Will Bitcoin Price Get a Christmas Rally? Experts Bet on Early 2026

Key Takeaways:

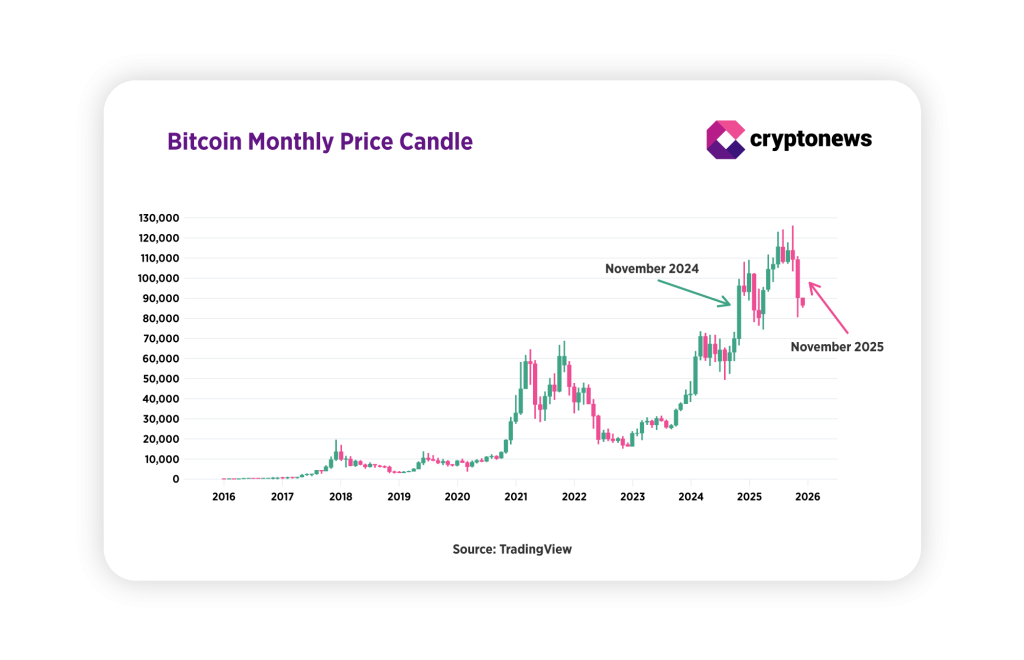

- November 2025 went down as one of the scariest months for crypto, with the Fear and Greed Index hitting 9 for the first time in history.

- Bitcoin printed a large red monthly candle and dropped more than 30%, which, according to experts, looks more like a mid-cycle reset than a full trend reversal. Expert views remain mixed. Some see potential for a new super cycle in early 2026, while others point to weakening retail demand and thin liquidity.

- ETF flows have slowed, criticism around MicroStrategy persists, and questions about Tether’s reserves continue to weigh on sentiment.

- Global liquidity remains the key driver. If liquidity stabilizes or expands in early 2026, Bitcoin may regain momentum, but caution and capital protection remain essential.

- In This Article

-

‘Weak Hands Shaken Out’: Bitcoin Price Closed November in the RedBitcoin Price Still Has a Chance in Early 2026ConclusionKey Crypto & Macro Events to Watch in December 2025

- In This Article

-

‘Weak Hands Shaken Out’: Bitcoin Price Closed November in the Red

-

Bitcoin Price Still Has a Chance in Early 2026

-

Conclusion

- Show Full Guide

-

Key Crypto & Macro Events to Watch in December 2025

November 2025 went down as one of the scariest months in crypto history. And this isn’t a metaphor.

The Crypto Fear & Greed Index fell to 9 points on Nov. 16, one of the lowest readings seen in recent years. What made this month even more surreal was the contrast with the previous year.

November 2025 became the mirror image of November 2024, only in the opposite direction. Last year, the index hit 94 on Nov. 22, signaling extreme greed. That reading is among the highest ever recorded. Only December 2020 went slightly higher at 95.

The Crypto Fear and Greed Index is a simple tool. When it moves into the fear zone, it hints that adding exposure might be worth considering. A neutral reading, or yellow, usually suggests it is better to wait. Greed signals that it may be time to reduce risk. As one of the most legendary investors, Warren Buffett, put it:

But no indicator guarantees accuracy. Fear cycles can last longer than anyone expects, and no one has precise answers. That is why many investors find it hard to sit through deep drawdowns. Building positions at the bottom is even harder. Psychology often takes over, and strategy fades.

In this month’s Cryptonews report, we look at what could be next for Bitcoin price as the year comes to an end. We also speak with industry experts to understand whether a Christmas rally is still possible and whether the market has enough strength left to deliver it.

