Solana (SOL) Price: Vanguard Opens Crypto Access as ETF Inflows Hit $650 Million

TLDR

- Vanguard, the world’s second-largest asset manager with $11 trillion under management, reversed its crypto ban and now allows clients to access crypto ETFs and mutual funds

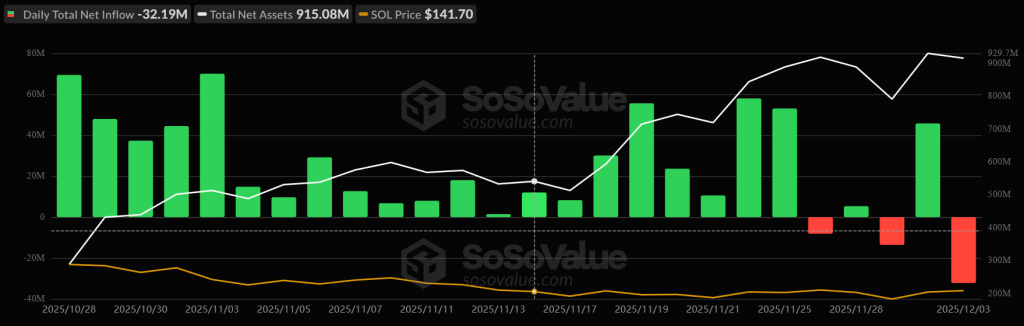

- Solana ETFs recorded $46.7 million in inflows on the day of Vanguard’s announcement, continuing a 22-day streak of institutional buying

- SOL is forming a double bottom pattern at the $120 support level with momentum indicators turning bullish after two months in oversold territory

- U.S. spot Solana ETFs have accumulated over $650 million in total inflows, with Franklin Templeton launching its SOEZ ETF to meet growing demand

- Solana dominated decentralized exchange volume with $4.16 billion in 24-hour trading activity

Solana is trading at $142 as of December 4, 2025, showing a 2% gain amid renewed institutional interest. The price movement comes after Vanguard reversed its previous stance on cryptocurrency investments.

Solana (SOL) Price

Solana (SOL) Price

The asset management firm now permits its clients to invest in crypto-related ETFs and mutual funds. Vanguard manages over $11 trillion in assets globally.

Solana ETFs received $46.7 million in inflows following the Vanguard announcement. This continues a 22-day streak of positive flows into SOL investment products.

Total inflows into U.S. spot Solana ETFs have exceeded $650 million. Franklin Templeton recently launched its Solana ETF under the ticker SOEZ.

Source: SoSoValue

Source: SoSoValue

The sustained institutional buying occurred during November, which marked crypto’s second-worst performing month of the year. Traditional finance investors chose to accumulate Solana positions during the price decline.

Technical Indicators Point to Recovery

SOL is forming a double bottom pattern at the $120 support level. This price point has marked local bottoms throughout the current market cycle.

The Relative Strength Index is testing the neutral line after spending two months in oversold conditions. The RSI has built a lead above the signal line.

The Chaikin Money Flow indicator registered 0.08, showing positive buying pressure. The MACD indicator remains in positive territory with the MACD line above the signal line.

A break above the $144 neckline would complete the double bottom pattern. The technical structure targets a move to $210 based on the pattern measurement.

DeFi Activity Remains Strong

Solana recorded $4.16 billion in decentralized exchange volume over the past 24 hours. This performance placed SOL as the leading blockchain for DEX trading activity.

The network continues to attract users and developers building DeFi applications. Solana Mobile announced plans to release its SKR native token in January 2026.

The SKR token announcement generated a 4% price increase for SOL. The token will integrate with the Seeker smartphone ecosystem.

Key support levels sit at $130 and $120 if the market experiences a pullback. Resistance appears around the $150 zone, with the next target at $170.

The broader cryptocurrency market is showing recovery signs. Bitcoin is approaching the $100,000 level while Ethereum holds above $3,000.

The post Solana (SOL) Price: Vanguard Opens Crypto Access as ETF Inflows Hit $650 Million appeared first on CoinCentral.

You May Also Like

XRPL Validator Reveals Why He Just Vetoed New Amendment

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities