XRP ETFs Post 11th Straight Day of Inflows as Price Hovers Above $2

- US spot XRP ETFs have recorded 11 consecutive days of net inflows, pulling in US$89.65 million on Monday and pushing total inflows since launch to US$756 million.

- The cumulative inflow has absorbed nearly 330 million XRP in 11 days, surpassing Solana ETF flows and outpacing current Bitcoin ETF inflows.

- The demand is supported by Vanguard opening its platform to third-party crypto ETFs, including XRP products, and analysts pointing to “bullish divergence” on XRP’s price charts.

Money has kept flowing into US spot XRP exchange-traded funds (ETFs) for 11 days in a row, even as traders debate whether the token can hold above US$2 (AU$3.06) and extend its recent recovery.

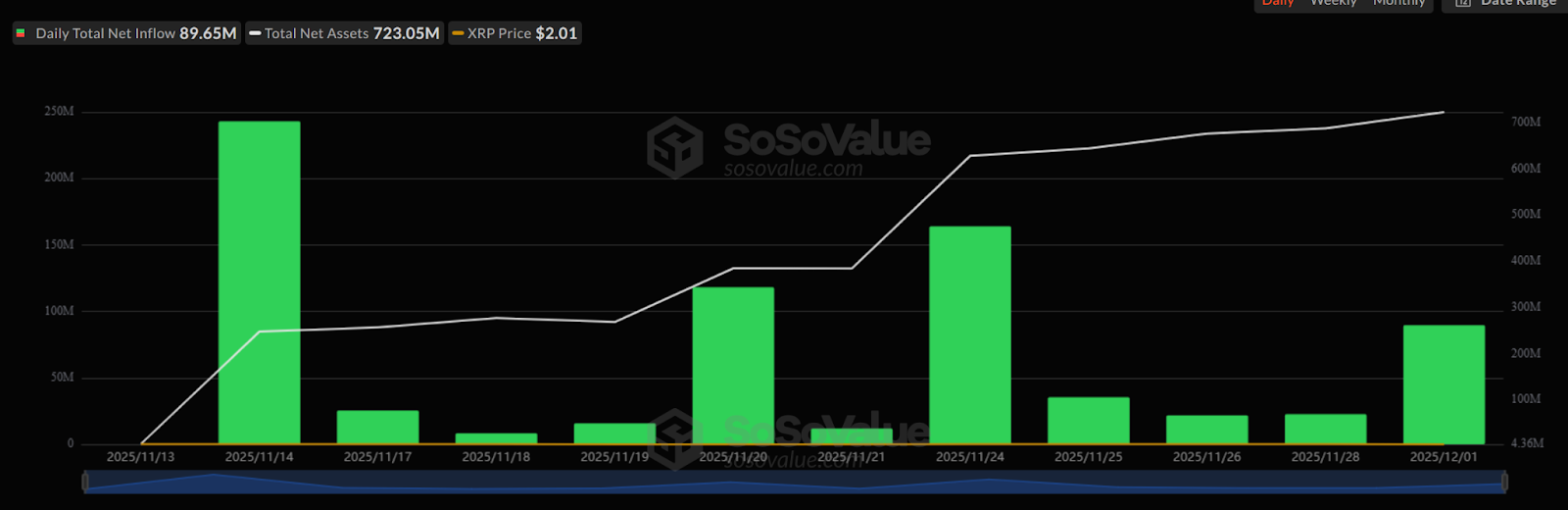

Data from SoSoValue shows that US-listed spot XRP ETFs brought in US$89.65 million (AU$137.16 million) on Monday, taking total net inflows since launch on Nov. 13 to US$756 million (AU$1.16 billion). Assets under management now stand at about US$723 million (AU$1.11 billion).

Source: SoSo Value.

Source: SoSo Value.

Four XRP ETFs are currently live. Canary’s XRPC on Nasdaq leads with around US$350 million (AU$535.5 million) in net inflows, followed by Bitwise’s product with roughly US$170 million (AU$260.1 million).

In total, almost 330 million XRP have been absorbed over the last 11 days, more than Solana ETF flows over the same period and against a backdrop of smaller Bitcoin ETF inflows.

Read more: Kalshi Goes Onchain With Solana in Bid to Challenge Polymarket

XRP ETFs Shattering Records

Globally, XRP exchange-traded products saw record demand last week, attracting US$289 million (AU$442.17 million), according to CoinShares’ head of research James Butterfill. He linked the move to the launch of new U.S. XRP ETFs, including Canary Capital’s fund.

Vanguard, which manages about US$11 trillion (AU$16.83 trillion), is also opening its platform to crypto ETFs, including XRP products, for more than 50 million clients this week.

On the charts, XRP is currently trading at US$2.16 (AU$3.29), a 14% decrease in the past month, but a 6.4% increase in the last 24 hours.

Moreover, Traders like ChartNerd see signs of momentum building, pointing to a “bullish divergence” between XRP’s price and its relative strength index (RSI) on the daily chart, which can mean selling pressure is fading and a bounce is more likely.

Related: China’s Central Bank Reasserts Crypto Ban, Warns Stablecoins Pose Major Financial Risks

The post XRP ETFs Post 11th Straight Day of Inflows as Price Hovers Above $2 appeared first on Crypto News Australia.

You May Also Like

Holywater Raises Additional $22 Million To Expand AI Vertical Video Platform

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement