Bitcoin Leads $716M Inflows as Crypto Funds Recover From $5.5B Dump

- Crypto ETP inflows jumped again with Bitcoin, XRP and Chainlink drawing strong institutional interest.

- ProShares gained fresh capital while BlackRock and several peers faced withdrawals despite broad regional inflows.

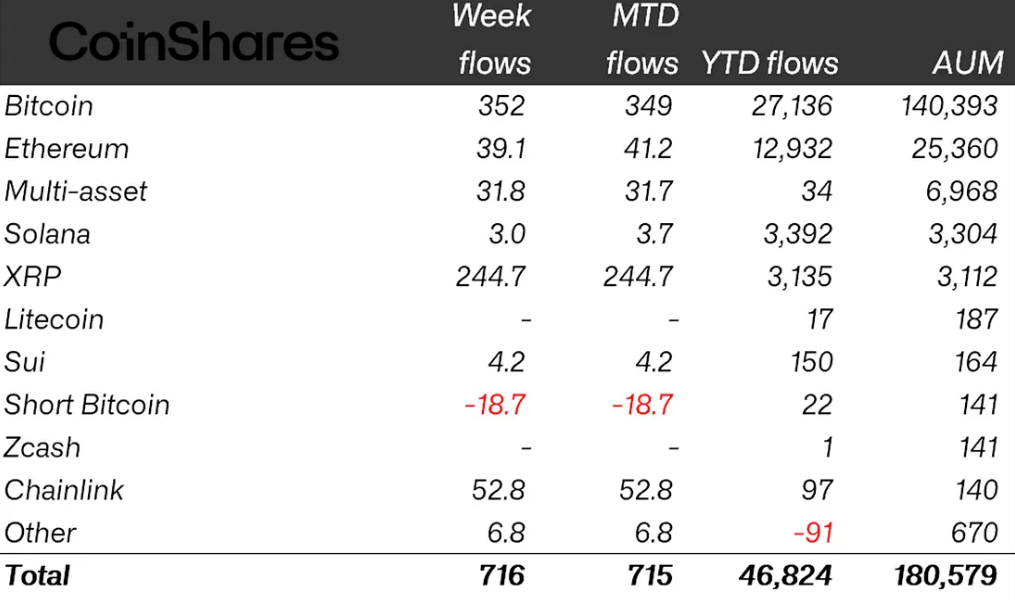

Crypto investment funds registered $716 million in inflows last week, marking a second straight week of gains, according to CoinShares. This followed $1 billion in inflows the previous week, showing a solid rebound from recent turbulence that wiped out $5.5 billion over a four-week period.

Bitcoin led the surge with $352 million in inflows, raising its yearly total to $27.1 billion. Although still below the 2024 record of $41.6 billion, the recent numbers reflect a steady appetite for exposure despite lower price swings and slowing momentum.

Total assets under management across all crypto funds have now climbed past $180 billion. This marks an 8% recovery from the lows of November. Still, the total remains significantly below the all-time high of $264 billion, as pointed out by CoinShares’ head of research, James Butterfill.

Short-Bitcoin outflows hit March 2025 peak

Ethereum funds brought in $39 million, while short Bitcoin products saw $18.7 million in outflows. This was the largest pullback from short-Bitcoin funds since March 2025. Some analysts view this as a sign that bearish sentiment may be losing strength.

XRP saw a sharp increase in capital flows, pulling in $245 million last week. This brought its year-to-date total to $3.1 billion, far above the $608 million registered in 2024. The strong uptick is linked to the start of spot XRP ETFs in the United States.

Chainlink also saw a record $52.8 million in weekly inflows. This represents 54% of total assets under management for the coin. This comes as institutions and developers show growing interest in real-world asset tokenization and the data structure that connects different blockchain networks.

Weekly crypto ETP flows by asset | Source: CoinShares

Weekly crypto ETP flows by asset | Source: CoinShares

ProShares leads with $210 million inflows

Among fund issuers, ProShares reported the highest inflows at $210 million. In contrast, BlackRock’s iShares faced $105 million in outflows. Grayscale and Cathie Wood’s ARK funds also saw money leaving, with outflows of $7 million and $78 million, respectively.

Regionally, inflows were concentrated in the US, Germany and Canada. The US led with $483 million, followed by Germany’s $97 million and Canada’s $80.7 million. These markets showed the strongest investor appetite across the week.

Sweden stood out on the negative side. The country recorded $5.6 million in outflows last week, which pushed its total for the year to $836 million which is the highest outflow total among all tracked regions.

]]>You May Also Like

REX Shares’ Solana staking ETF sees $10M inflows, AUM tops $289M for first time

XRP Price Prediction: Inflows, Rising Open Interest, and ETF Momentum Put $2.75 in Focus