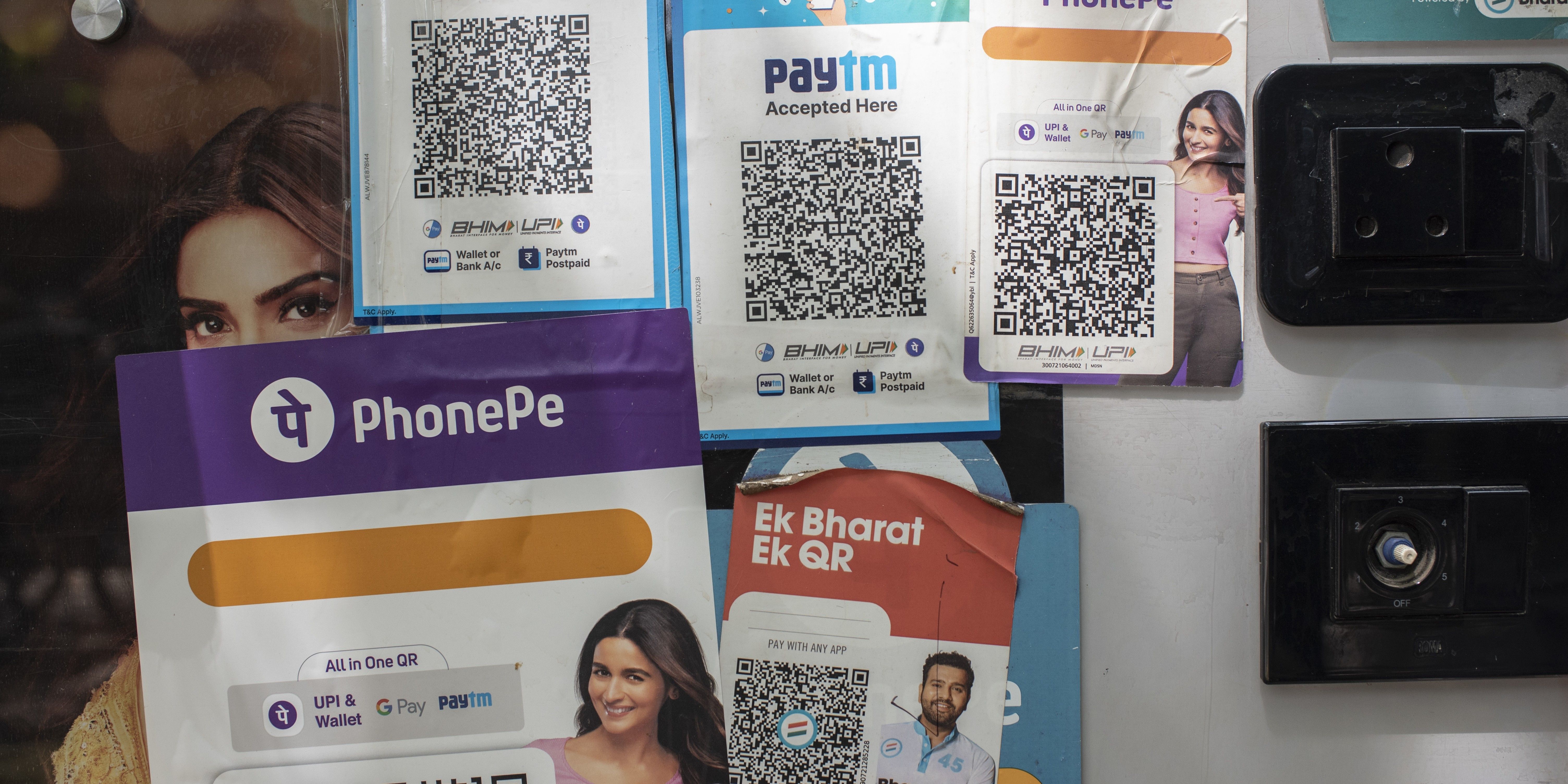

November UPI activity near record highs despite post-festival dip

UPI recorded its second-highest month of activity in November, holding just below October’s festival-driven peak.

The system continued to process payments at near-record levels with 20.47 billion transactions processed worth Rs 26.32 lakh crore, making it the second-busiest month of 2025. Volumes jumped 32.2% from 15.48 billion a year earlier, while value jumped 22.13% from Rs 21.55 lakh crore in November 2024.

The only month that beat it was October, when Diwali and Dhanteras spending pushed activity to 20.7 billion transactions and Rs 27.27 lakh crore. Interestingly, while volumes slipped barely 1% from October, values fell 3.4%, hinting that average ticket sizes shrank as the wave of big-ticket festive purchases gave way to routine, lower-value payments.

Festive-season buying pushed UPI spending on digital gold up 62.4% to Rs 229.04 crore in October 2025, as Dhanteras demand surged even while UPI transactions on online marketplaces fell 16.9% from the previous quarter.

According to data from the National Payments Corporation of India (NPCI), Indians purchased digital gold worth Rs 229.04 crore using UPI in October, a striking 62.4% jump from Rs 141.02 crore a year earlier amid heavy Dhanteras spending.

People traditionally buy gold on Dhanteras as it is believed to invite prosperity and good fortune into the home, making the metal one of the most culturally ingrained purchases during the Diwali period.

Online marketplaces logged a 16.9% quarter-over-quarter drop in UPI-based transactions to Rs 835.03 crore, although the category is still growing year-over-year, up 27.2% from October 2024, NPCI data showed.

The softer short-term numbers could be chalked up to front-loaded festive sales and consumers shifting discretionary budgets toward gold and big-ticket electronics.

Investors, meanwhile, stayed active. UPI transactions in broking and dealing rose 33.6% quarter-over-quarter to Rs 6,609.55 crore, helped by the annual tradition of Muhurat trading during Diwali.

But annually, activity remains subdued: securities-related UPI flows slipped 16.3% from the levels seen a year earlier, reflecting a broader slowdown in retail market participation.

Edited by Jyoti Narayan

You May Also Like

Eric Trump bets Fed rate cut will send crypto stocks skyrocketing

Laura L. Lott Named New Executive Director of the National Art Education Association