Is Bitcoin Truly Digital Gold? An Analysis Between Myth and Reality

For several years now, a significant part of the debate in the cryptocurrency world has revolved around a particularly intriguing concept: Bitcoin is considered the new gold, its digital version. This comparison is not accidental. Both assets are portrayed as scarce goods, independent of central bank decisions, and potentially capable of protecting wealth from the erosion of purchasing power. This image has achieved great communicative success, both among professional investors and among the public approaching the crypto world for the first time. However, when the narrative is compared with market data and more robust empirical analyses, elements emerge that call for greater realism.

Scarcity and Independence: The Commonalities Between Bitcoin and Gold

The thesis equating Bitcoin to gold is primarily based on the notion of scarcity. Gold is a metal found in limited quantities in the Earth’s crust; the rate at which its availability increases depends on extraction, which proceeds in a relatively slow and costly manner. Bitcoin, on the other hand, incorporates scarcity directly into its code: the protocol sets a maximum cap of 21 million units, beyond which no new BTC can be created. In both cases, therefore, value is associated with the difficulty of increasing supply.

Additionally, there is a second element, namely independence from political control. Neither gold bars nor Bitcoin can be issued at the discretion of a government or a central bank, unlike fiat currencies which can be expanded through expansive monetary policies. Finally, both gold and Bitcoin are presented as potential stores of value, capable of offering at least partial protection against inflation, currency devaluation, and crises in the traditional financial system.

These analogies explain why the expression “digital gold” has become such a widespread conceptual shortcut. In short, it is possible to transfer to Bitcoin some of the prestige accumulated by gold over centuries of financial history.

Correlation Between Bitcoin and Gold: What Do the Data Say?