‘Weak Hands Shaken Out’: Bitcoin Price Closed November in the Red

Eneko Knorr, CEO and founder of Stabolut, told Cryptonews that December and January could become decisive months for the crypto market:

As mentioned earlier, November 2025 echoed November 2024 for Bitcoin, only with the opposite scenario. The monthly close highlights this shift and remains one of the most important indicators on the market. Last November closed with a strong green candle that led to a correction and then a new all-time high. This November finished with a noticeable red candle, shifting sentiment to the downside. Yet the price stopping almost precisely at $90,000 still gives bulls something to hold on to.

Phillip Lord, President of Bakkt International, told Cryptonews that he does not see the current cycle ending and that there is still room for Bitcoin to rise. At the same time, the market does not have a clear leader, and both sides continue to build their cases:

The launch of Bitcoin ETFs was met with enthusiasm, bringing a wave of institutional money into the market. These inflows supported Bitcoin’s rise. Now, retail investors play a much smaller role. The market is shaped mostly by large capital and ETFs. This has created a double-sided dynamic. According to some analysts, institutions may be reallocating capital, which helps explain why liquidity has remained thin for the second month in a row. Retail investors do not see this backstage process. They only see the losses.

Another concern for retail traders is the idea of crypto cycles. According to this framework, Bitcoin was expected to rally in November. This did not happen. Instead, the price dropped by more than 30%. It raises the question of whether these cycles have stopped working or whether a new market structure has formed because of institutional participation.

Lord adds another view:

Lord also notes that Bitcoin needs to hold the $83,000 to $86,000 range to move back above $100,000 and approach its all-time high. In his view, the more positive scenario is more likely to unfold in 2026:

Bitcoin Price Still Has a Chance in Early 2026

According to liquidity expert Michael Howell, the main driver of Bitcoin price has already shifted from halving to global liquidity. The correlation between BTC and the Global Liquidity Index (GLI) is considered high and sits in the 0.83 to 0.94 range across different studies, which makes liquidity one of the key forces shaping market direction. When the global financial system has more available money, Bitcoin usually moves higher. When liquidity tightens, pressure increases on all risk assets, including crypto.

The chart below confirms this dynamic.

In November, global liquidity (M2) printed a sharp peak, while Bitcoin had already turned lower. This is typical behavior. BTC often leads the GLI by 8 to 10 weeks and reacts even faster during corrections. The current drop in Bitcoin price may be an early indicator of a future decline in liquidity, and this signal matters not only for crypto.

Howell also notes that GLI moves in multi-year cycles that last about 5 to 6 years. The current cycle may still include another liquidity impulse around the second quarter of 2026. If this scenario plays out, a new liquidity expansion could align with the next upward phase for Bitcoin price. Bitcoin often acts as an early indicator. When it starts to struggle because liquidity conditions deteriorate, the same kind of pressure can soon be felt in the stock market. The technology sector is especially sensitive to shrinking liquidity, since it relies heavily on the availability of cheap capital.

According to Howell, a possible liquidity reversal depends on several factors. The first is a slowdown in the contraction of the U.S. money supply and an increase in excess reserves held by banks. The second is whether the Federal Reserve decides to give markets more support, even in a limited form, to ease stress. The third is whether China increases its stimulus efforts. Any of these steps would raise the availability of money in the global economy and create more supportive conditions for Bitcoin and other risk assets.

Conclusion

November showed how quickly sentiment can flip when liquidity tightens, and expectations collide with market reality. Bitcoin’s drop, the red monthly candle, and the shakeout in retail positioning all point to a market that is resetting rather than collapsing. At the same time, several bearish signals have started to surface, including a slowdown in ETF inflows, ongoing criticism around Strategy, and renewed doubts about Tether’s reserves. These factors add pressure to the market and highlight the need for caution.

The next move will depend on liquidity, ETF flows, and how macro conditions evolve into early 2026. If global liquidity stabilizes or starts to expand again, Bitcoin still has the potential to regain momentum, but investors should remain careful and protect their capital.

Key Crypto & Macro Events to Watch in December 2025

December 3

• S&P Global Services PMI (November)

• ISM Non-Manufacturing PMI (November)

• ISM Non-Manufacturing Prices (November)

December 4

• Initial Jobless Claims

December 7

• Japan GDP (QoQ) (Q3)

December 16

• Nonfarm Payrolls (November)

• Unemployment Rate (November)

December 18

• ECB Interest Rate Decision (December)

• Japan BoJ Interest Rate Decision

• CPI (MoM) (November)

• CPI (YoY) (November)

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

You May Also Like

A Radical Neural Network Approach to Modeling Shock Dynamics

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release