Why is XRP Price Down Today Amid Another ETF Launch?

- XRP price drops 3.58% despite ETF launch excitement today.

- Nearly $400 million in long positions liquidated in the market.

- Unpredictable market volatility risks traders despite new XRP ETF launch.

XRP has seen a significant drop in price today, with a 7% decline in the last 24 hours according to the latest market data. Despite the excitement surrounding the anticipated launch of the 21Shares XRP ETF (TOXR), the cryptocurrency’s price failed to capitalize on the potential boost that such an event typically generates.

Instead, XRP’s value dropped to $2.04, reflecting the ongoing fragility in market conditions. This sharp decline occurred without any major news catalysts, further highlighting the unpredictable and volatile nature of the current market.

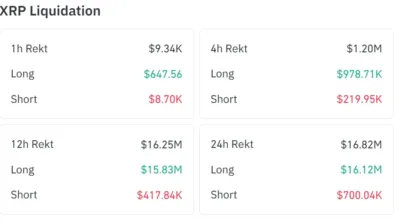

In the past hour, nearly $400 million in long positions were liquidated, further exacerbating the market’s instability. This massive liquidation event is a clear indication of how easily leveraged positions can be wiped out in a volatile environment.

Over the past 24 hours, the liquidation figures show $16.8 million wiped out, with most of it coming from long positions. Such drastic movements, especially during times of low liquidity, demonstrate the heightened risks for traders, particularly those holding long positions in the hopes of a price increase.

Also Read: Ripple’s XRP Ledger Supports Singapore’s Drive for Regulated Tokenisation

XRP ETF Launch and Market Sentiment

The launch of an ETF typically brings a sense of optimism, as it opens the door for more institutional investors to enter the market. However, today’s price action tells a different story. The anticipated ETF launch failed to prevent the drop in XRP’s price, and the market has instead been driven by a combination of thin liquidity and unpredictable price swings.

The decline in XRP’s value aligns with the ongoing volatility in the broader cryptocurrency market, where sharp price movements are common, particularly during late-week sessions when liquidity is lower.

Liquidations Highlight Market Instability

The liquidation numbers further emphasize the impact of this volatility, as $15.83 million worth of long positions were liquidated in the past 12 hours. Additionally, short positions also experienced some significant liquidations, amounting to over $700,000 in the last 24 hours.

Despite the ETF launch, these liquidation events reveal that the current market conditions are dominated by uncertainty, causing traders to experience significant losses.

Source: Conglass

While the ETF could have been a catalyst for a bullish move, the fragility of the market, as reflected in the liquidations and price drop, suggests that external events like an ETF launch are often not enough to counterbalance the inherent risks in the cryptocurrency space.

As XRP continues to fluctuate, traders are reminded of the unstable conditions that make market timing and leveraged positions highly risky. It serves as a reminder that even during key moments like ETF launches, market volatility remains a constant risk for investors.

Also Read: Apple Pay and Google Pay Endorse XRP Across 40 Countries: Fact Check

The post Why is XRP Price Down Today Amid Another ETF Launch? appeared first on 36Crypto.

You May Also Like

Will Bitcoin Make a New All-Time High Soon? Here’s What Users Think

SWIFT Tests Societe Generale’s MiCA-Compliant euro Stablecoin for Tokenized Bond Settlement