Hedera Price Surge 7% as $11 Trillion AUM Vanguard Group Launches HBAR ETF

Hedera HBAR $0.14 24h volatility: 9.7% Market cap: $6.09 B Vol. 24h: $188.16 M advanced 6.5% on Tuesday, recovering from recent selling pressure as the broader market reacted to Bitcoin BTC $91 708 24h volatility: 7.9% Market cap: $1.83 T Vol. 24h: $81.19 B sharp rebound above the $90,000 level, fueled by institutional dip-buying.

HBAR’s price recovery aligned with another key internal catalyst after Vanguard, the $11 trillion asset manager, confirmed the launch of its first HBAR ETF for global investors.

Following Canary Capital’s HBAR ETF approval last month, the Hedera team announced its listing on Vanguard on Tuesday, describing the ETF approval as validation of years of network-level development.

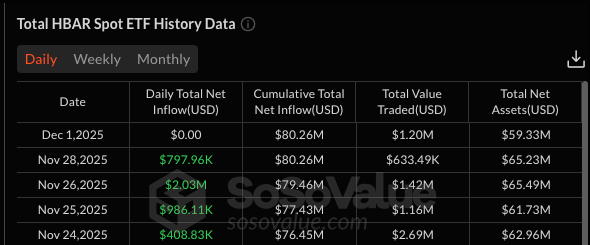

Hedera (HBAR) Spot ETF Total Netflows hit $80.26 million, Dec 2, 2025 | Source: SosoValue

The Canary Capital ETF has traded on NASDAQ over the past month, garnering $80.26 million in cumulative net inflows and $59.32 million in net assets, according to SosoValue data.

With the crypto market facing higher volatility in recent weeks, traders remain wary of potential pullbacks and unwilling to apply leverage on HBAR.

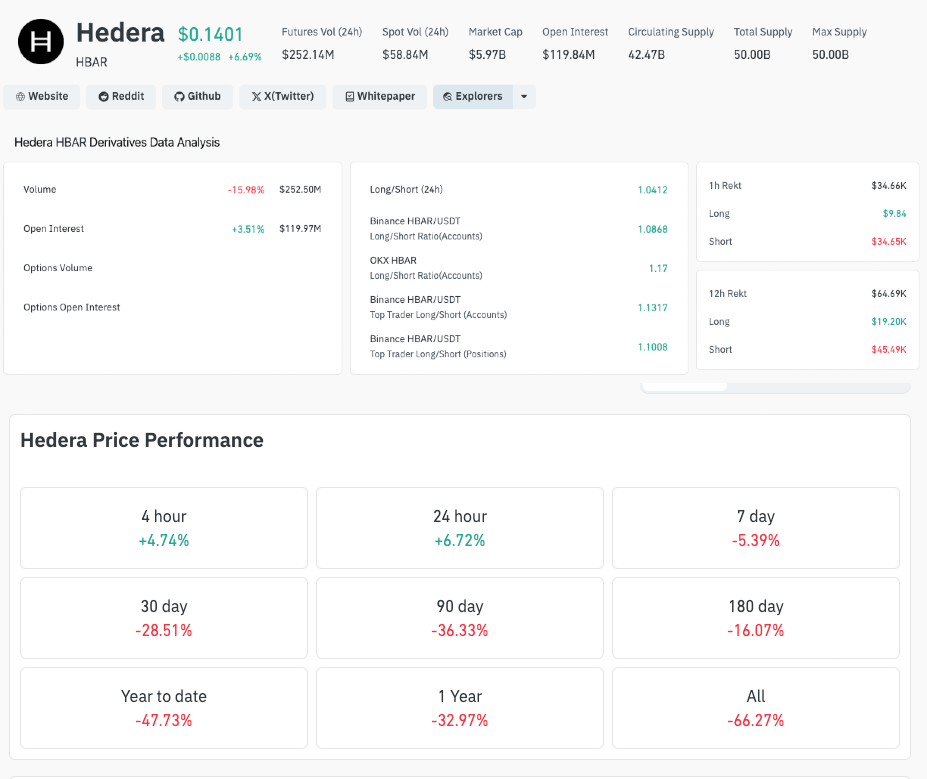

Hedera (HBAR) Derivative Market Analysis, Dec 2, 2025 | Coinglass

HBAR’s intraday gain of 6.72% reduced its seven-day decline to 5.39%, with the majority of Tuesday’s demand coming from direct spot purchases rather than speculative positions. According to Coinglass, open interest rose just 3.5% while futures trading volumes slipped 16%, indicating investors opted for a higher incidence of spot accumulation on Tuesday compared to derivatives activity.

HBAR Price Forecast: Can Bulls Break the Double Top Resistance at $0.30?

Hedera price has punched above $0.14, consolidating inside a falling wedge pattern that has capped the price action since early 2024. The chart also shows the two major bull cycle tops at $0.305 and $0.294, forming the upper boundary that continues to act as decisive resistance.

The Breakout Probability model assigns a recovery potential of 20.95% against a 67.06% downside risk, reflecting the dominant weight of the multi-month decline. The wedge’s lower support marks an initial bearish target, which corresponds to the local low at $0.08.

Hedera (HBAR) Technical Price Analysis | TradingView

RSI sits at 34.73, approaching oversold territory but not yet signaling a definitive reversal. Historically, HBAR reversals have occurred when RSI dips just below the 30 line, suggesting momentum remains weak but close to exhaustion. Profitability stands at 65.63%, meaning more than a third of holders are now underwater, a condition that could amplify volatility if HBAR’s price retests lower trendline support.

Volume Delta remains flat, with Tuesday’s session showing 7.85M net positive flow but no signs of large-size orders to offset sell-walls mounted during the broader market reversal in the final week of November.

To secure another leg higher, HBAR price must reclaim the mid-range resistance at $0.2287, the level that capped the last breakout attempt in April. A close above that level would signal an exit from the falling wedge and activate the target move toward the $0.30 region. Conversely, failure to maintain the $0.12 zone keeps the lower target near $0.08 in play.

nextThe post Hedera Price Surge 7% as $11 Trillion AUM Vanguard Group Launches HBAR ETF appeared first on Coinspeaker.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

InvestCapitalWorld Updates Platform Features to Support Broader Multi-Asset Market Access