HYPE Ready to Rip? Double Bottom Eyes $48 Target

Hyperliquid (HYPE) is trading at around $34, with daily volume at $480 million. The token is up 9% over the past 24 hours, while posting a slight drop over the last seven days.

After testing the $30–$33 support zone again this week, the price bounced and is now moving toward resistance around $36.

Support Zone Holds as Price Attempts a Reversal

HYPE has tested the same support area several times since June. Each time, the price held, and short-term buyers stepped in. The current chart shows two recent lows near this range, suggesting a double-bottom pattern may be forming.

CryptoPulse noted,

If the pattern plays out, a break above the $36–$38 resistance area would be needed. That level acted as a barrier in previous rallies. If cleared, the next targets could be $40 and $50 in the coming weeks.

Interestingly, the MACD line has crossed above the signal line. The MACD reading is 0.098, while the signal line sits at -1.87. The histogram is now positive, showing early signs of momentum shifting.

Source: TradingView

Source: TradingView

The RSI is at 45 and rising above its own moving average of around 40. While still below 50, this shows improving short-term momentum. Neither indicator shows strong trends yet, but both reflect a change from recent weakness.

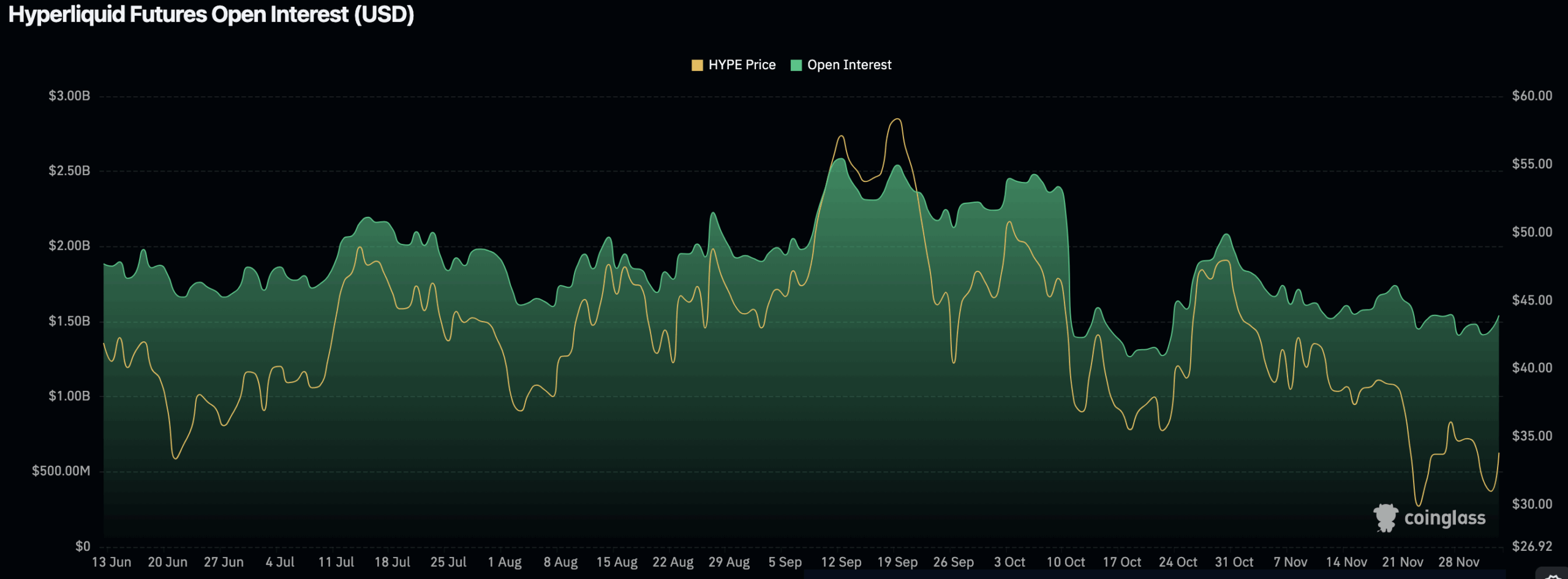

Futures Traders Return as Open Interest Rises

Futures open interest has increased to $1.57 billion after falling sharply in late November. This shows that more traders are opening positions as the price begins to recover. A rise in both price and open interest often signals growing market participation.

Source: Coinglass

Source: Coinglass

Earlier periods with similar setups led to short-term rallies. But in past cases, quick jumps in open interest without follow-through in price have also caused liquidations. Current conditions suggest traders are positioning for a possible breakout, while watching for price confirmation.

Meanwhile, Hyperliquid Strategies is expected to begin trading on Nasdaq under the ticker $PURR. The fund will hold 12.6 million HYPE tokens and $300 million in cash reserves. It will operate as a treasury reserve tied to the Hyperliquid ecosystem.

Hyperliquid Daily reported,

The move follows approval of a merger with Nasdaq-listed Sonnet, potentially creating a $1 billion digital asset treasury.

The post HYPE Ready to Rip? Double Bottom Eyes $48 Target appeared first on CryptoPotato.

You May Also Like

Pi Network Surges 35.9% Weekly: On-Chain Data Reveals Unexpected Accumulation Pattern

IRS Sets Course for Digital-Only Tax Reporting for Cryptocurrency Users