin on Friday, but Gold stayed near the upper end of its weekly range.

Gold Investors Turn to US Data

Fed officials cannot comment again until the December 9–10 meeting. As a result, markets will rely on US data to gauge the likelihood of a rate cut.

According to the CME FedWatch Tool, traders now assign roughly an 85% chance of a 25 bps cut in December.

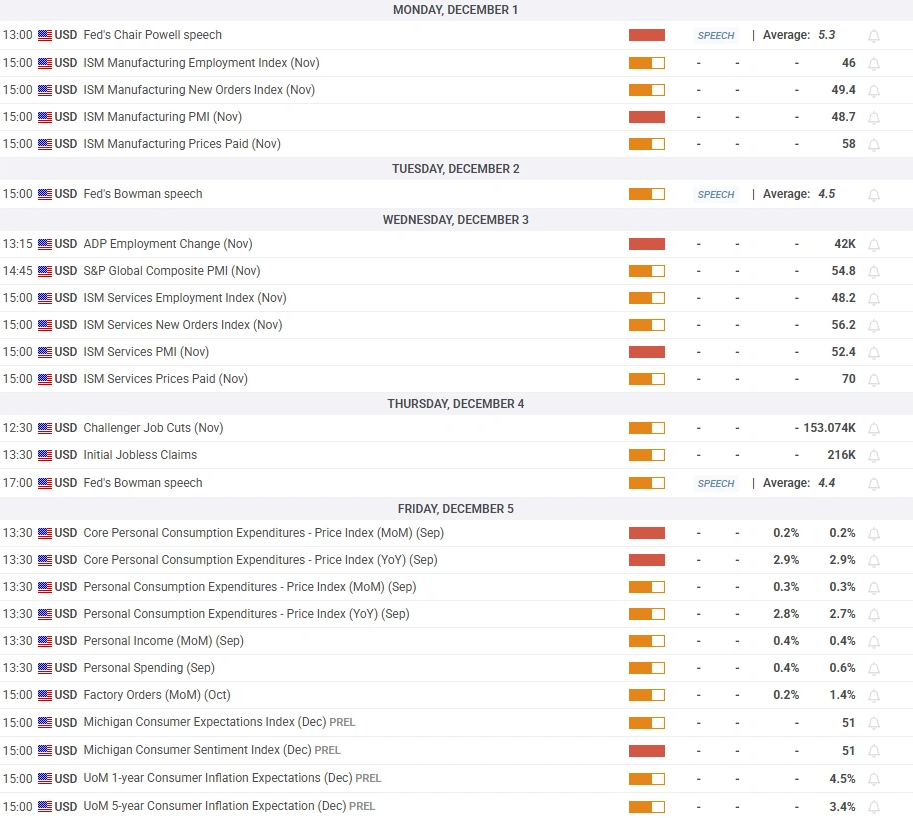

The US calendar begins with ISM Manufacturing PMI on Monday. A stronger employment index — especially a reading above 50 — could support the US dollar and weigh on XAU/USD.

The ISM Services PMI follows on Wednesday. A drop below 50 would signal contraction and could pressure the USD, offering support to Gold.

US Economic Calender For the First Week of December

US Economic Calender For the First Week of December

Investors will also watch Thursday’s Challenger Job Cuts report. Layoffs surged to 153,074 in October, the highest level in 22 years. A sharp drop would ease labor-market concerns and may support the USD.

The BEA releases PCE Price Index data on Friday. However, this report covers September due to earlier backlog and is unlikely to move markets.

Gold Technical Analysis

The short-term technical view remains constructive, though momentum has not strengthened further.

On the daily chart, Gold trades comfortably above the 20-day Simple Moving Average and the 23.6% Fibonacci retracement of the August–October rally at $4,125. The RSI holds near 60 and moves sideways.

Gold Price Chart

Gold Price Chart

Support sits at $4,125 before $4,085 (20-day SMA), $4,030 (50-day SMA), and $3,970 (38.2% Fibonacci retracement). On the upside, resistance stands at $4,245, followed by $4,300 and $4,380.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

XCN Rallies 116% — Can Price Hold as New Holders Gain?