XRP Makes U.S. Crypto History With Launch on CFTC-Regulated Spot Exchange

- XRP now trades on a CFTC regulated U.S. spot exchange with futures, perps, options and collateral use.

- Ripple’s CTO made XRPL Hub performance data public, adding transparency during ongoing debates on XRP Ledger programmability.

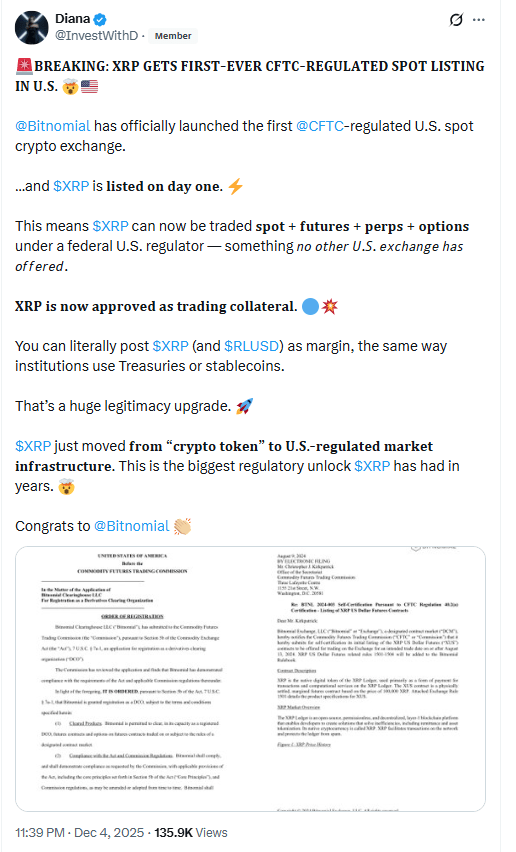

Bitnomial has launched what it says is the first U.S. spot cryptocurrency exchange regulated by the Commodity Futures Trading Commission, and listed XRP on the venue from day one.

The Chicago-based firm already operates a CFTC-regulated derivatives clearing organization. A CFTC order of registration for Bitnomial Clearinghouse LLC shows the company is authorized to clear futures and options on designated contract markets. The new spot market extends that infrastructure to cash trading in digital assets under the same federal oversight.

According to Bitnomial’s product details shared by industry commentators, customers can now trade XRP on the platform alongside futures, perpetual swaps and options tied to the token. The exchange also allows traders to post XRP and Ripple’s RLUSD stablecoin as margin, treating them as trading collateral in a manner similar to U.S. Treasuries or other highly liquid instruments.

Supporters say that structure moves XRP further into the realm of traditional market plumbing, because both its spot trading and related derivatives now sit inside a supervised clearing and risk-management framework. They also note that most U.S. crypto trading has until now taken place on venues regulated at the state level or as money-services businesses, rather than under the CFTC’s derivatives rule book.

XRP CFTC Spot Listing. Source: Diana InvestWithD on X

XRP CFTC Spot Listing. Source: Diana InvestWithD on X

The launch comes as regulators and courts continue to define how existing U.S. securities and derivatives laws apply to digital tokens. XRP, which Ripple Labs issues and uses in its cross border payment products, has spent years under scrutiny from the Securities and Exchange Commission.

Now, by listing XRP on a CFTC regulated clearinghouse and spot platform, Bitnomial places the token inside federal market infrastructure that institutions already use for futures and options. However, whether this change brings wider adoption will depend on how much trading volume moves from offshore and unregulated platforms to the new venue.

Ripple CTO David Schwartz Opens XRPL Hub Metrics to the Public

Meanwhile, Ripple Chief Technology Officer David Schwartz has turned his XRPL Hub from a quiet internal node into a public benchmark, sharing detailed performance data and access details, as previously mentioned in our report. He published the connection info, software version, traffic metrics, and charts, noting that the hub has run on version 2.6.2 for more than a month without any issues.

He also released latency trends, peer counts, disconnect rates, and traffic load over time. Although the hub still runs below its limits, he said peer reservations remain available if connection demand rises. XRPL operators can now use the public hostname and port to link to a stable node.

The disclosure comes as the community again debates how programmable the XRP Ledger should be. It also lands amid fresh questions over whether new features should exist mainly to reward validators, an idea Schwartz has openly rejected.

XRP trades near $2.09 dollars as it remains below the 50 week EMA around $2.30.

XRPUSD Weekly Chart. Source: TradingView ]]>

XRPUSD Weekly Chart. Source: TradingView ]]>You May Also Like

SOL Faces Pressure, DOT Climbs 2.3%, While BullZilla Presale Rockets Past $460K as the Top New Crypto to Join Now

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.