Solana ($140) Breakout Signal: Why Digitap ($TAP) Crypto Presale Will Follow the Utility Trend

The post Solana ($140) Breakout Signal: Why Digitap ($TAP) Crypto Presale Will Follow the Utility Trend appeared first on Coinpedia Fintech News

Solana’s (SOL) token looked poised to retest the $100 level after a brutal November. But, after a solid rebound from $125, SOL is showing signs of breaking out at $140. This would signal renewed bullish momentum and could open the door for a breakout back to $200.

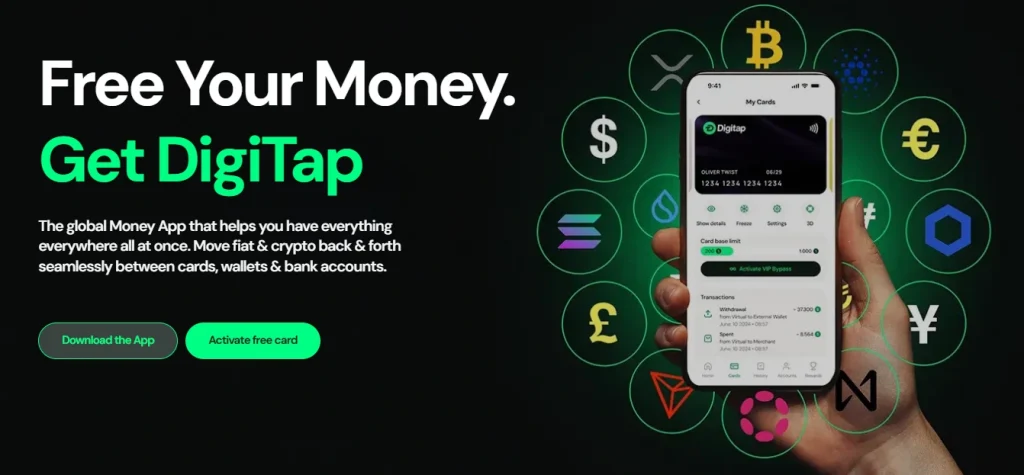

Adding Solana to the list of top altcoins to buy underscores a broader market theme. Cryptocurrencies with real utility and adoption are likely to lead the charge. One crypto presale project riding this “utility trend” is Digitap ($TAP), the maker of the world’s first “omni-bank.”

Digitap is a good crypto to buy because it is centered on a powerful banking use case that could mirror Solana’s prior success in 2026 and beyond.

Digitap’s Utility Puts It High On Crypto To Buy Lists

Digitap is a crypto presale project focused on delivering practical financial tools through crypto. Digitap positions itself as the world’s first “omni-bank,” essentially a single digital fintech platform that unifies crypto and traditional fiat banking. The project’s mobile app is live on iOS and Android and functions as a next-gen neobank.

Users can send, receive, store, save, invest, swap, and now spend multiple fiat currencies via offshore IBAN accounts and more than 100 different cryptos. A recent partnership with Visa brought the payment card’s network to Digitap. Users can load their Visa card in their Digitap account, in both fiat and crypto, and spend their money anywhere Visa cards are accepted.

By blending features of a bank with crypto’s flexibility, Digitap provides tangible utility. The app supports everyday payments, remittances, and banking needs. By addressing these massive use cases with a working product, Digitap stands out as an altcoin to buy because it offers clear utility rather than just speculation.

Digitap’s Presale Shows Early Demand for Real Utility

Digitap’s presale of its native $TAP has already raised more than $2.2 million. This is impressive because the presale only started in late summer and coincided with the heavy selling pressure in the broader crypto market.

$TAP stood out as a solid crypto to buy in recent weeks as investors recognized its long-term potential and the opportunity to get in at the ground floor of a utility-driven project. The presale is priced in stages, with the price of $TAP rising after each round sells out. The token was first offered for sale at $0.0125 and has steadily risen to $0.0344, implying day-one investors are sitting on a more than 150% paper profit.

The token’s economics also played a role in investors flocking to $TAP. Half of all Digitap platform profits will go toward buybacks and token burns, and funding stakers. This catalyst will reduce the fixed token supply of 2 billion $TAP over time.

The company plans to use part of its raise to fund a global marketing campaign, which will accelerate the deflationary rate as more people use the platform daily.

Essentially, Digitap’s presale offers investors the immediate appeal of a low entry price backed by the fundamental strength of a real, working platform. This is a rare combination not only within the crypto presale segment but also in the broader market.

Solana’s TVL And Transactions Rise As Price Eyes Rebound

The excitement around Digitap and Solana represents a wider shift in the altcoin market toward utility. In Solana’s case, its recent price rebound has been reinforced by renewed adoption. Notably, total value locked in DeFi increased from $8.23 billion on Dec. 2 to $9.204 billion.

Similarly, total transactions improved from around 54 million in early November to 65.39 million on Dec. 3. The token is also seeing renewed support from Wall Street. Forward Industries, the largest Solana treasury company, hired former ParaFi Capital executive and Solana expert Ryan Navi to take charge of its strategy.

Solana’s chart is also flashing signs of a breakout. Analysts note it continues to defend and trade above the long-term trendline. Going back to 2023, this occurrence has sparked a strong rebound in each case.

While certainly bullish, Solana remains a crypto titan with a near-$80 billion valuation. As such, its ability to multiply in value is relatively constrained. Doubling in value seems like a reasonable scenario for 2026, which means it could re-test its all-time high of $293. After all, Solana has gained more than 17,000% since it started trading, so the easy money has already been made.

Why Digitap Could Be The Next Utility-Driven Breakout Story

Solana’s bullish momentum highlights recent investor demand for projects with clear utility and progress. It also serves as a reminder that crypto value depends on real utility and user demand.

SOL’s breakout potential is based on a recent uptick in usage and innovation. That same logic is driving interest in Digitap. With an advanced banking app that is already live and a rapidly growing crypto presale, Digitap is positioned to follow the utility trend that Solana exemplifies.

Upstart projects like Digitap represent the next generation of altcoins to buy because they offer a fresh chance to participate in a utility-driven success story from the ground up. Bringing banking to crypto is a strong proposition, and Digitap could be poised to ride the wave of real-world crypto adoption in the months and years ahead.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Qatar partners with Microsoft to deploy AI across government services

SOL Rockets 30%, ADA Holds $0.90, BlockDAG Dominates With $407M Presale