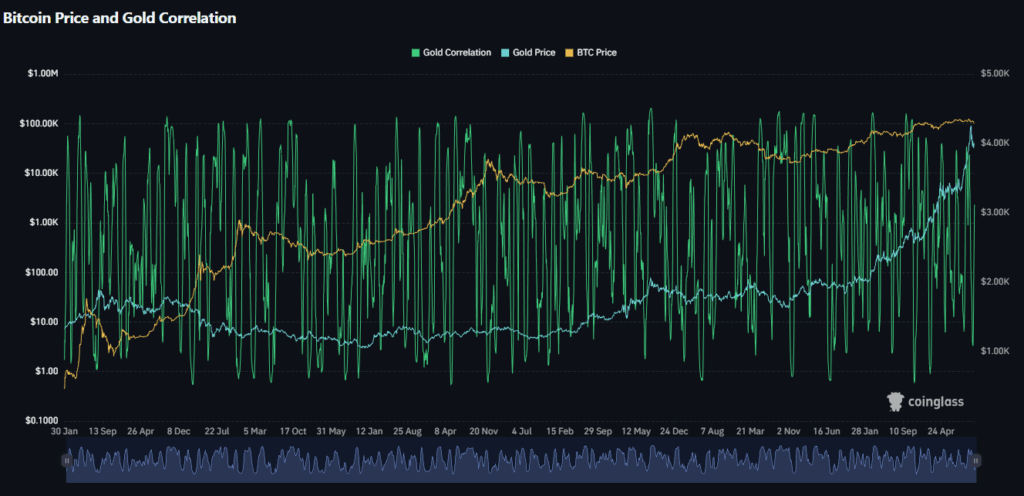

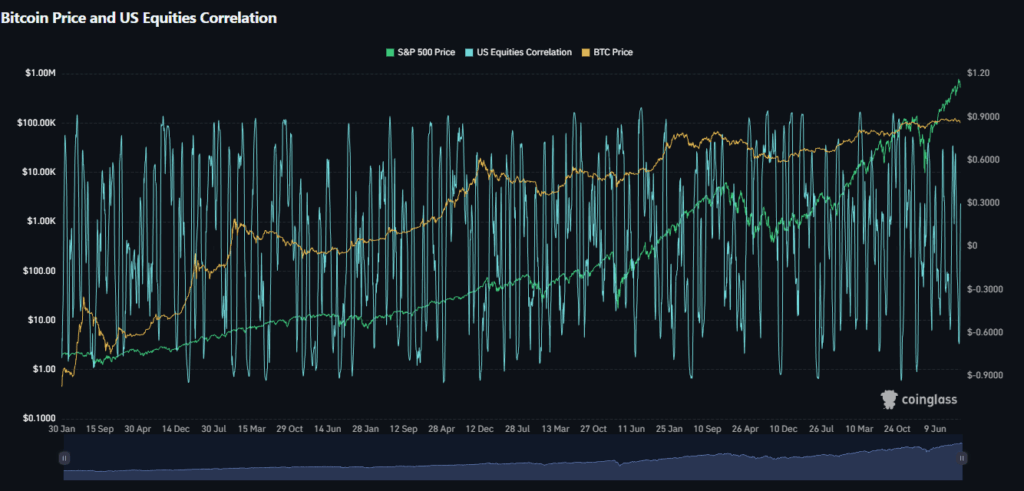

In reality, the analogy holds only up to a certain point. A first test is represented by the correlation between the returns of the two assets. If Bitcoin were truly the digital equivalent of gold, one might expect a moderately high and stable correlation, indicating a somewhat aligned price dynamic.

Statistical analyses conducted over various time periods suggest a different picture instead.

In many studies, the average correlation between Bitcoin and gold returns is found to be low, often close to zero, while the relationship tends to vary significantly over time. There are phases where the two assets move in the same direction, especially during periods dominated by the search for “hard assets” as protection against inflation and geopolitical uncertainty, but there are also intervals where the correlation weakens or even turns negative. This indicates that there is no structural and stable relationship between the two, but rather an episodic connection, heavily dependent on the macroeconomic context and the prevailing narrative at a given time.

Figure 1 – Annual rolling correlation between Bitcoin and Gold (source Longtermtrends.net)

Figure 3 – 30-day rolling correlation between Bitcoin and Gold (source Coinglass.com)

Figure 4 – 30-day rolling correlation between Bitcoin and S&P 500 (source Coinglass.com)

Is Bitcoin a Safe Haven Asset? Beware of Volatility

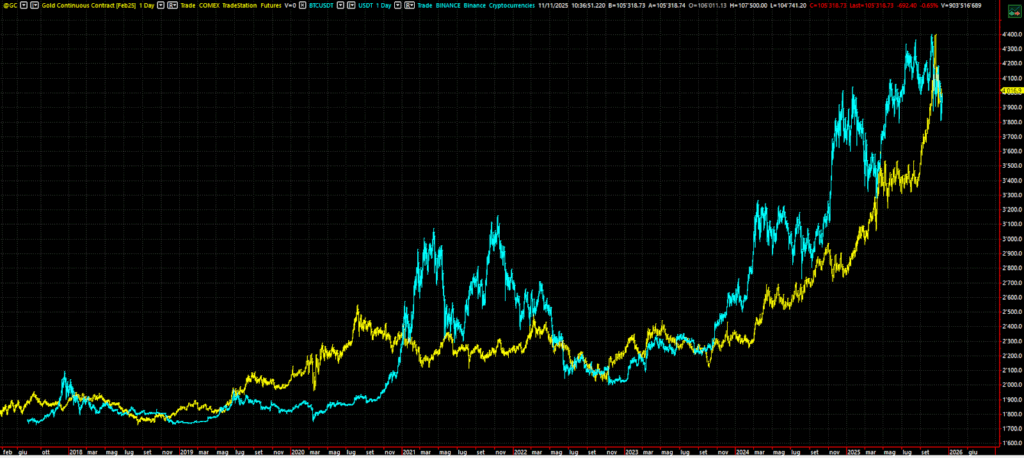

A second differentiating factor concerns volatility. Gold is historically subject to significant fluctuations, yet it still falls within the typical range of a safe-haven asset. Its volatility is well-known and, to some extent, anticipated by market participants. Bitcoin, although it has gradually reduced the extreme level of instability seen in its early years, continues to exhibit much wider price movements, with rapid upward and downward swings and bear market phases characterized by deep drawdowns.

This characteristic makes the parallel with gold much more fragile when considering its actual behavior during periods of financial stress. In the most significant crises of recent years, gold has in many cases maintained its role as a partial anchor of stability for portfolios, albeit with exceptions and complex dynamics. Bitcoin, on the other hand, has shown a tendency more akin to that of risky assets: during initial panic phases, its price also experienced violent corrections, only to potentially recover in subsequent phases.

Figure 2 – Comparison of Bitcoin and Gold Price Changes

It is therefore not surprising that many empirical analyses qualify Bitcoin not so much as a safe haven, but rather as a diversifier. Its low, and often unstable, correlation with stocks, bonds, and even gold can offer diversification benefits within a well-constructed portfolio, but this characteristic does not align with the classic safe haven function performed by the precious metal. In various studies, Bitcoin appears capable of assuming a hedging role only in specific contexts, while gold maintains a more established ability to mitigate the effects of systemic crises, albeit without representing perfect protection.

Bitcoin and Gold in a Portfolio: Substitutes or Complements?

The theme becomes even more evident when examining the impact of including Bitcoin and gold in an investment portfolio. Asset allocation models that integrate both asset classes show that the introduction of Bitcoin is not merely a simple substitution of a portion of gold with its supposed digital equivalent. Rather, the addition of BTC tends to increase the overall volatility of the portfolio while simultaneously altering the potential risk-return profile.

Gold continues to serve as a defensive component, useful for reducing losses during periods of significant stress in the stock markets. Bitcoin, on the other hand, acts as a higher-risk satellite element, which can help increase expected returns but exposes the investor to more pronounced value fluctuations. From this perspective, the two instruments are more complementary than substitutive.

The Appeal of Digital Gold: Winning Communication or Real Strategy?

Despite such evidence, the digital gold narrative remains deeply rooted. This is due to several factors. On one hand, the simplicity of communication represents a clear advantage: associating Bitcoin with gold allows a complex subject to be explained to a non-specialist audience using a familiar and reassuring analogy. On the other hand, structural analogies, though not perfect, do exist. The programmed scarcity of Bitcoin directly echoes the limited nature of gold, just as the extra-sovereign nature of both fuels the discourse on protection against potential excessive expansionary monetary policies.

Moreover, there are contexts, particularly in countries characterized by high inflation or strict capital controls, where Bitcoin is effectively used as an alternative tool for value preservation and wealth transfer outside traditional circuits.

An additional element supporting this narrative concerns long-term expectations. A segment of the financial world believes that, with the advancement of institutional adoption, clearer regulation, and greater market maturation, Bitcoin’s behavior could gradually align with that of an established safe-haven asset, reducing the extent of speculative excesses. In this view, the expression “digital gold” does not so much describe the current situation as the potential outcome of an evolutionary process still underway.

Conclusions: Bitcoin is not gold… but it can complement it

In light of these considerations, the relationship between gold and Bitcoin appears complex and continuously evolving. On a conceptual level, the two assets share some fundamental traits, related to scarcity and their distance from fiat currency logic. However, on an empirical level, data on correlations, volatility, and behavior during crises indicate significant differences. Thus, the definition of Bitcoin as digital gold is currently more of an effective metaphor and a bet on the future than an accurate description of observable facts.

In conclusion, the central aspect is not about outright rejecting or embracing this narrative, but about recognizing its limits and implications. Gold and Bitcoin can coexist within the same portfolio, but they require differentiated weights, purposes, and time horizons. A mindful management considers not only the analogies that fuel headlines but also the differences that emerge from market data. Only in this way is it possible to prevent a compelling image, like that of digital gold, from becoming a distorting filter in the assessment of risks and opportunities associated with the first and most well-known among crypto assets.

Until next time, and happy trading!

Andrea Unger

You May Also Like

Let insiders trade – Blockworks

Today’s Wordle #1630 Hints And Answer For Friday, December 5