Bank of America Just Unleashed Bitcoin ETFs to 15,000+ Advisers – Here’s Why It Matters

Bank of America has taken a major step toward expanding regulated crypto exposure across traditional finance, allowing more than 15,000 of its wealth advisers to recommend Bitcoin exchange-traded funds to clients for the first time.

Confirmed in a statement shared with Yahoo Finance, the move marks a major integration of Bitcoin products into the banking sector to date and indicates a rising appetite for digital assets among large U.S. institutions.

BofA’s New Crypto Access Marks Turning Point Ahead of Potential Stablecoin Launch

Until now, Bank of America’s wealthiest clients could only access Bitcoin ETFs by directly requesting them, leaving advisers unable to initiate any crypto-related recommendations.

However, starting January 5, clients of Merrill, Bank of America Private Bank, and Merrill Edge will gain streamlined access to four spot Bitcoin ETFs.

These include the Bitwise Bitcoin ETF, Fidelity’s Wise Origin Bitcoin Fund, Grayscale’s Bitcoin Mini Trust, and BlackRock’s iShares Bitcoin Trust.

The bank is pairing this access with formal guidance that encourages clients to consider a small crypto allocation.

Bank of America’s chief investment officer, Chris Hyzy, said clients with an interest in innovation and an understanding of market swings could consider a 1% to 4% allocation to digital assets.

He noted that the lower end of the range may be suitable for conservative investors, while those with a higher tolerance for portfolio swings may consider the upper end.

Hyzy stressed that the bank’s guidance remains focused on regulated investment vehicles and informed decision-making.

Source: Forbes

Source: Forbes

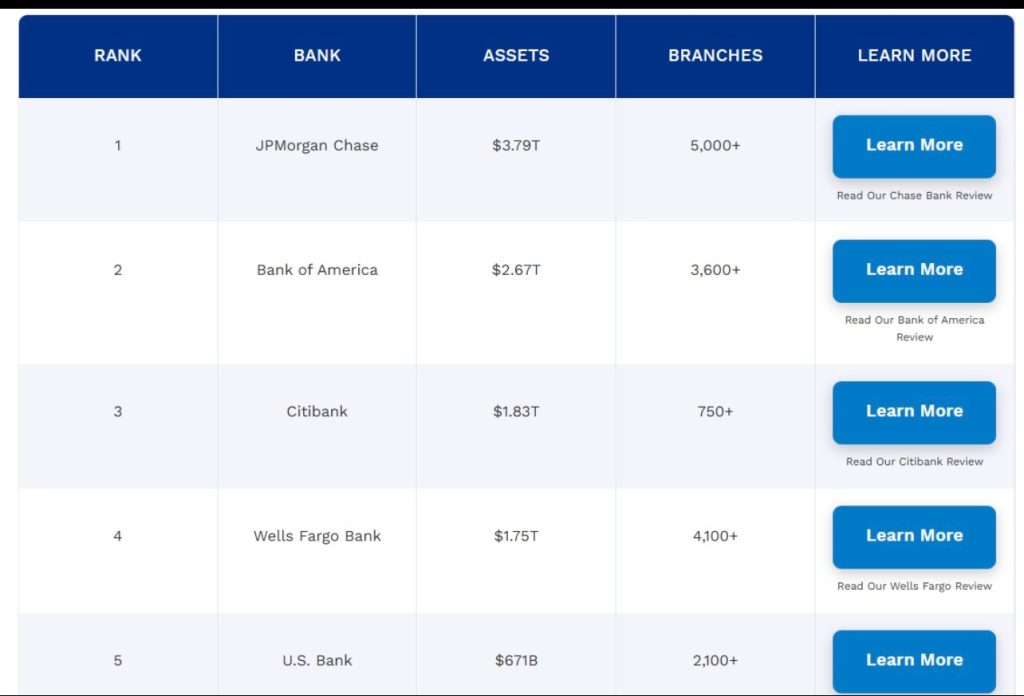

Bank of America, which holds roughly $2.67 trillion in consolidated assets and operates more than 3,600 branches, said the shift reflects rising demand from its client base.

The decision arrives as several other major U.S. financial institutions move deeper into crypto markets.

Morgan Stanley, in October, suggested that investors consider a 2%–4% allocation to crypto.

In January, BlackRock told clients that a 1%–2% Bitcoin allocation falls within a reasonable range, arguing that Bitcoin now carries a risk profile comparable to major tech stocks such as Apple, Microsoft, Amazon, and Nvidia.

Fidelity has also made a similar recommendation, stating that a 2%–5% Bitcoin allocation could offer upside while managing downside exposure.

Additionally, in June, Bank of America CEO Brian Moynihan said the firm has completed substantial groundwork on launching its own stablecoin, though the timeline will depend on regulatory clarity.

He added that the bank intends to meet customer demand when conditions allow.

Major Banks Deepen Crypto Push as Vanguard, Goldman, and JPMorgan Expand Services

Beyond investment guidance, several major banks have accelerated their broader crypto plans.

Vanguard, after years of hesitation, has begun allowing customers to trade crypto-focused ETFs and mutual funds on its U.S. brokerage platform.

Goldman Sachs recently agreed to acquire Innovator Capital Management, adding a set of defined-outcome ETFs, including a Bitcoin-linked product, to its asset-management division.

JPMorgan Chase has ramped up crypto integrations as well, allowing customers to fund Coinbase accounts using Chase credit cards.

Meanwhile, regulators in the United States and abroad are shaping the environment in which these institutions will operate.

The Office of the Comptroller of the Currency recently confirmed that national banks may hold crypto on their balance sheets for activities such as paying blockchain transaction fees.

Additionally, a growing shift among younger investors is also influencing this wave of institutional activity.

A survey from crypto payments firm Zerohash found that 35% of young, high-earning Americans have already moved money away from advisers who do not offer crypto exposure.

More than 80% said their confidence in digital assets increased as major institutions adopted them.

The study also found strong demand for access to a wider range of digital assets beyond Bitcoin and Ethereum.

You May Also Like

‘Love Island Games’ Season 2 Release Schedule—When Do New Episodes Come Out?

Solana Price Prediction Stuck at $85 While Pepeto Presale Delivers What Solana Holders Have Been Waiting For